Region:Asia

Author(s):Rebecca

Product Code:KRAB4198

Pages:83

Published On:October 2025

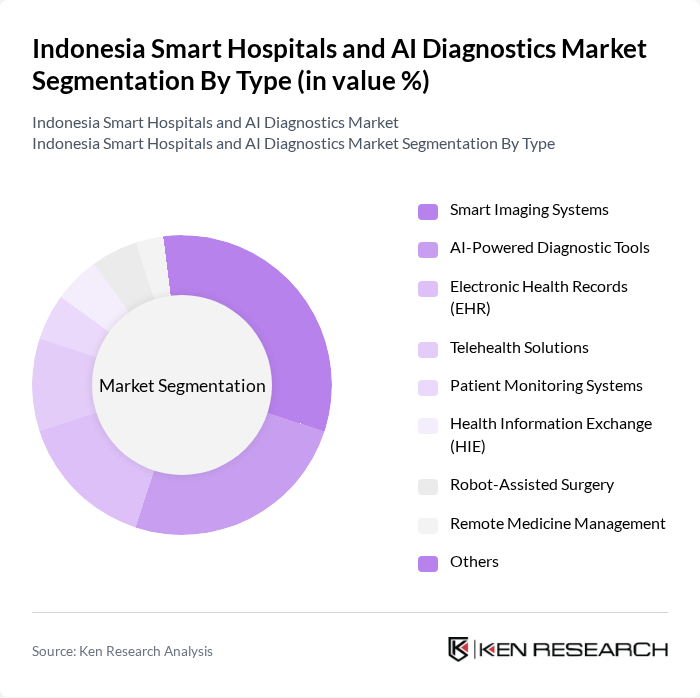

By Type:The market is segmented into various types, including Smart Imaging Systems, AI-Powered Diagnostic Tools, Electronic Health Records (EHR), Telehealth Solutions, Patient Monitoring Systems, Health Information Exchange (HIE), Robot-Assisted Surgery, Remote Medicine Management, and Others. Among these, Smart Imaging Systems and AI-Powered Diagnostic Tools are leading the market due to their critical role in enhancing diagnostic accuracy and improving patient outcomes. The increasing demand for efficient healthcare solutions has driven hospitals to invest in these technologies, resulting in a significant market share for these segments. The adoption of AI-powered diagnostic tools is accelerating, supported by government initiatives and rising investments in digital health infrastructure.

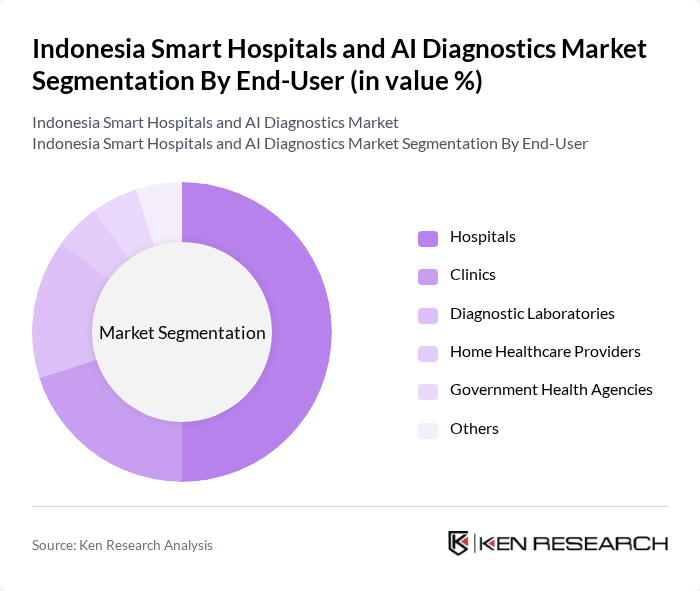

By End-User:The end-user segmentation includes Hospitals, Clinics, Diagnostic Laboratories, Home Healthcare Providers, Government Health Agencies, and Others. Hospitals are the dominant end-user segment, driven by the increasing need for advanced diagnostic tools and smart healthcare solutions to improve patient care and operational efficiency. The growing trend of digital transformation in healthcare is pushing hospitals to adopt these technologies, leading to a significant market share in this segment. Clinics and diagnostic laboratories are also expanding their adoption of smart technologies, particularly in urban areas.

The Indonesia Smart Hospitals and AI Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as RSUP Dr. Cipto Mangunkusumo, Siloam Hospitals, Mitra Keluarga Karyasehat Tbk, RSUP Persahabatan, RSUD Dr. Soetomo, Alodokter, Halodoc, Prodia Widyahusada Tbk, Klinik Pintar, Medika Komunika Teknologi, SehatQ, KlikDokter, Aido Health, Bio Farma, Telkom Indonesia, PT Kalbe Farma Tbk, Philips Indonesia, Siemens Healthineers Indonesia, GE HealthCare Indonesia, PT Kimia Farma Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Smart Hospitals and AI Diagnostics market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government continues to prioritize digital health initiatives, hospitals are expected to enhance their infrastructure and adopt innovative solutions. Furthermore, the integration of AI and IoT technologies will likely lead to improved patient outcomes and operational efficiencies, positioning Indonesia as a leader in healthcare innovation in Southeast Asia.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Imaging Systems AI-Powered Diagnostic Tools Electronic Health Records (EHR) Telehealth Solutions Patient Monitoring Systems Health Information Exchange (HIE) Robot-Assisted Surgery Remote Medicine Management Others |

| By End-User | Hospitals Clinics Diagnostic Laboratories Home Healthcare Providers Government Health Agencies Others |

| By Application | Chronic Disease Management Preventive Healthcare Emergency Care Rehabilitation Services Remote Medicine Management Robot-Assisted Surgery Others |

| By Distribution Channel | Direct Tender Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Technology | Artificial Intelligence Machine Learning Natural Language Processing Robotics Cloud Computing IoT Connectivity Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Innovation Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Implementation | 100 | Hospital Administrators, IT Managers |

| AI Diagnostic Tools Usage | 80 | Healthcare Professionals, Radiologists |

| Patient Experience with Smart Technologies | 75 | Patients, Caregivers |

| Healthcare Policy Impact | 60 | Healthcare Policy Makers, Regulatory Officials |

| Market Trends in AI Diagnostics | 90 | Market Analysts, Technology Developers |

The Indonesia Smart Hospitals and AI Diagnostics Market is valued at approximately USD 230 million, reflecting significant growth driven by the adoption of advanced healthcare technologies, increased healthcare expenditure, and a focus on patient-centric care.