Region:Asia

Author(s):Rebecca

Product Code:KRAE2792

Pages:95

Published On:February 2026

By Course Type:The course type segmentation includes various categories such as Business and Management, Technology and Computer Science, Arts and Humanities, Health and Medicine, Language Learning, and Others. Among these, Technology and Computer Science courses are particularly dominant due to the increasing demand for tech skills in the job market. The rapid digital transformation across industries has led to a surge in enrollment in these courses, as individuals seek to enhance their employability and adapt to changing job requirements.

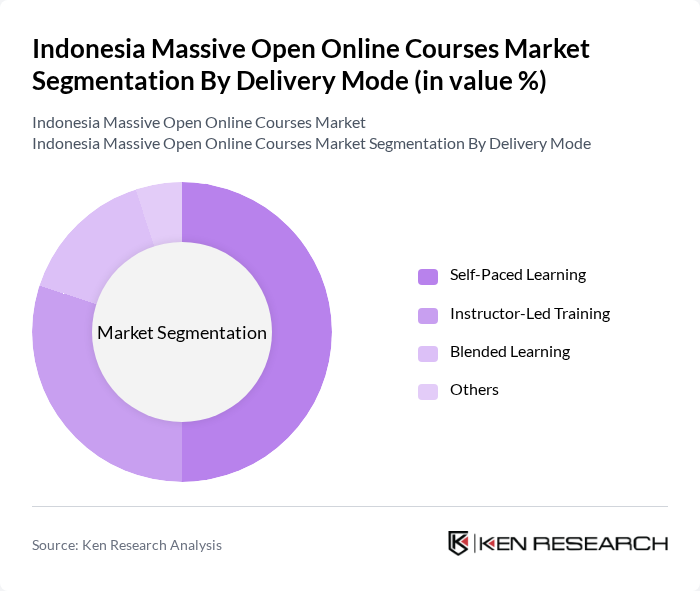

By Delivery Mode:The delivery mode segmentation encompasses Self-Paced Learning, Instructor-Led Training, Blended Learning, and Others. Self-Paced Learning is the leading mode, favored by learners for its flexibility and convenience. This format allows individuals to learn at their own pace, accommodating various schedules and learning styles, which has made it particularly appealing in the context of Indonesia's diverse population and varying educational needs.

The Indonesia Massive Open Online Courses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ruangguru, Zenius, HarukaEdu, Udemy, Coursera, Skill Academy, Quipper, EdX, Khan Academy, Study.com, LearnDash, LinkedIn Learning, Google Digital Garage, Microsoft Learn, FutureLearn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian MOOC market appears promising, driven by technological advancements and increasing acceptance of online education. As more learners seek flexible and accessible learning options, the integration of innovative technologies such as artificial intelligence and adaptive learning will enhance the learning experience. Additionally, partnerships between educational institutions and MOOC providers are expected to foster the development of high-quality, accredited courses, further solidifying the market's growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Course Type | Business and Management Technology and Computer Science Arts and Humanities Health and Medicine Language Learning Others |

| By Delivery Mode | Self-Paced Learning Instructor-Led Training Blended Learning Others |

| By Target Audience | Students Professionals Corporates Others |

| By Certification Type | Verified Certificates Professional Certificates Micro-Credentials Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Others |

| By Industry Application | Education Healthcare IT and Software Development Others |

| By Geographic Reach | Urban Areas Rural Areas National Reach Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 100 | University Administrators, Curriculum Developers |

| Corporate Training Programs | 80 | HR Managers, Training Coordinators |

| Student Engagement in MOOCs | 150 | Current MOOC Users, Recent Graduates |

| Content Providers and Educators | 70 | Course Instructors, Educational Content Creators |

| Government Education Officials | 60 | Policy Makers, Education Program Directors |

The Indonesia Massive Open Online Courses market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased demand for flexible learning solutions and government initiatives aimed at educational reform.