Region:Asia

Author(s):Rebecca

Product Code:KRAE2800

Pages:83

Published On:February 2026

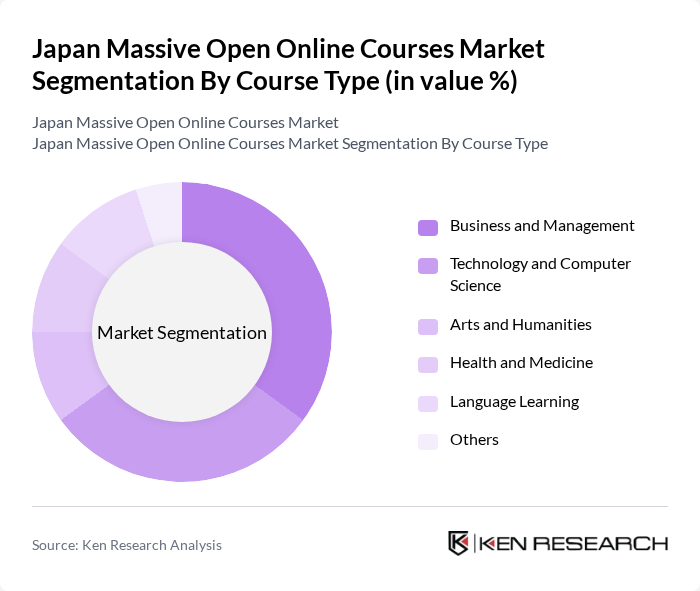

By Course Type:The course type segmentation includes various categories such as Business and Management, Technology and Computer Science, Arts and Humanities, Health and Medicine, Language Learning, and Others. Each of these subsegments caters to different learner needs and preferences, with Business and Management courses leading the market due to their relevance in the corporate sector. Technology and Computer Science courses also see significant demand as the tech industry continues to grow.

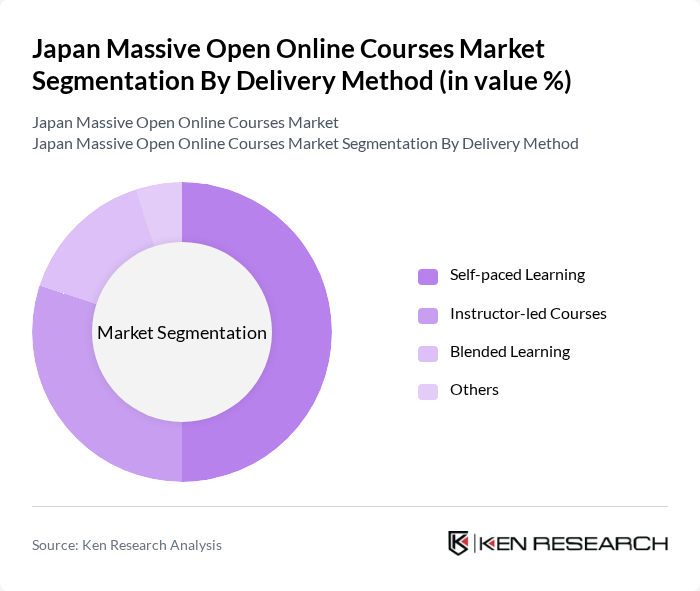

By Delivery Method:The delivery method segmentation encompasses Self-paced Learning, Instructor-led Courses, Blended Learning, and Others. Self-paced Learning is the most popular method, allowing learners to study at their own convenience, which is particularly appealing in a fast-paced society like Japan. Instructor-led Courses are also gaining traction as they provide structured learning experiences and direct interaction with educators.

The Japan Massive Open Online Courses market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, edX, Udemy, Skillshare, FutureLearn, Khan Academy, Pluralsight, LinkedIn Learning, OpenClassrooms, Udacity, Codecademy, Alison, Domestika, MasterClass, DataCamp contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan Massive Open Online Courses market appears promising, driven by technological advancements and evolving educational needs. The integration of artificial intelligence for personalized learning experiences is expected to enhance course engagement and effectiveness. Additionally, the increasing focus on micro-credentials will cater to the demand for skill-based learning, aligning educational outcomes with industry requirements. As the market matures, collaboration between educational institutions and MOOC providers will likely foster innovation and improve course offerings, ensuring sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Course Type | Business and Management Technology and Computer Science Arts and Humanities Health and Medicine Language Learning Others |

| By Delivery Method | Self-paced Learning Instructor-led Courses Blended Learning Others |

| By Target Audience | Students Professionals Corporates Lifelong Learners Others |

| By Certification Type | Verified Certificates Professional Certificates Micro-credentials Others |

| By Industry Application | Education Healthcare Information Technology Finance Others |

| By Geographic Reach | National International Others |

| By Pricing Model | Subscription-based Pay-per-course Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Administrators | 100 | Deans, Program Directors, Online Learning Coordinators |

| MOOC Platform Executives | 80 | CEOs, Product Managers, Marketing Directors |

| Students Enrolled in MOOCs | 150 | Undergraduate and Graduate Students, Lifelong Learners |

| Educators and Instructors | 70 | Faculty Members, Course Designers, Instructional Technologists |

| Industry Experts and Analysts | 50 | Education Consultants, Market Researchers, Policy Makers |

The Japan Massive Open Online Courses market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for flexible learning options and the increasing acceptance of online certifications among employers.