South Africa Luxury Fashion & Designer Goods Market Overview

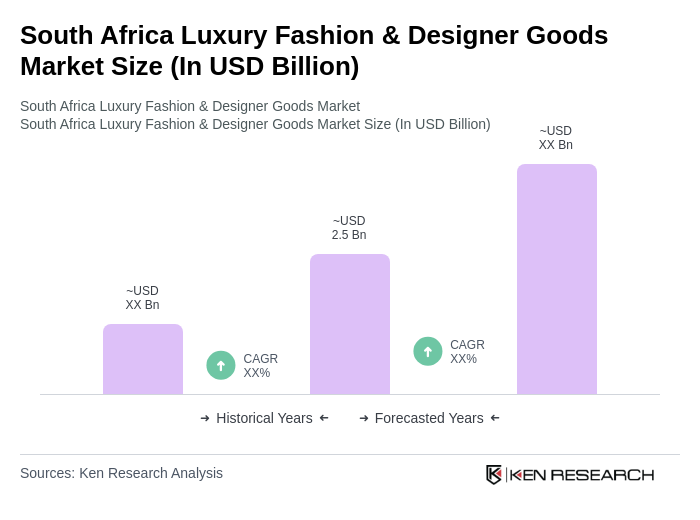

- The South Africa Luxury Fashion & Designer Goods Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a growing middle class, and a rising demand for high-quality, branded products among consumers. The market has seen a significant uptick in luxury spending, particularly in urban areas, as consumers seek to express their status and lifestyle through luxury fashion and designer goods.

- Key cities such as Johannesburg, Cape Town, and Durban dominate the luxury fashion market due to their affluent populations and vibrant retail environments. Johannesburg, as the economic hub, attracts numerous luxury brands, while Cape Town is known for its tourism and high-end shopping experiences. Durban's growing affluent demographic also contributes to the market's expansion, making these cities pivotal in shaping luxury consumption trends.

- In 2023, the South African government implemented regulations aimed at promoting local fashion designers and brands. This initiative includes tax incentives for local manufacturers and grants for emerging designers, encouraging the growth of homegrown talent in the luxury fashion sector. The government aims to enhance the competitiveness of local brands while reducing reliance on imported goods, fostering a more sustainable fashion ecosystem.

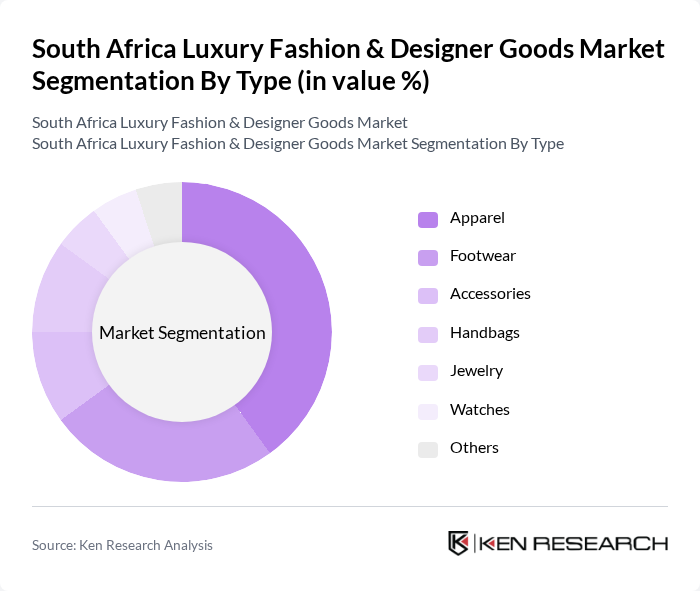

South Africa Luxury Fashion & Designer Goods Market Segmentation

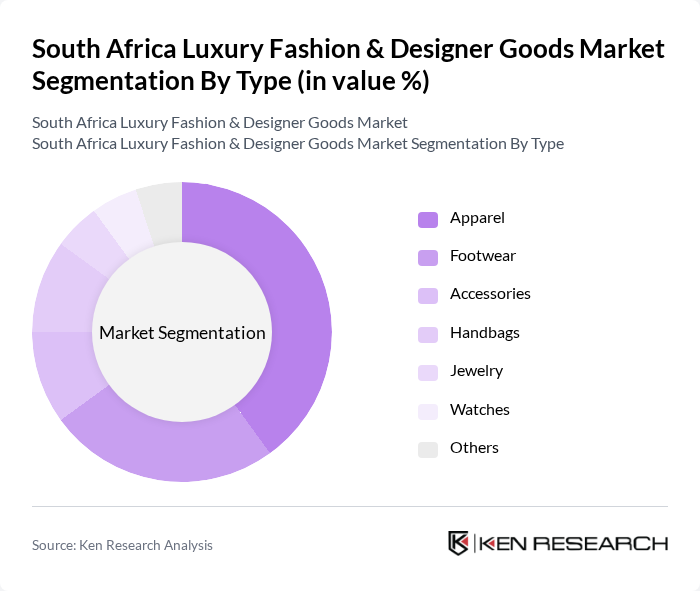

By Type:The luxury fashion market in South Africa is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by consumer preferences for high-quality clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as consumers increasingly invest in stylish and branded items that complement their outfits. Accessories, jewelry, and watches cater to niche markets, appealing to consumers looking for unique and luxury items.

