Region:Asia

Author(s):Shubham

Product Code:KRAB5642

Pages:81

Published On:October 2025

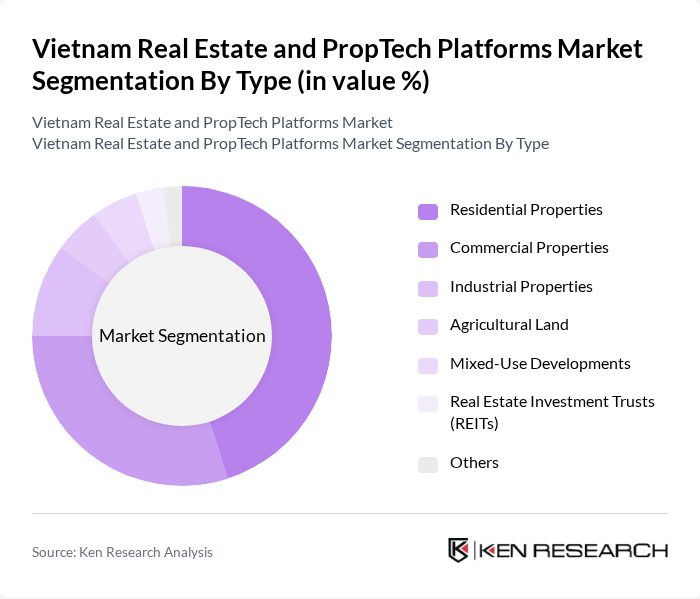

By Type:The market is segmented into various types, including Residential Properties, Commercial Properties, Industrial Properties, Agricultural Land, Mixed-Use Developments, Real Estate Investment Trusts (REITs), and Others. Among these, Residential Properties are the most dominant segment, driven by the increasing demand for housing due to urban migration and population growth. Commercial Properties also hold significant market share, fueled by the expansion of businesses and retail sectors.

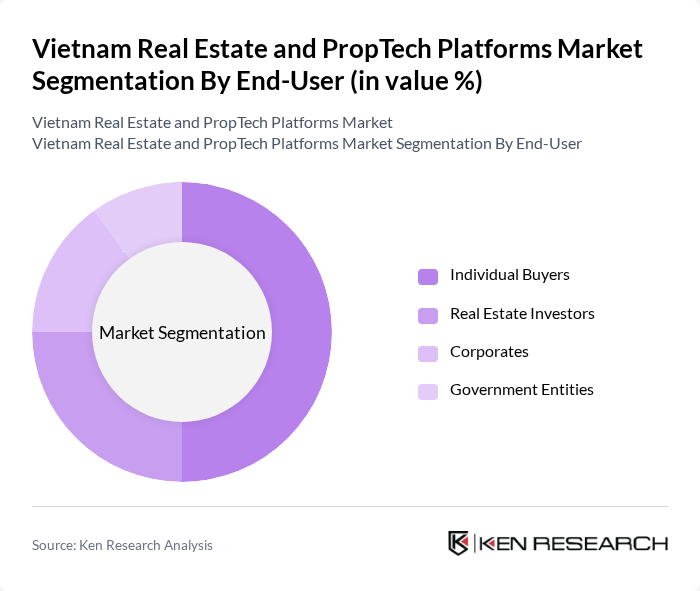

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Individual Buyers represent the largest segment, driven by the growing middle class and their aspirations for home ownership. Real Estate Investors are also significant, as they seek opportunities in both residential and commercial properties to capitalize on the booming market.

The Vietnam Real Estate and PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinhomes JSC, Novaland Investment Group, Dat Xanh Group, FPT Corporation, CEN Group, Him Lam Land, Phu My Hung Development Corporation, Kinh Bac City Development Holding Corporation, Saigon Newport Corporation, An Phuoc Investment and Development, Viettel Group, TNR Holdings Vietnam, Sun Group, Nam Long Investment Corporation, CII Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam real estate and PropTech market is poised for significant transformation as urbanization accelerates and digital adoption increases. In the future, the integration of advanced technologies such as AI and big data will enhance property management and transaction efficiency. Additionally, the government's commitment to infrastructure development will create new opportunities for real estate investment. As consumer preferences shift towards online platforms, PropTech solutions will play a crucial role in shaping the future landscape of the real estate market in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Agricultural Land Mixed-Use Developments Real Estate Investment Trusts (REITs) Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Sales Channel | Online Platforms Real Estate Agencies Direct Sales Auctions |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Property Size | Small Scale Properties Medium Scale Properties Large Scale Properties |

| By Financing Type | Bank Loans Private Equity Crowdfunding Self-Financing |

| By Policy Support | Subsidies for Developers Tax Exemptions for Buyers Grants for Sustainable Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Developers | 100 | Project Managers, Business Development Heads |

| Commercial Property Managers | 80 | Operations Managers, Leasing Agents |

| PropTech Startups | 60 | Founders, Product Managers |

| Real Estate Agents and Brokers | 120 | Sales Agents, Market Analysts |

| End-users of PropTech Solutions | 90 | Home Buyers, Investors, Tenants |

The Vietnam Real Estate and PropTech Platforms Market is valued at approximately USD 5 billion, driven by rapid urbanization, increasing disposable incomes, and a growing middle class seeking home ownership and investment opportunities.