Region:Asia

Author(s):Geetanshi

Product Code:KRAB5729

Pages:96

Published On:October 2025

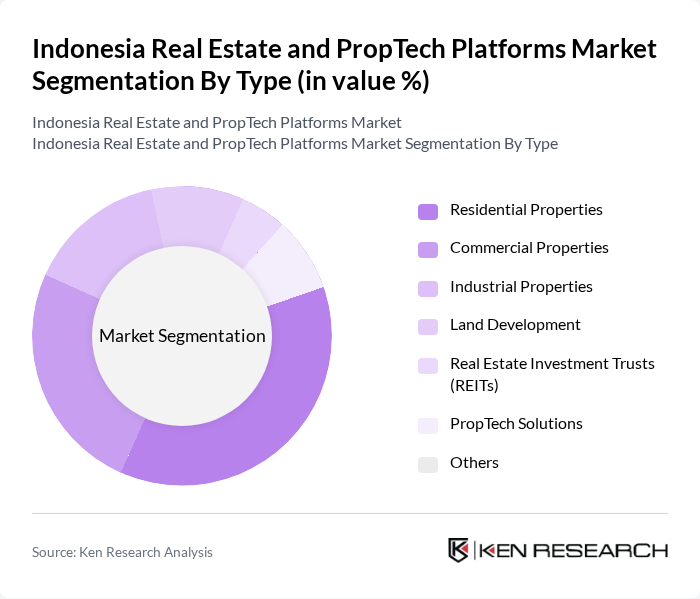

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Land Development, Real Estate Investment Trusts (REITs), PropTech Solutions, and Others. Each of these segments caters to different consumer needs and investment strategies, reflecting the diverse landscape of the real estate market.

The Residential Properties segment is currently dominating the market, driven by the increasing demand for housing due to urban migration and a growing population. This segment caters to a wide range of consumers, from first-time homebuyers to luxury property investors. The trend towards urban living and the development of affordable housing projects have further fueled this growth. Additionally, the rise of digital platforms has made it easier for consumers to access residential listings, enhancing market dynamics.

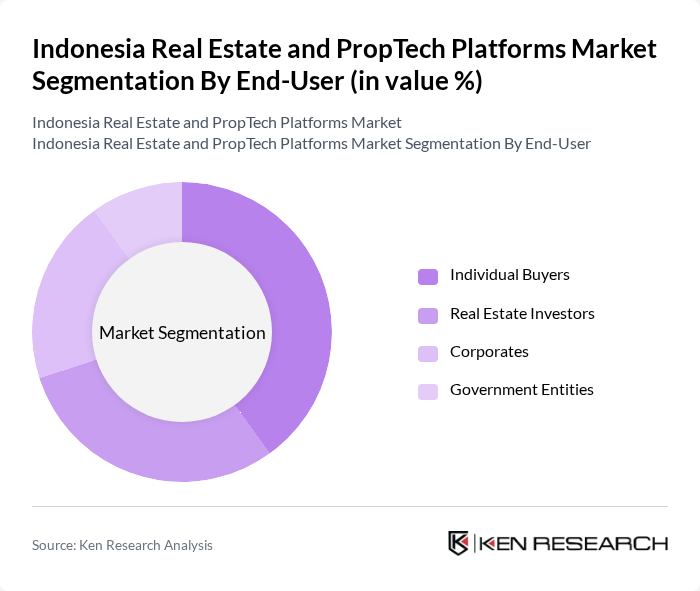

By End-User:The market is segmented by end-users, including Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Each end-user category has distinct motivations and requirements, influencing their engagement with the real estate market.

The Individual Buyers segment is the largest, driven by the increasing number of first-time homebuyers and the growing middle class seeking homeownership. This demographic is particularly influenced by government housing programs and financing options that make purchasing homes more accessible. Additionally, the trend of urbanization has led to a surge in demand for residential properties among individual buyers, further solidifying their dominance in the market.

The Indonesia Real Estate and PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rumah123, 99.co, PropertyGuru Indonesia, Lamudi Indonesia, UrbanIndo, Jendela360, Mamikos, CitraLand (PT Ciputra Development Tbk), Ciputra Group, Agung Podomoro Land (PT Agung Podomoro Land Tbk), Sinarmas Land (PT Sinar Mas Land), Summarecon Agung (PT Summarecon Agung Tbk), Bintaro Jaya (PT Bumi Serpong Damai Tbk), Intiland Development (PT Intiland Development Tbk), Pakuwon Jati (PT Pakuwon Jati Tbk) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's real estate and PropTech platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for innovative housing solutions will rise, prompting developers to adopt smart technologies. Additionally, the integration of AI and big data analytics will enhance decision-making processes, improving operational efficiency. The government's commitment to infrastructure development will further bolster market growth, creating a conducive environment for investment and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Land Development Real Estate Investment Trusts (REITs) PropTech Solutions (including property listings, rental management, investment analytics, building automation, smart homes, and construction technologies) Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Online Platforms Real Estate Agents Direct Sales Auctions |

| By Property Size | Small Scale Medium Scale Large Scale |

| By Investment Type | Equity Investments Debt Financing Crowdfunding |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Transactions | 120 | Real Estate Agents, Home Buyers |

| Commercial Property Leasing | 90 | Property Managers, Business Owners |

| PropTech Adoption Insights | 60 | Tech Startups, Real Estate Developers |

| Investment Trends in Real Estate | 50 | Real Estate Investors, Financial Analysts |

| Market Challenges and Opportunities | 70 | Industry Experts, Market Analysts |

The Indonesia real estate market is valued at approximately USD 95 billion, driven by urbanization, increasing disposable incomes, and a growing middle class seeking better housing and investment opportunities.