Egypt Luxury Fashion & Designer Goods Market Overview

- The Egypt Luxury Fashion & Designer Goods Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a burgeoning middle class, and a growing appetite for luxury brands among consumers. The market has seen a significant rise in demand for high-end apparel, accessories, and designer goods, reflecting a shift in consumer preferences towards premium products.

- Cairo and Alexandria are the dominant cities in the Egypt Luxury Fashion & Designer Goods Market. Cairo, as the capital, serves as a cultural and economic hub, attracting both local and international luxury brands. Alexandria, with its rich history and affluent population, also plays a crucial role in the luxury market, providing a strong customer base for high-end fashion and designer goods.

- In 2023, the Egyptian government implemented a new regulation aimed at promoting local fashion designers and brands. This initiative includes tax incentives for local manufacturers and a grant program to support emerging designers. The regulation is designed to enhance the competitiveness of local brands in the luxury market, encouraging innovation and creativity while reducing reliance on imported goods.

Egypt Luxury Fashion & Designer Goods Market Segmentation

By Type:The luxury fashion and designer goods market can be segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-quality clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as consumers seek stylish and functional options. Accessories, jewelry, and watches cater to niche markets, appealing to consumers looking for unique and luxury items.

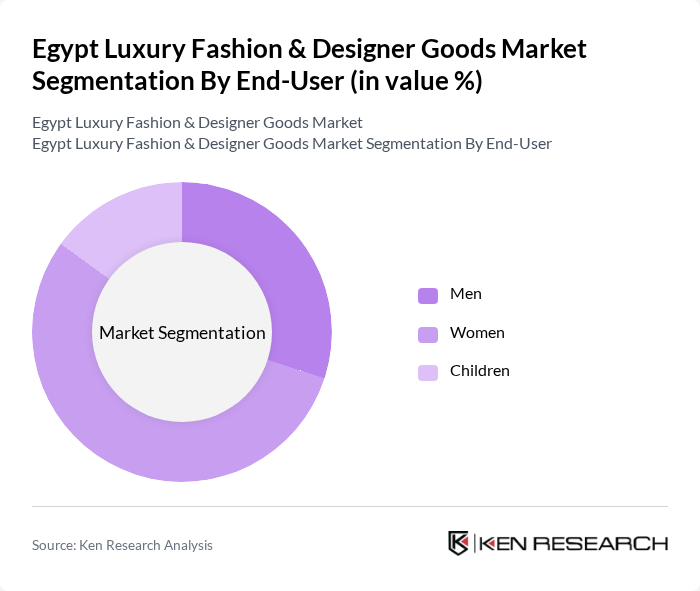

By End-User:The market can also be segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on fashion and luxury items. Men are increasingly becoming significant consumers in the luxury market, particularly in apparel and accessories. The children's segment, while smaller, is growing as parents seek high-quality and branded products for their children.

Egypt Luxury Fashion & Designer Goods Market Competitive Landscape

The Egypt Luxury Fashion & Designer Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar Properties, Al Haramain, Azza Fahmy, Maison Pyramide, Okhtein, Amina K., Hossam El Din, Kemet, Mohanad Kojak, The Egyptian Fashion Council, Zayan The Label, Nefertari, Nelly Roudy, Rami Kadi, Yasmine Yeya contribute to innovation, geographic expansion, and service delivery in this space.

Egypt Luxury Fashion & Designer Goods Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Egypt is projected to reach approximately EGP 60,000 per capita in future, reflecting a 20% increase from the previous year. This rise in income enables consumers to allocate more funds towards luxury fashion and designer goods. As the middle and upper classes expand, the demand for high-end products is expected to grow significantly, driving market expansion and encouraging brands to invest in the Egyptian luxury sector.

- Rising Demand for Luxury Brands:In future, the luxury goods market in Egypt is anticipated to grow by EGP 20 billion, driven by an increasing appetite for international luxury brands. The influx of global brands into the Egyptian market, coupled with a growing consumer base that values exclusivity and quality, is propelling this demand. This trend is particularly evident among affluent millennials and Gen Z consumers, who prioritize brand prestige and unique offerings.

- Growth of E-commerce Platforms:E-commerce sales in Egypt are expected to reach EGP 40 billion in future, marking a 33% increase from the previous year. The rise of online shopping platforms has made luxury fashion more accessible to consumers across the country. Enhanced digital payment systems and improved logistics are facilitating this growth, allowing luxury brands to tap into a broader audience and cater to the evolving shopping preferences of tech-savvy consumers.

Market Challenges

- Economic Instability:Egypt's economy faces challenges, with inflation rates projected to hover around 20% in future. This economic instability can lead to reduced consumer spending on non-essential luxury items. As disposable incomes fluctuate and purchasing power diminishes, luxury brands may struggle to maintain sales volumes, impacting overall market growth and profitability in the luxury fashion sector.

- High Import Tariffs:The Egyptian government imposes import tariffs averaging 50% on luxury goods, significantly increasing the retail prices of foreign brands. This high cost can deter consumers from purchasing luxury items, leading to a decline in sales for international brands. Additionally, these tariffs create challenges for local retailers who wish to compete with established luxury brands, limiting market entry and expansion opportunities.

Egypt Luxury Fashion & Designer Goods Market Future Outlook

The future of the luxury fashion market in Egypt appears promising, driven by increasing consumer interest in high-end products and the expansion of e-commerce. As disposable incomes rise and tourism rebounds, luxury brands are likely to see enhanced sales. Furthermore, the integration of technology in retail, such as virtual try-ons and personalized shopping experiences, will cater to evolving consumer preferences, ensuring sustained growth in the sector over the coming years.

Market Opportunities

- Expansion of Online Retail:The growth of online retail presents a significant opportunity for luxury brands in Egypt. With e-commerce projected to account for 25% of total retail sales in future, brands can leverage digital platforms to reach a wider audience, enhance customer engagement, and streamline their sales processes, ultimately driving revenue growth in the luxury segment.

- Collaborations with Local Designers:Collaborating with local designers can create unique offerings that resonate with Egyptian consumers. Such partnerships can enhance brand authenticity and appeal, tapping into the growing trend of supporting local talent. This strategy not only fosters community engagement but also differentiates brands in a competitive market, potentially increasing market share and customer loyalty.