Region:Europe

Author(s):Shubham

Product Code:KRAB5553

Pages:96

Published On:October 2025

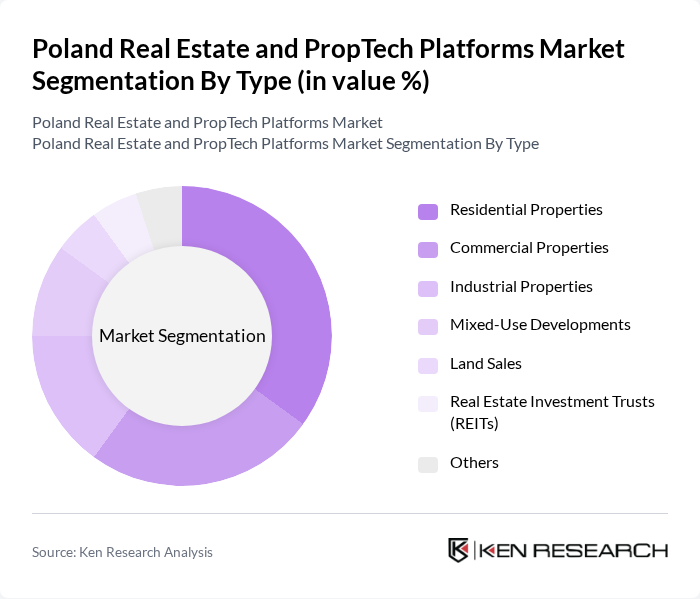

By Type:The market can be segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Mixed-Use Developments, Land Sales, Real Estate Investment Trusts (REITs), and Others. Each of these segments caters to different consumer needs and investment strategies, reflecting the diverse landscape of the real estate market.

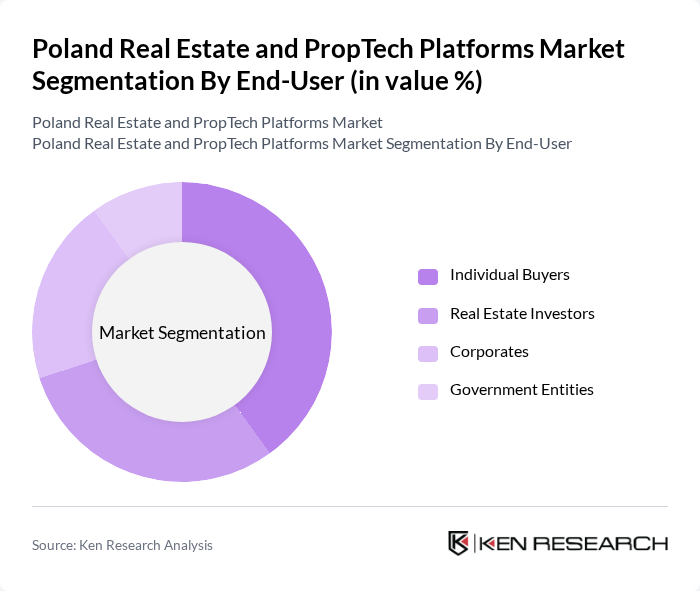

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Each group has distinct motivations and requirements when engaging with the real estate market, influencing the types of properties they seek and the investment strategies they employ.

The Poland Real Estate and PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dom Development S.A., Echo Investment S.A., J.W. Construction Holding S.A., Atal S.A., Robyg S.A., Budimex S.A., Ghelamco Poland, Skanska Property Poland, Griffin Real Estate, Capital Park S.A., Mota-Engil Central Europe, Vastint Poland, Panattoni Europe, Cavatina Holding S.A., 7R S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Poland real estate and PropTech market is poised for significant evolution, driven by technological integration and changing consumer preferences. As urbanization continues, the demand for innovative housing solutions will rise, prompting further investment in smart technologies. Additionally, the increasing focus on sustainability will shape property development strategies. Companies that adapt to these trends and leverage data analytics will likely gain a competitive advantage, positioning themselves favorably in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Developments Land Sales Real Estate Investment Trusts (REITs) Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Online Platforms Real Estate Agents Direct Sales Auctions |

| By Investment Type | Direct Investment Crowdfunding Joint Ventures |

| By Property Management Type | Full-Service Management Self-Management Hybrid Management |

| By Financing Source | Bank Loans Private Equity Government Grants |

| By Market Segment | Luxury Segment Mid-Range Segment Affordable Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Executives |

| Commercial Property Managers | 80 | Operations Managers, Asset Managers |

| PropTech Platform Users | 120 | Real Estate Investors, Tech Start-up Founders |

| Real Estate Brokers | 90 | Sales Agents, Market Analysts |

| Government Regulatory Bodies | 50 | Policy Makers, Urban Planners |

The Poland Real Estate and PropTech Platforms Market is valued at approximately USD 10 billion, reflecting significant growth driven by urbanization, a rising middle class, and advancements in technology for property management and transactions.