France Luxury Fashion & Designer Goods Market Overview

- The France Luxury Fashion & Designer Goods Market is valued at USD 40 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of affluent consumers, and a strong cultural affinity for luxury brands. The market has seen a significant uptick in demand for high-end products, particularly in apparel and accessories, as consumers prioritize quality and exclusivity.

- Key cities such as Paris, Lyon, and Nice dominate the luxury fashion market due to their status as fashion capitals, attracting both local and international consumers. Paris, in particular, is renowned for its iconic fashion houses and luxury boutiques, making it a global hub for luxury shopping. The concentration of high-net-worth individuals and tourists further enhances the market's vibrancy in these regions.

- In 2023, the French government implemented regulations aimed at promoting sustainability in the luxury fashion sector. This includes mandatory reporting on environmental impact and the introduction of eco-labels for sustainable products. These regulations are designed to encourage brands to adopt more sustainable practices, thereby enhancing the overall reputation of the French luxury fashion industry.

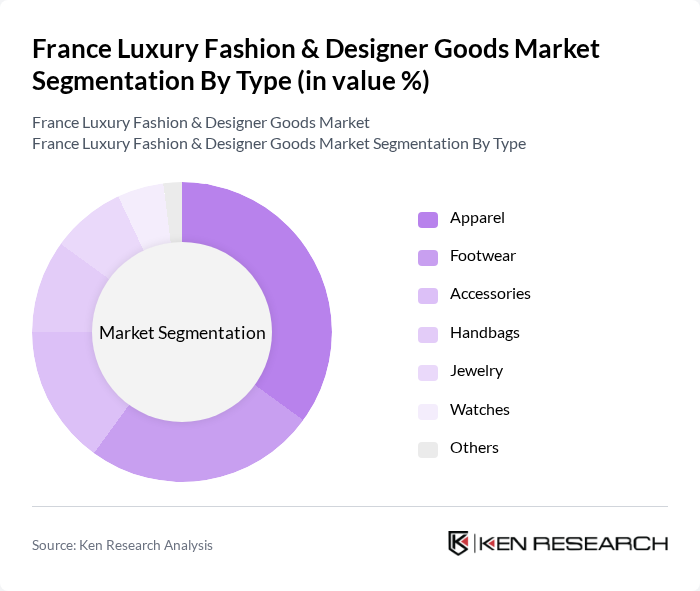

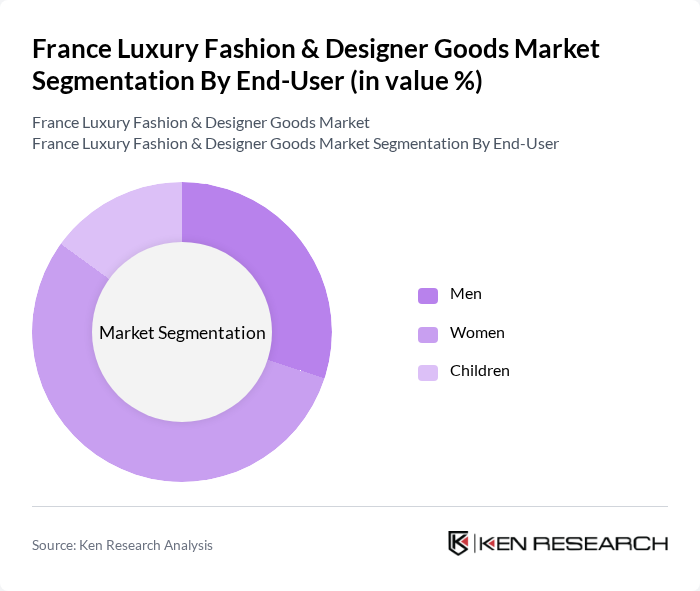

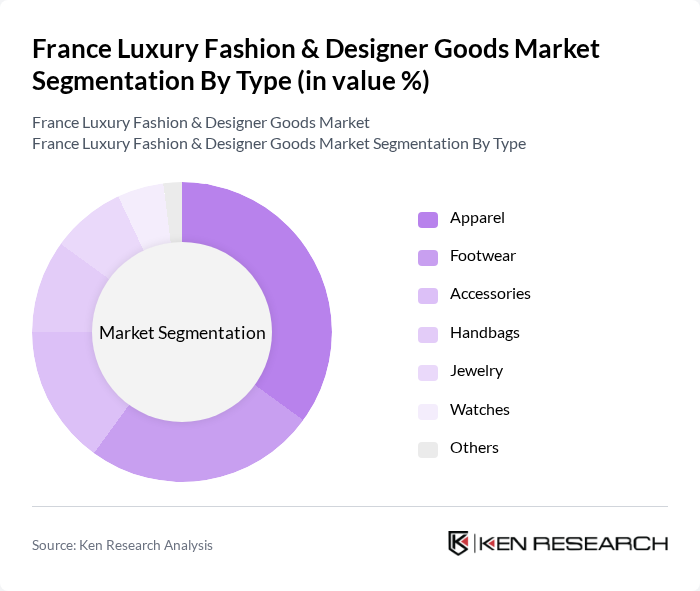

France Luxury Fashion & Designer Goods Market Segmentation

By Type:The luxury fashion market is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by consumer preferences for high-quality clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as they are essential components of luxury fashion. The demand for accessories, jewelry, and watches is growing, reflecting a shift towards complete luxury lifestyles.

