Region:Asia

Author(s):Rebecca

Product Code:KRAE2801

Pages:80

Published On:February 2026

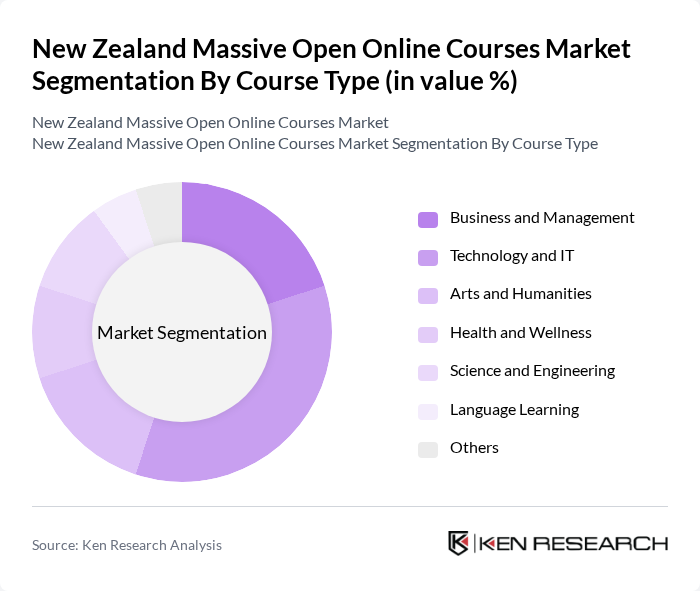

By Course Type:The market is segmented into various course types, including Business and Management, Technology and IT, Arts and Humanities, Health and Wellness, Science and Engineering, Language Learning, and Others. Among these, Technology and IT courses dominate the market due to the increasing demand for tech skills in the job market. The rapid pace of technological advancement has led to a surge in individuals seeking to upskill or reskill in this area, making it a key focus for online education providers.

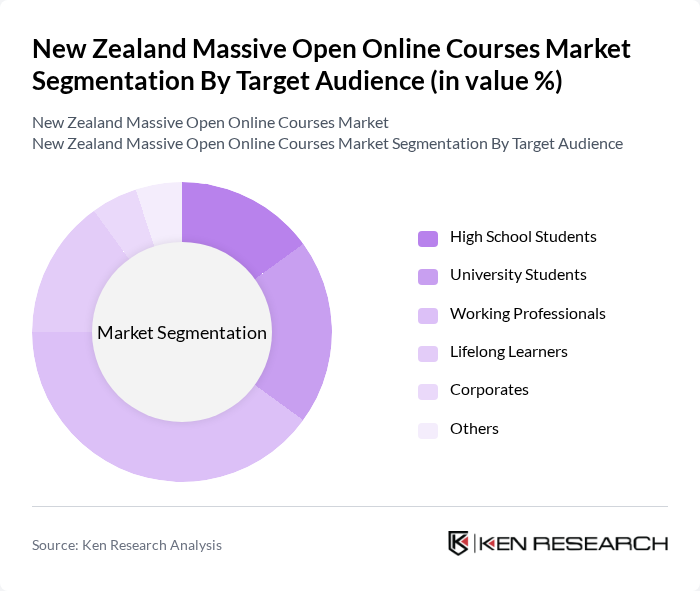

By Target Audience:The target audience for online courses includes High School Students, University Students, Working Professionals, Lifelong Learners, Corporates, and Others. Working Professionals represent the largest segment, driven by the need for continuous professional development and the flexibility that online courses offer. This demographic is increasingly looking for ways to enhance their skills while balancing work and personal commitments, making them a primary focus for course providers.

The New Zealand Massive Open Online Courses Market is characterized by a dynamic mix of regional and international players. Leading participants such as Open Polytechnic of New Zealand, FutureLearn, edX, Coursera, Udemy, Skillshare, LinkedIn Learning, Teachable, Khan Academy, New Zealand Institute of Skills and Technology, Open University, Victoria University of Wellington, Auckland University of Technology, Massey University, University of Otago contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand MOOC market appears promising, driven by increasing digital literacy and government support for online education. As more learners seek flexible and accessible learning options, the demand for MOOCs is expected to rise significantly. Additionally, the integration of advanced technologies, such as artificial intelligence, will enhance course delivery and personalization, making online education more appealing. The focus on micro-credentialing and industry-specific courses will further align educational offerings with market needs, fostering growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Course Type | Business and Management Technology and IT Arts and Humanities Health and Wellness Science and Engineering Language Learning Others |

| By Target Audience | High School Students University Students Working Professionals Lifelong Learners Corporates Others |

| By Delivery Method | Self-Paced Learning Instructor-Led Training Blended Learning Virtual Classrooms Others |

| By Certification Type | Verified Certificates Professional Certificates Micro-Credentials Degree Programs Others |

| By Industry Focus | Information Technology Healthcare Education Finance Marketing Others |

| By Geographic Reach | National International Localized Content Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Corporate Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University MOOC Participation | 150 | Students, Academic Coordinators |

| Corporate Training via MOOCs | 100 | HR Managers, Training Coordinators |

| MOOC Content Development | 80 | Course Designers, Educational Technologists |

| Student Engagement in Online Learning | 120 | Current MOOC Users, Educational Researchers |

| Market Trends and Future Outlook | 90 | Industry Experts, Policy Makers |

The New Zealand Massive Open Online Courses market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing demand for flexible learning options and the acceptance of online certifications by employers.