Region:Asia

Author(s):Geetanshi

Product Code:KRAD5866

Pages:89

Published On:December 2025

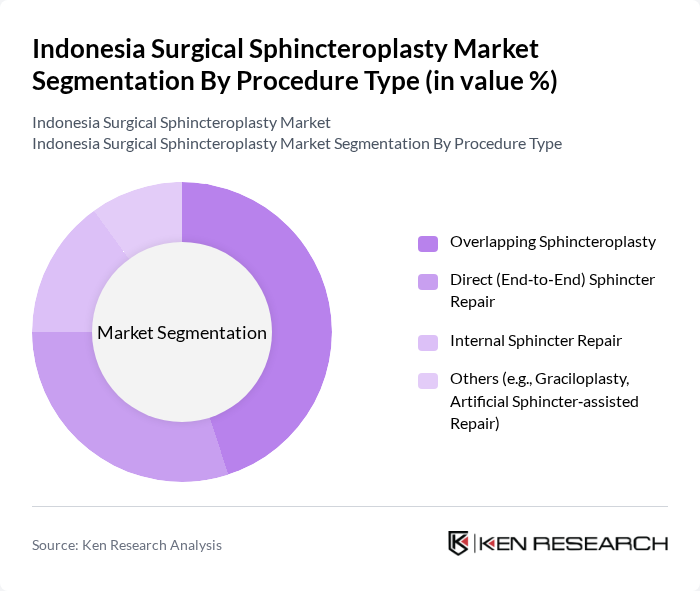

By Procedure Type:The procedure type segmentation includes various surgical techniques employed in sphincteroplasty. The dominant sub-segment is Overlapping Sphincteroplasty, which is preferred due to its effectiveness in restoring anal function and lower complication rates. Direct (End-to-End) Sphincter Repair is also significant, particularly for cases with less severe damage. Internal Sphincter Repair is gaining traction as minimally invasive techniques become more popular. The "Others" category, which includes Graciloplasty and Artificial Sphincter-assisted Repair, is smaller but important for specific patient needs.

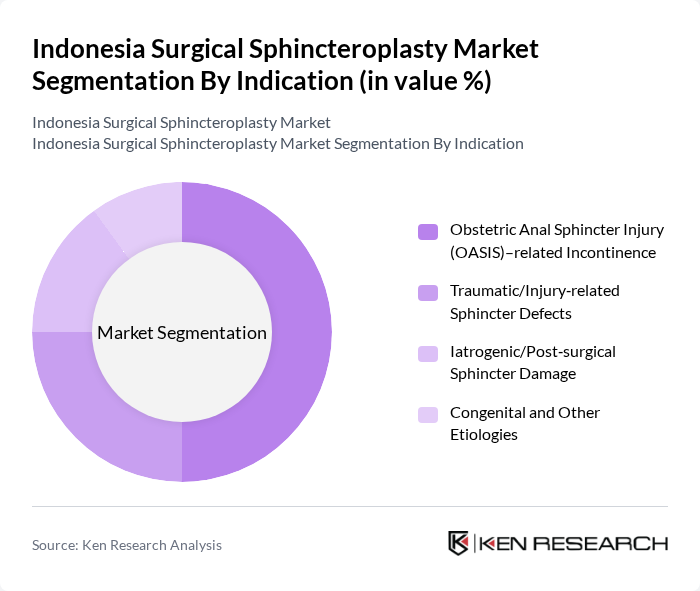

By Indication:The indication segmentation highlights the various causes of anal sphincter damage that necessitate surgical intervention. Obstetric Anal Sphincter Injury (OASIS)–related Incontinence is the leading cause, driven by the high rates of childbirth-related injuries. Traumatic/Injury-related Sphincter Defects also represent a significant portion, particularly in active populations. Iatrogenic/Post-surgical Sphincter Damage is increasingly recognized as a concern, while Congenital and Other Etiologies account for a smaller share but are critical for specific patient demographics.