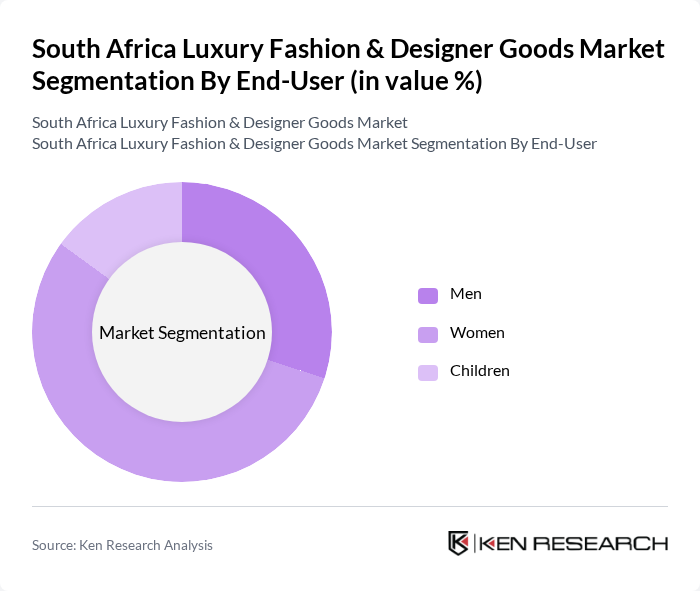

By End-User:The luxury fashion market is segmented by end-user into men, women, and children. Women represent the largest consumer group, driven by a strong inclination towards fashion and luxury goods. The men's segment is also growing, with increasing awareness and interest in luxury brands. The children's segment, while smaller, is gaining traction as parents are willing to invest in high-quality and branded items for their children, reflecting a trend towards luxury consumption across all age groups.

South Africa Luxury Fashion & Designer Goods Market Competitive Landscape

The South Africa Luxury Fashion & Designer Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Prada, Chanel, Burberry, Dolce & Gabbana, Versace, Fendi, Hermès, Salvatore Ferragamo, Bvlgari, Montblanc, Valentino, Tiffany & Co., Alexander McQueen contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Luxury Fashion & Designer Goods Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in South Africa is projected to reach approximately ZAR 90,000 per capita in future, reflecting a growth trend driven by a recovering economy. This increase allows consumers to allocate more funds towards luxury fashion and designer goods. As the middle class expands, the demand for high-end products is expected to rise, with affluent households contributing significantly to this market segment, enhancing overall spending power.

- Rising Demand for Sustainable Fashion:In future, the global sustainable fashion market is estimated to be valued at USD 10 billion, with South Africa witnessing a growing interest in eco-friendly products. Local brands are increasingly adopting sustainable practices, appealing to environmentally conscious consumers. This shift is supported by a 40% increase in consumer willingness to pay more for sustainable goods, indicating a robust market for luxury items that prioritize ethical production and materials.

- Growth of E-commerce Platforms:E-commerce sales in South Africa are projected to reach ZAR 70 billion in future, driven by increased internet penetration and mobile device usage. This growth facilitates access to luxury fashion brands, allowing consumers to shop conveniently online. The rise of digital marketing strategies and social media engagement has further enhanced brand visibility, leading to a significant uptick in online luxury purchases, particularly among younger demographics.

Market Challenges

- Economic Instability:South Africa's GDP growth is forecasted at 2% for future, reflecting ongoing economic challenges, including high unemployment rates at 30%. This instability affects consumer confidence and spending habits, particularly in the luxury sector. Economic fluctuations can lead to reduced discretionary spending, making it difficult for luxury brands to maintain consistent sales and profitability in a volatile market environment.

- High Import Tariffs:The South African government imposes import tariffs averaging 25% on luxury goods, significantly impacting pricing strategies for international brands. These tariffs can lead to inflated retail prices, making luxury items less accessible to consumers. As a result, brands may struggle to compete with local alternatives, which can hinder market growth and limit the availability of diverse luxury offerings in the region.

South Africa Luxury Fashion & Designer Goods Market Future Outlook

The South African luxury fashion market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize ethical practices are likely to thrive. Additionally, the integration of augmented reality and virtual fitting rooms in e-commerce platforms will enhance the shopping experience, attracting tech-savvy consumers. The luxury sector is expected to adapt to these trends, fostering innovation and collaboration with local designers to meet the demands of a diverse clientele.

Market Opportunities

- Expansion of Online Retail:The surge in online shopping presents a significant opportunity for luxury brands to reach a broader audience. With e-commerce projected to grow by 30% annually, brands can leverage digital platforms to enhance customer engagement and streamline purchasing processes, ultimately driving sales and brand loyalty in the luxury segment.

- Collaborations with Local Designers:Partnering with local designers can create unique offerings that resonate with South African consumers. This strategy not only supports local talent but also enhances brand authenticity. Collaborations can lead to innovative product lines that reflect cultural heritage, appealing to both domestic and international markets, thereby expanding brand reach and consumer base.