By End-User:The luxury fashion market is segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on luxury fashion and accessories. Men's luxury fashion is also growing, with increasing interest in tailored clothing and high-end casual wear. The children's segment is emerging, as parents are willing to invest in luxury items for their children, reflecting a trend towards early exposure to luxury brands.

France Luxury Fashion & Designer Goods Market Competitive Landscape

The France Luxury Fashion & Designer Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering S.A., Chanel S.A., Hermès International S.A., Christian Dior SE, Prada S.p.A., Gucci (Kering S.A.), Burberry Group plc, Valentino S.p.A., Balenciaga (Kering S.A.), Fendi (LVMH), Givenchy (LVMH), Salvatore Ferragamo S.p.A., Bottega Veneta (Kering S.A.), Dolce & Gabbana S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

France Luxury Fashion & Designer Goods Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The disposable income in France is projected to reach €1.6 trillion in future, reflecting a growth of 2.5% from the previous year. This increase allows consumers to allocate more funds towards luxury fashion and designer goods. As the middle and upper classes expand, particularly in urban areas, the demand for high-end products is expected to rise significantly. This trend is further supported by a stable unemployment rate of around 7.4%, enhancing consumer confidence and spending power.

- Rising Demand for Sustainable Fashion:The sustainable fashion segment in France is anticipated to grow by €1.3 billion in future, driven by increasing consumer awareness regarding environmental issues. Approximately 62% of French consumers are willing to pay more for sustainable products, indicating a shift in purchasing behavior. This trend is bolstered by government initiatives promoting eco-friendly practices, with the French government investing €600 million in sustainable fashion initiatives, further encouraging brands to adopt sustainable practices.

- Growth of E-commerce Platforms:E-commerce sales in the luxury fashion sector are expected to reach €11 billion in future, marking a 15% increase from the previous year. The convenience of online shopping, coupled with enhanced digital marketing strategies, has significantly influenced consumer behavior. With over 72% of luxury consumers in France now shopping online, brands are increasingly investing in their digital presence, leading to a more competitive and accessible market landscape for luxury goods.

Market Challenges

- Economic Fluctuations Affecting Consumer Spending:Economic uncertainties, including inflation rates projected at 3.1% in future, pose a significant challenge to consumer spending in the luxury sector. As prices rise, consumers may prioritize essential goods over luxury items, leading to a potential decline in sales. Additionally, geopolitical tensions and global economic instability can further exacerbate these fluctuations, impacting overall market performance and consumer confidence in luxury purchases.

- Counterfeit Products Impacting Brand Integrity:The counterfeit market for luxury goods in France is estimated to be worth €1.5 billion in future, undermining brand integrity and consumer trust. With approximately 32% of luxury consumers reporting concerns about authenticity, brands face significant challenges in maintaining their reputation. This issue not only affects sales but also necessitates increased investment in anti-counterfeiting measures, diverting resources from innovation and marketing efforts.

France Luxury Fashion & Designer Goods Market Future Outlook

The future of the luxury fashion and designer goods market in France appears promising, driven by a combination of increasing disposable incomes and a growing emphasis on sustainability. As brands adapt to consumer preferences for ethical practices, the market is likely to witness a surge in demand for eco-friendly products. Additionally, the integration of advanced technologies in retail, such as augmented reality and AI-driven personalization, will enhance the shopping experience, making luxury goods more accessible and appealing to a broader audience.

Market Opportunities

- Expansion into Emerging Markets:French luxury brands have a significant opportunity to expand into emerging markets, particularly in Asia and Africa, where the middle class is rapidly growing. With an estimated 1.3 billion potential consumers in these regions, brands can tap into new revenue streams and diversify their market presence, enhancing overall growth potential.

- Collaborations with Local Designers:Collaborating with local designers can provide French luxury brands with unique insights into regional trends and consumer preferences. Such partnerships can enhance brand authenticity and appeal, particularly among younger consumers who value originality. This strategy not only fosters innovation but also strengthens community ties, potentially leading to increased brand loyalty and market share.