Region:Asia

Author(s):Shubham

Product Code:KRAA4975

Pages:90

Published On:September 2025

By Type:The luxury fashion market in Indonesia is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-quality clothing and the influence of global fashion trends. Consumers are increasingly seeking unique and stylish apparel that reflects their personal identity and status, making this segment a significant contributor to market growth.

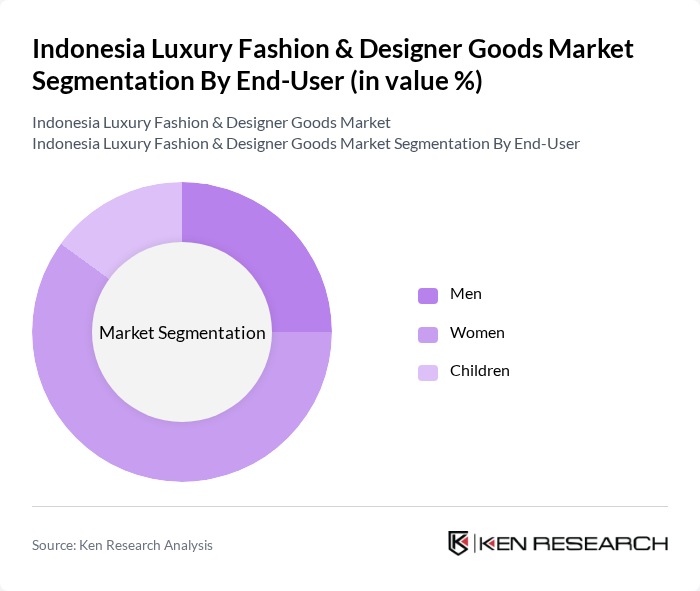

By End-User:The market is segmented by end-user demographics, including men, women, and children. The women’s segment dominates the market, driven by a growing interest in fashion and luxury goods among female consumers. Women are increasingly investing in luxury apparel, accessories, and handbags, reflecting their desire for self-expression and status. This trend is further supported by the rise of social media influencers and fashion icons who promote luxury brands.

The Indonesia Luxury Fashion & Designer Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Prada, Chanel, Hermès, Burberry, Fendi, Dior, Versace, Balenciaga, Valentino, Bvlgari, Salvatore Ferragamo, Montblanc, Tiffany & Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's luxury fashion market appears promising, driven by a growing middle class and increasing digital engagement. As consumers become more environmentally conscious, brands that adopt sustainable practices are likely to gain a competitive edge. Additionally, the rise of influencer marketing is expected to reshape consumer purchasing behaviors, making luxury brands more relatable and accessible. Overall, the market is poised for growth, provided that brands navigate challenges effectively and leverage emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Offline Retail Luxury Department Stores |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Origin | Domestic Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Occasion | Casual Wear Formal Wear Special Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 150 | High-income Consumers, Fashion Enthusiasts |

| Designer Accessories Market | 100 | Luxury Brand Managers, Retail Buyers |

| Footwear Trends in Luxury Fashion | 80 | Footwear Designers, Retail Store Managers |

| Consumer Preferences in Luxury Goods | 120 | Market Analysts, Fashion Influencers |

| Online Luxury Shopping Behavior | 90 | E-commerce Managers, Digital Marketing Specialists |

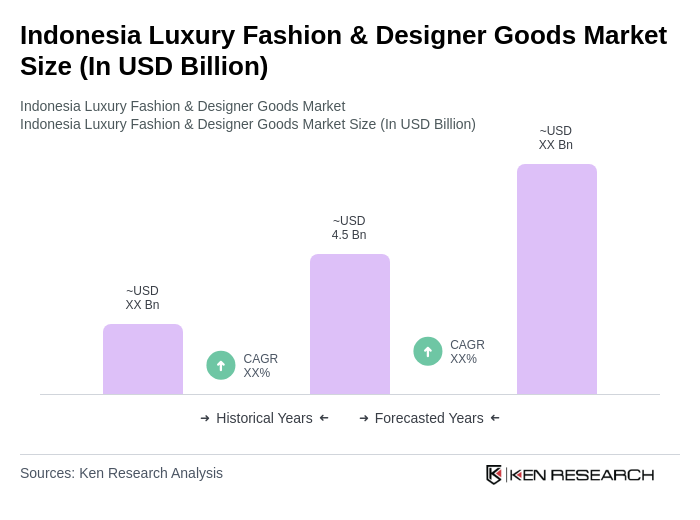

The Indonesia Luxury Fashion & Designer Goods Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by rising disposable incomes and an increasing appetite for luxury brands among Indonesian consumers.