Region:Middle East

Author(s):Rebecca

Product Code:KRAE2797

Pages:97

Published On:February 2026

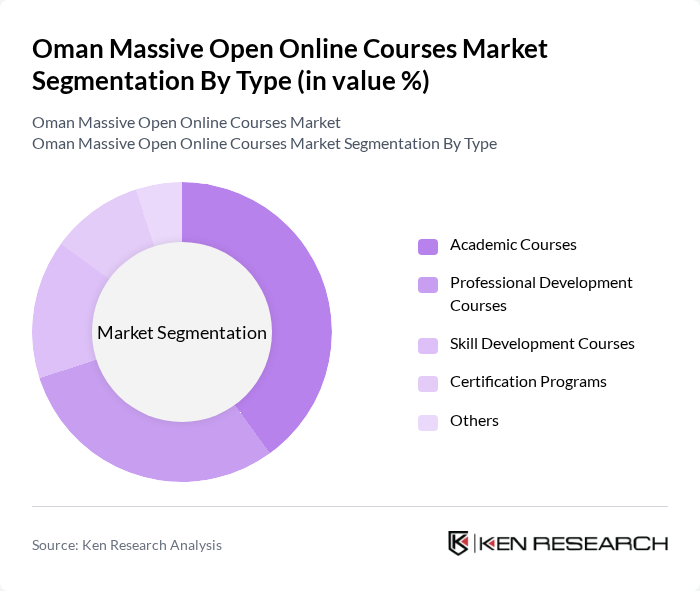

By Type:The market is segmented into various types of courses, including Academic Courses, Professional Development Courses, Skill Development Courses, Certification Programs, and Others. Among these, Academic Courses are currently leading the market due to the increasing number of students seeking higher education online. The demand for Professional Development Courses is also rising as working professionals look to upskill and remain competitive in their fields. Skill Development Courses are gaining traction as individuals seek to acquire specific competencies that enhance their employability.

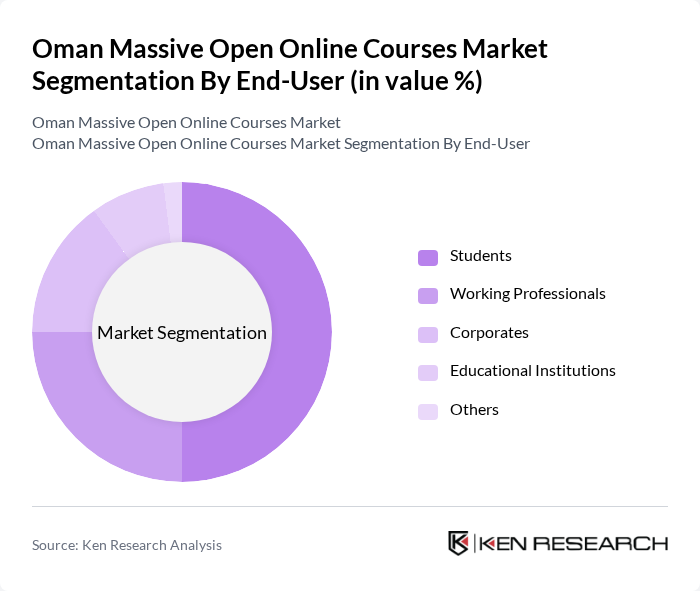

By End-User:The end-user segmentation includes Students, Working Professionals, Corporates, Educational Institutions, and Others. Students represent the largest segment as they increasingly turn to online platforms for academic courses. Working Professionals are also a significant segment, driven by the need for continuous learning and skill enhancement. Corporates are investing in online courses for employee training and development, while Educational Institutions are adopting these platforms to expand their course offerings and reach a broader audience.

The Oman Massive Open Online Courses market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, edX, Udacity, FutureLearn, Khan Academy, Skillshare, LinkedIn Learning, Pluralsight, Alison, Udemy, OpenClassrooms, Academic Earth, Codecademy, DataCamp, MasterClass contribute to innovation, geographic expansion, and service delivery in this space.

The future of the MOOC market in Oman appears promising, driven by increasing digital literacy and a growing acceptance of online learning. As educational institutions continue to adapt to technological advancements, the integration of innovative learning methodologies will likely enhance user engagement. Furthermore, the collaboration between government and private sectors to improve course quality and accessibility will play a crucial role in shaping the market landscape, fostering a more educated workforce equipped for the demands of the modern economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Academic Courses Professional Development Courses Skill Development Courses Certification Programs Others |

| By End-User | Students Working Professionals Corporates Educational Institutions Others |

| By Delivery Mode | Self-Paced Learning Instructor-Led Learning Blended Learning Others |

| By Subject Area | Business and Management Technology and Computer Science Arts and Humanities Health and Medicine Others |

| By Geographic Reach | Local Courses Regional Courses International Courses Others |

| By Pricing Model | Free Courses Subscription-Based Courses Pay-Per-Course Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Students Enrolled in MOOCs | 150 | Undergraduate and Graduate Students |

| Educators and Course Instructors | 100 | University Professors, Online Course Designers |

| Industry Professionals Seeking Upskilling | 80 | Working Professionals, HR Managers |

| Government Education Officials | 50 | Policy Makers, Educational Administrators |

| MOOC Platform Representatives | 30 | Business Development Managers, Marketing Executives |

The Oman Massive Open Online Courses market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased demand for flexible learning solutions and government initiatives promoting online education.