The Indonesia Surgical Sphincteroplasty Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Medikaloka Hermina Tbk (RS Hermina Group), PT Siloam International Hospitals Tbk (Siloam Hospitals Group), PT Mitra Keluarga Karyasehat Tbk (Mitra Keluarga Hospitals), PT Bundamedik Tbk (RSU Bunda Group), PT Sarana Meditama Metropolitan Tbk (OMNI Hospitals Group), PT Mayapada Healthcare Tbk (Mayapada Hospitals), PT Royal Prima Tbk (Royal Prima Hospitals), PT Pertamina Bina Medika IHC (Indonesia Healthcare Corporation), PT Prodia Widyahusada Tbk (Supportive Diagnostics for Colorectal Surgery), PT Kalbe Farma Tbk (Surgical & Peri?operative Pharmaceuticals Portfolio), PT Enseval Putera Megatrading Tbk (Medical Device & Surgical Supply Distribution), PT Oneject Indonesia (Surgical Consumables & Disposables), Medtronic Indonesia (Medtronic plc – Local Operations), Johnson & Johnson Indonesia (Ethicon – Surgical Solutions), B. Braun Medical Indonesia (Surgical Instruments & Hospital Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical sphincteroplasty market in Indonesia appears promising, driven by ongoing advancements in surgical techniques and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, more patients will gain access to surgical options. Additionally, the integration of telemedicine is expected to facilitate pre- and post-operative consultations, improving patient engagement and outcomes. These trends indicate a positive trajectory for the market, with potential for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Procedure Type | Overlapping Sphincteroplasty Direct (End?to?End) Sphincter Repair Internal Sphincter Repair Others (e.g., Graciloplasty, Artificial Sphincter?assisted Repair) |

| By Indication | Obstetric Anal Sphincter Injury (OASIS)–related Incontinence Traumatic/Injury?related Sphincter Defects Iatrogenic/Post?surgical Sphincter Damage Congenital and Other Etiologies |

| By Approach | Open Sphincteroplasty Minimally Invasive / Laparoscopic?assisted Procedures Robotic?assisted / Image?guided Procedures Others |

| By Care Setting | Tertiary Care & Teaching Hospitals Private Multi?specialty Hospitals Specialized Colorectal & Proctology Clinics Ambulatory Surgical Centers / Day?care Surgery Units |

| By Region (Indonesia) | Java (Jakarta, West Java, Central Java, East Java, Banten, Yogyakarta) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| By Payer Type | Public Insurance (BPJS Kesehatan / JKN) Private Health Insurance Self?pay / Out?of?Pocket Corporate / Employer?sponsored Schemes |

| By Surgeon Specialty | Colorectal Surgeons General Surgeons Urogynecologists / Obstetricians?Gynecologists Others (e.g., Urologists, Pediatric Surgeons) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Surgical Departments | 95 | Surgeons, Department Heads |

| Private Clinic Patient Feedback | 80 | Patients, Clinic Administrators |

| Healthcare Policy Makers | 45 | Health Ministry Officials, Policy Analysts |

| Insurance Providers | 55 | Claims Analysts, Underwriters |

| Medical Equipment Suppliers | 40 | Sales Representatives, Product Managers |

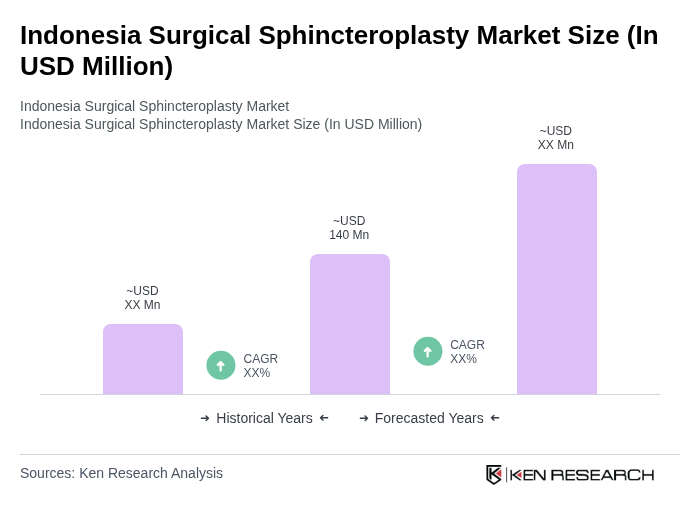

The Indonesia Surgical Sphincteroplasty Market is valued at approximately USD 140 million, reflecting a five-year historical analysis. This growth is largely attributed to the increasing prevalence of anal incontinence and advancements in surgical techniques.