Region:Asia

Author(s):Shubham

Product Code:KRAB3210

Pages:82

Published On:October 2025

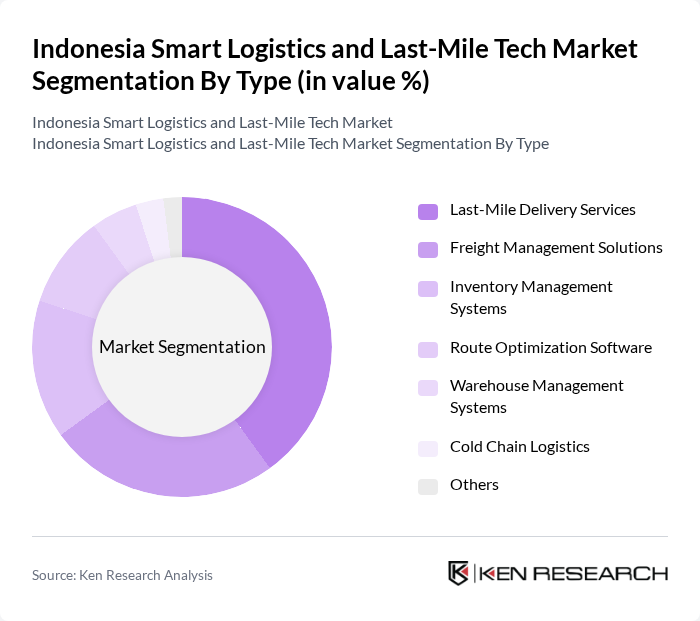

By Type:The market is segmented into various types, including Last-Mile Delivery Services, Freight Management Solutions, Inventory Management Systems, Route Optimization Software, Warehouse Management Systems, Cold Chain Logistics, and Others. Among these, Last-Mile Delivery Services is the most prominent segment, driven by the surge in e-commerce and consumer expectations for quick delivery. The increasing reliance on technology for tracking and managing deliveries has also contributed to the growth of this segment.

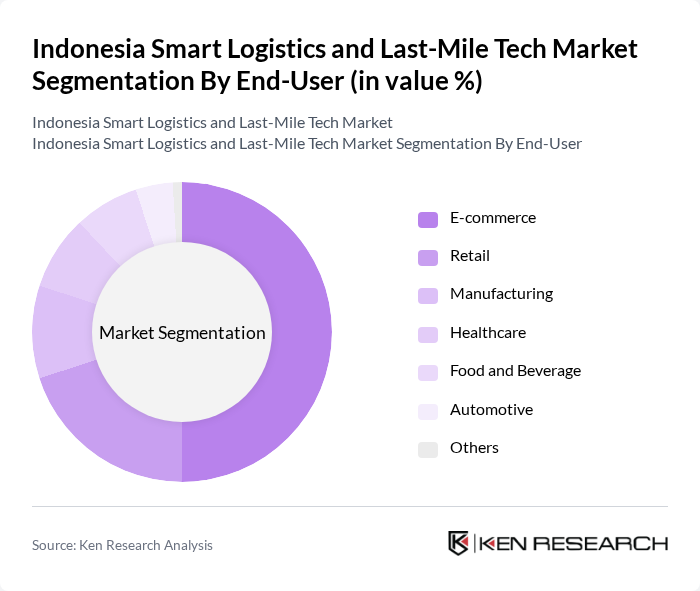

By End-User:The end-user segmentation includes E-commerce, Retail, Manufacturing, Healthcare, Food and Beverage, Automotive, and Others. The E-commerce sector is the leading end-user, as the demand for efficient logistics solutions has surged with the growth of online shopping. Retailers are increasingly adopting smart logistics technologies to enhance their supply chain efficiency and meet consumer expectations for timely deliveries.

The Indonesia Smart Logistics and Last-Mile Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as JNE Express, Tiki, Gojek, Grab, Ninja Xpress, SiCepat, Anteraja, Wahana Prestasi Logistik, Pos Indonesia, Deliveree, Kargo Technologies, Lalamove, Rappi, Bluebird Group, GrabExpress contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's smart logistics and last-mile tech market appears promising, driven by ongoing urbanization and technological advancements. As e-commerce continues to expand, logistics providers are likely to invest in innovative solutions to enhance delivery efficiency. The integration of AI and IoT technologies will play a pivotal role in optimizing operations. Additionally, the government's focus on improving infrastructure and regulatory frameworks will further support market growth, creating a conducive environment for logistics innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Services Freight Management Solutions Inventory Management Systems Route Optimization Software Warehouse Management Systems Cold Chain Logistics Others |

| By End-User | E-commerce Retail Manufacturing Healthcare Food and Beverage Automotive Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Multimodal Transport Others |

| By Sales Channel | Direct Sales Online Platforms Distributors Retail Outlets Others |

| By Service Type | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last-Mile Delivery Solutions | 150 | Logistics Managers, Operations Directors |

| E-commerce Fulfillment Strategies | 100 | eCommerce Executives, Supply Chain Analysts |

| Technology Adoption in Logistics | 80 | IT Managers, Innovation Officers |

| Consumer Preferences in Delivery Services | 120 | Marketing Managers, Customer Experience Leads |

| Government Policies Impacting Logistics | 70 | Policy Makers, Urban Development Planners |

The Indonesia Smart Logistics and Last-Mile Tech Market is valued at approximately USD 5 billion, driven by the rapid growth of e-commerce, urbanization, and the demand for efficient supply chain solutions.