Region:Asia

Author(s):Dev

Product Code:KRAB3089

Pages:83

Published On:October 2025

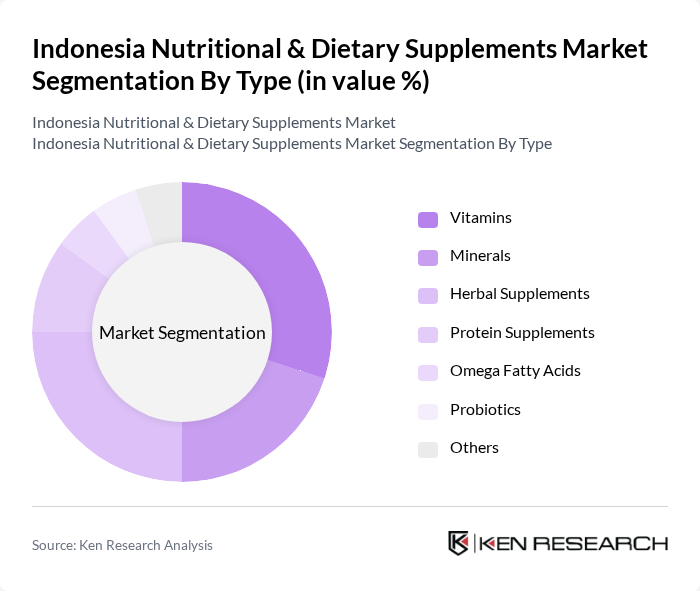

By Type:The market is segmented into various types of nutritional and dietary supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing consumer preference for natural and organic products has led to a significant rise in the demand for herbal supplements, while vitamins remain a staple for overall health maintenance.

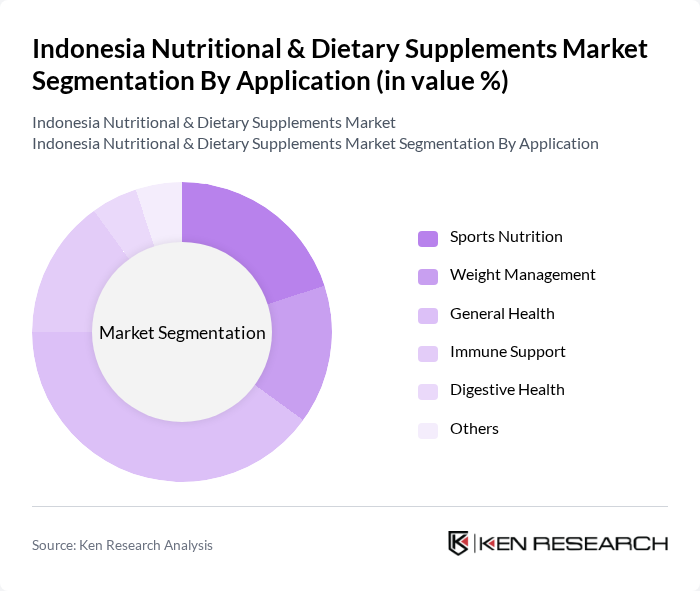

By Application:The applications of nutritional and dietary supplements include sports nutrition, weight management, general health, immune support, digestive health, and others. Sports nutrition is gaining traction among fitness enthusiasts and athletes, while weight management products are increasingly sought after due to rising obesity rates. The general health segment remains dominant as consumers prioritize overall wellness, leading to a diverse range of products catering to various health needs.

The Indonesia Nutritional & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Sido Muncul Tbk, PT Unilever Indonesia Tbk, PT Nutrifood Indonesia, PT Amerta Indah Otsuka, PT Deltomed Laboratories, PT Darya-Varia Laboratoria Tbk, PT Duta Nutrisi, PT Duta Sari Internasional, PT Duta Cita Sejahtera, PT Herbalife Indonesia, PT Mandom Indonesia Tbk, PT Prodia Widyahusada Tbk, PT Sarihusada Generasi Mahardhika, PT Tiga Pilar Sejahtera Food Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian nutritional and dietary supplements market appears promising, driven by increasing health awareness and a growing preference for preventive healthcare. As consumers become more educated about health benefits, the demand for personalized and organic supplements is expected to rise. Additionally, advancements in digital marketing strategies will enhance product visibility, while collaborations with health professionals will further legitimize supplement use, fostering a more informed consumer base and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By Application | Sports Nutrition Weight Management General Health Immune Support Digestive Health Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Income Level (Low, Middle, High) |

| By Packaging Type | Bottles Sachets Blister Packs Tubs Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Nutritional Supplements | 150 | Store Managers, Sales Representatives |

| Consumer Dietary Habits | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Doctors, Nutritionists, Dietitians |

| Market Trends in Herbal Supplements | 80 | Herbal Product Retailers, Herbalists |

| Online Sales Channels for Supplements | 120 | E-commerce Managers, Digital Marketing Specialists |

The Indonesia Nutritional & Dietary Supplements Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increasing health awareness and a rising middle class seeking preventive healthcare solutions.