Region:Asia

Author(s):Dev

Product Code:KRAC3465

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of sporting goods, including fitness equipment, team sports equipment, outdoor gear, individual sports equipment, sports apparel and footwear, accessories, and wearable technology. Among these, fitness equipment and sports apparel are particularly popular due to the growing trend of home workouts, athleisure fashion, and the influence of social media and fitness influencers. The demand for outdoor gear is also rising as more consumers engage in recreational activities such as hiking and camping, reflecting a broader lifestyle shift toward wellness and adventure .

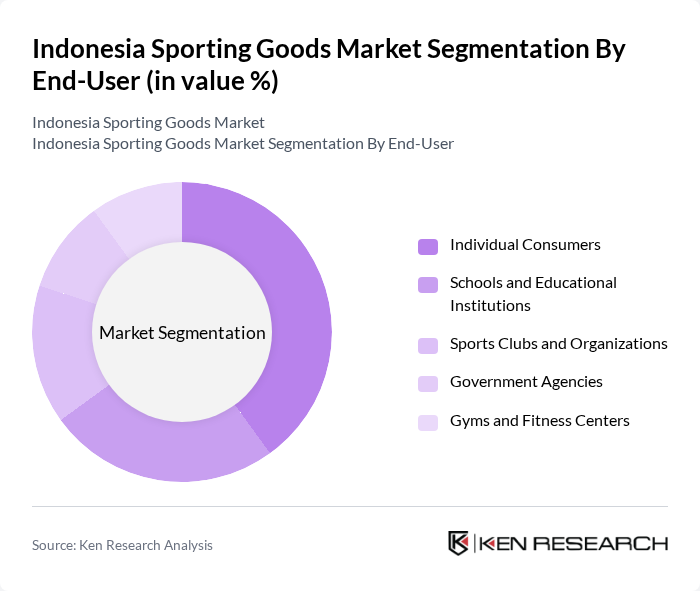

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, sports clubs and organizations, government agencies, and gyms and fitness centers. Individual consumers represent the largest segment, driven by the increasing trend of personal fitness and wellness, as well as the popularity of athleisure and digital fitness platforms. Schools and educational institutions are also significant as they promote sports among students, while gyms and fitness centers are expanding their offerings to attract more members. The growing role of government agencies in organizing community sports events and supporting grassroots sports development further diversifies end-user demand .

The Indonesia Sporting Goods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas Indonesia, Nike Indonesia, Asics Indonesia, Decathlon Indonesia, Wilson Sporting Goods, Mizuno Indonesia, Puma Indonesia, Under Armour Indonesia, PT Eigerindo Multi Produk Industri (EIGER), PT Pan Brothers Tbk, PT League Indonesia (League), PT Berca Sportindo (Specs), New Balance Indonesia, Skechers Indonesia, Consina (PT Consina Outdoor Indonesia), Columbia Sportswear Company, The North Face Indonesia, Merrell Indonesia, Salomon Indonesia, Black Diamond Equipment Indonesia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indonesian sporting goods market appears promising, driven by increasing health consciousness and government support for sports initiatives. As disposable incomes rise, consumers are likely to invest more in quality sporting goods. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. However, businesses must navigate challenges such as intense competition and supply chain disruptions to capitalize on these growth opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Team Sports Equipment (Football, Basketball, Volleyball, etc.) Outdoor Gear (Camping, Hiking, Climbing, etc.) Individual Sports Equipment (Badminton, Tennis, Golf, Running, Cycling, etc.) Sports Apparel and Footwear Accessories (Bags, Water Bottles, Protective Gear, etc.) Wearable Technology (Fitness Trackers, Smartwatches) |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government Agencies Gyms and Fitness Centers |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Specialty Sports Stores Department Stores Supermarkets/Hypermarkets Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sporting Goods Sales | 75 | Store Managers, Sales Representatives |

| Consumer Purchasing Behavior | 85 | Active Sports Participants, Casual Buyers |

| Online Sporting Goods Market | 65 | E-commerce Managers, Digital Marketing Specialists |

| Fitness Equipment Usage | 55 | Gym Owners, Personal Trainers |

| Sports Apparel Trends | 50 | Fashion Buyers, Brand Managers |

The Indonesia Sporting Goods Market is valued at approximately USD 5.9 billion, reflecting a significant growth trend driven by increased health consciousness, sports participation, and government initiatives promoting physical fitness and sports activities.