Region:Asia

Author(s):Shubham

Product Code:KRAB5635

Pages:93

Published On:October 2025

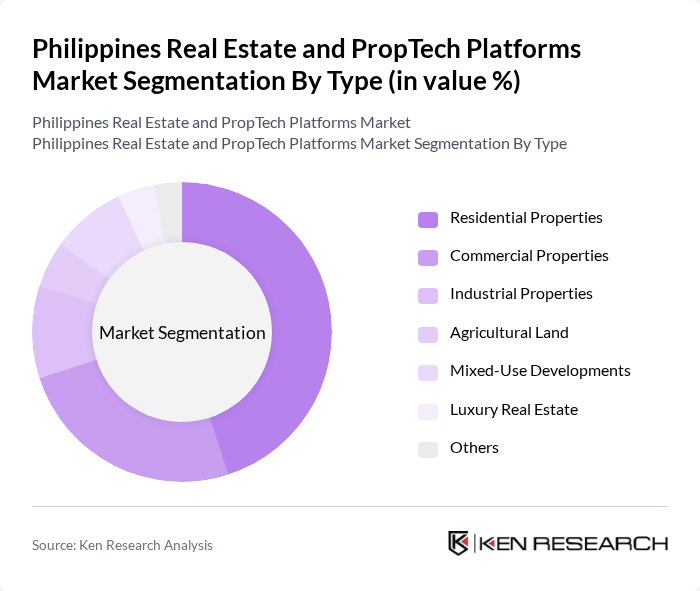

By Type:The market is segmented into various types of properties, including residential, commercial, industrial, agricultural, mixed-use developments, luxury real estate, and others. Among these, residential properties dominate the market due to the increasing demand for housing driven by urban migration and population growth. The trend towards urbanization has led to a surge in residential developments, making it the leading sub-segment.

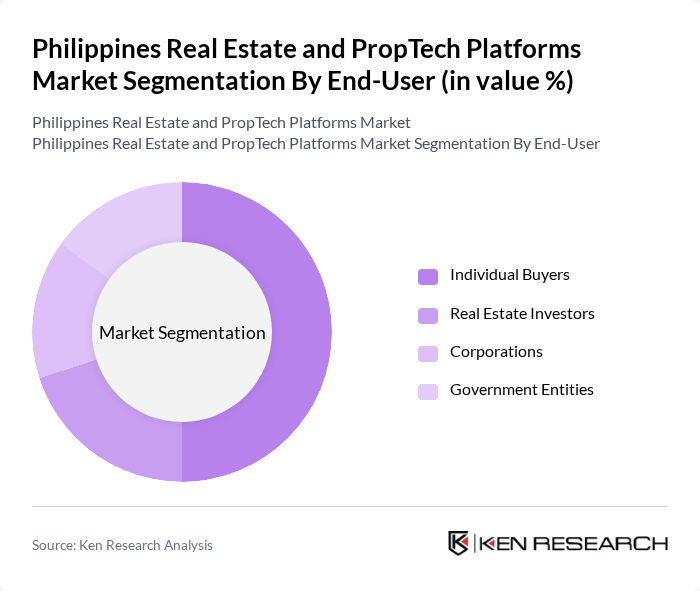

By End-User:The end-user segmentation includes individual buyers, real estate investors, corporations, and government entities. Individual buyers represent the largest segment, driven by the increasing number of first-time homebuyers and the growing middle class seeking home ownership. This trend is supported by favorable financing options and government initiatives aimed at making housing more accessible.

The Philippines Real Estate and PropTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., SM Development Corporation, Megaworld Corporation, DMCI Homes, Robinsons Land Corporation, Vista Land & Lifescapes, Inc., Federal Land, Inc., Rockwell Land Corporation, Century Properties Group, Inc., Property Company of Friends, Inc., Ortigas & Company, Ltd., Greenfield Development Corporation, Aboitiz InfraCapital, Inc., DoubleDragon Properties Corp., 8990 Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines real estate and PropTech market is poised for significant transformation as urbanization accelerates and technology adoption increases. In the future, the integration of smart technologies and digital platforms will reshape property management and transactions, enhancing efficiency and customer engagement. Additionally, the growing middle-class population will drive demand for affordable housing solutions, while regulatory reforms may gradually ease market entry barriers, fostering a more competitive landscape that encourages innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Properties Commercial Properties Industrial Properties Agricultural Land Mixed-Use Developments Luxury Real Estate Others |

| By End-User | Individual Buyers Real Estate Investors Corporations Government Entities |

| By Sales Channel | Direct Sales Online Platforms Real Estate Agents Auctions |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Property Size | Small Scale Medium Scale Large Scale |

| By Financing Type | Mortgages Cash Purchases Lease-to-Own |

| By Policy Support | Subsidies for First-Time Buyers Tax Incentives for Developers Housing Assistance Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Transactions | 150 | Real Estate Agents, Home Buyers |

| Commercial Property Investments | 100 | Property Investors, Commercial Brokers |

| PropTech Platform Usage | 80 | Tech-savvy Home Buyers, Real Estate Developers |

| Market Trends in Urban Areas | 70 | Urban Planners, Local Government Officials |

| Impact of Digital Tools on Real Estate | 90 | Real Estate Analysts, PropTech Entrepreneurs |

The Philippines Real Estate and PropTech Platforms Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by urbanization, a rising middle class, and the increasing use of digital platforms for property transactions.