Region:Asia

Author(s):Rebecca

Product Code:KRAE2794

Pages:95

Published On:February 2026

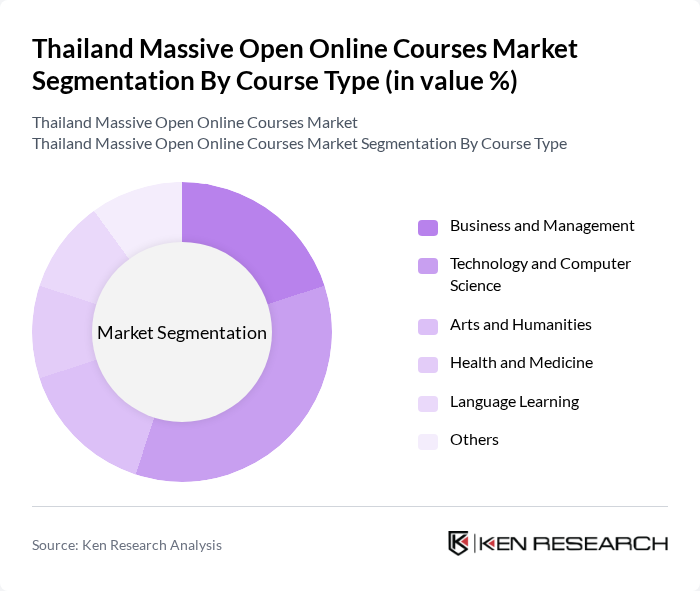

By Course Type:The market is segmented into various course types, including Business and Management, Technology and Computer Science, Arts and Humanities, Health and Medicine, Language Learning, and Others. Among these, Technology and Computer Science courses are leading due to the increasing demand for digital skills in the job market. The rapid technological advancements and the need for continuous learning in this field drive enrollment rates, making it a dominant segment.

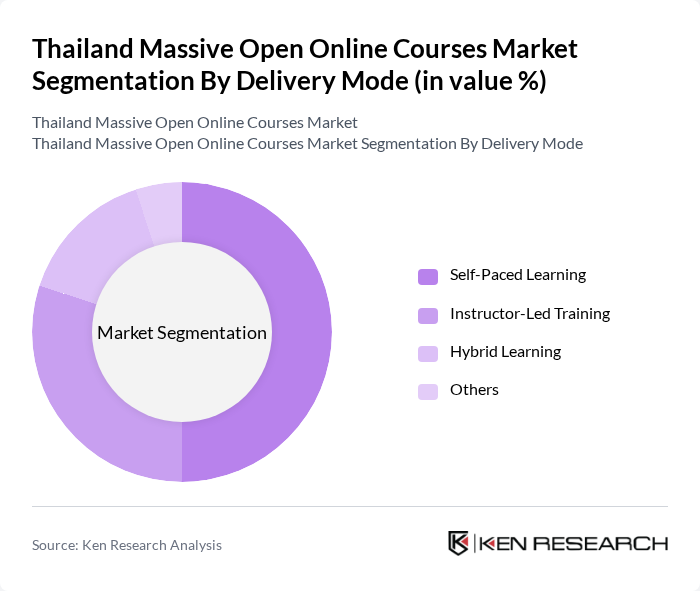

By Delivery Mode:The delivery modes for online courses include Self-Paced Learning, Instructor-Led Training, Hybrid Learning, and Others. Self-Paced Learning is the most popular mode, as it allows learners to study at their own convenience, catering to the busy schedules of professionals and students alike. This flexibility has led to a significant increase in enrollment in self-paced courses, making it the leading delivery mode in the market.

The Thailand Massive Open Online Courses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, edX, Udemy, Skillshare, Khan Academy, FutureLearn, LinkedIn Learning, Pluralsight, OpenClassrooms, Alison, Udacity, Teachable, MasterClass, Codecademy, and LearnWorlds contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand Massive Open Online Courses market appears promising, driven by technological advancements and evolving educational needs. As the demand for personalized and flexible learning experiences grows, institutions are likely to invest in innovative course offerings. Additionally, the integration of artificial intelligence and virtual reality into online learning platforms is expected to enhance engagement and effectiveness, attracting more learners. Collaborative efforts between educational institutions and corporate entities will further bolster the market, creating a dynamic ecosystem for online education.

| Segment | Sub-Segments |

|---|---|

| By Course Type | Business and Management Technology and Computer Science Arts and Humanities Health and Medicine Language Learning Others |

| By Delivery Mode | Self-Paced Learning Instructor-Led Training Hybrid Learning Others |

| By Target Audience | Students Professionals Corporates Lifelong Learners Others |

| By Certification Type | Verified Certificates Professional Certificates Micro-Credentials Others |

| By Duration | Short Courses (Less than 3 months) Medium Courses (3-6 months) Long Courses (More than 6 months) Others |

| By Industry Focus | Information Technology Healthcare Education Finance Others |

| By Geographic Reach | National Regional International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Students Enrolled in MOOCs | 150 | Undergraduate and Graduate Students |

| Working Professionals Seeking Skill Development | 100 | Mid-level Managers, Career Changers |

| Educators and Course Instructors | 80 | University Faculty, Online Course Designers |

| Government Officials in Education Sector | 50 | Policy Makers, Educational Administrators |

| Industry Experts and Analysts | 70 | Market Researchers, Educational Consultants |

The Thailand Massive Open Online Courses market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for flexible learning options and government initiatives promoting online education.