Region:Asia

Author(s):Dev

Product Code:KRAB5486

Pages:80

Published On:October 2025

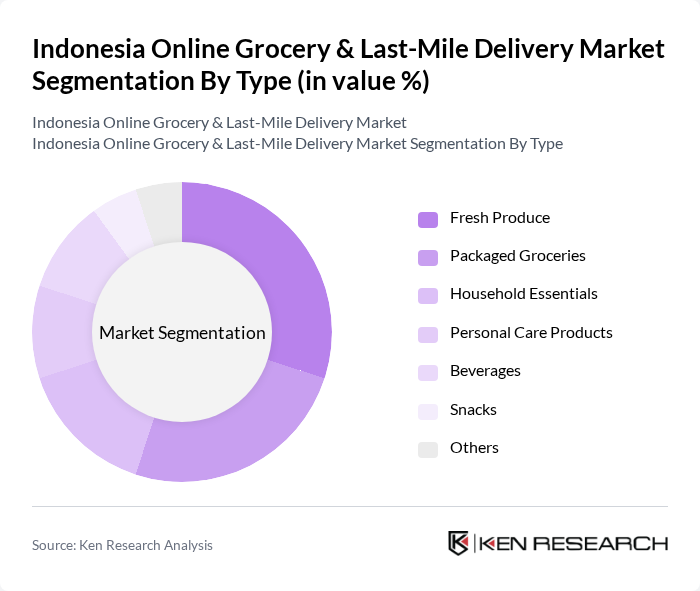

By Type:The market is segmented into various types, including Fresh Produce, Packaged Groceries, Household Essentials, Personal Care Products, Beverages, Snacks, and Others. Among these, Fresh Produce is gaining traction due to the increasing demand for organic and locally sourced food items, driven by health-conscious consumers. Packaged Groceries also hold a significant share as they offer convenience and longer shelf life, appealing to busy urban dwellers.

By Sales Channel:The market is segmented into Direct-to-Consumer, Third-Party Marketplaces, Subscription Services, and Social Media Platforms. Direct-to-Consumer channels are becoming increasingly popular as brands seek to establish a direct relationship with their customers, enhancing brand loyalty and customer experience. Third-Party Marketplaces also play a crucial role, providing a platform for various sellers to reach a broader audience.

The Indonesia Online Grocery & Last-Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Grab, HappyFresh, TaniHub, Sayurbox, Alfamart, Indomaret, Bukalapak, Tokopedia, Shopee, Lazada, Kecap Manis, BliBli, Roti Bakar 88, Warung Pintar contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's online grocery and last-mile delivery market appears promising, driven by technological advancements and evolving consumer preferences. As mobile applications become increasingly sophisticated, they will enhance user experience and streamline operations. Additionally, the integration of AI and data analytics will enable companies to optimize logistics and personalize offerings. With a growing focus on sustainability, businesses that prioritize eco-friendly practices are likely to gain a competitive edge, appealing to the environmentally conscious consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Household Essentials Personal Care Products Beverages Snacks Others |

| By Sales Channel | Direct-to-Consumer Third-Party Marketplaces Subscription Services Social Media Platforms |

| By Delivery Mode | Same-Day Delivery Scheduled Delivery Click and Collect |

| By Consumer Demographics | Millennials Families Seniors |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Product Origin | Local Products Imported Products |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Grocery Retailers | 150 | Business Owners, E-commerce Managers |

| Last-Mile Delivery Service Providers | 100 | Operations Managers, Logistics Coordinators |

| Consumer Insights on Grocery Shopping | 200 | Frequent Online Shoppers, General Consumers |

| Market Analysts and Industry Experts | 50 | Market Researchers, Industry Consultants |

| Regulatory Bodies and Policy Makers | 30 | Government Officials, Policy Advisors |

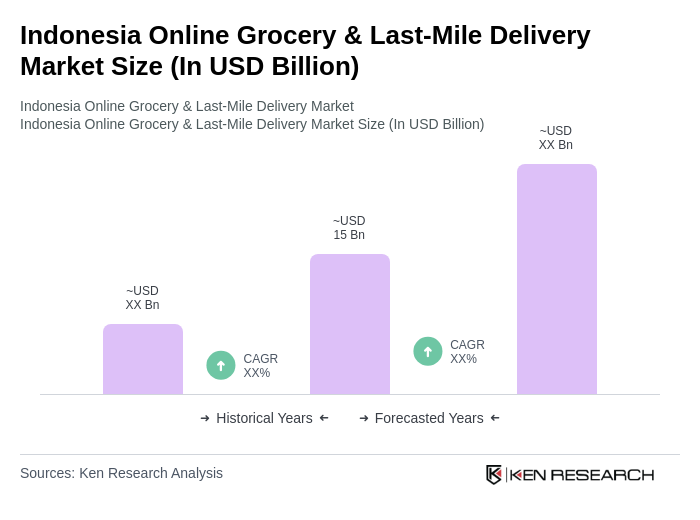

The Indonesia Online Grocery & Last-Mile Delivery Market is valued at approximately USD 15 billion, reflecting significant growth driven by increased e-commerce adoption, urbanization, and changing consumer behaviors, particularly accelerated by the COVID-19 pandemic.