3.1 Growth Drivers

3.1.1 Increasing Demand from Electronics Industry

3.1.2 Rising Awareness of Static Electricity Hazards

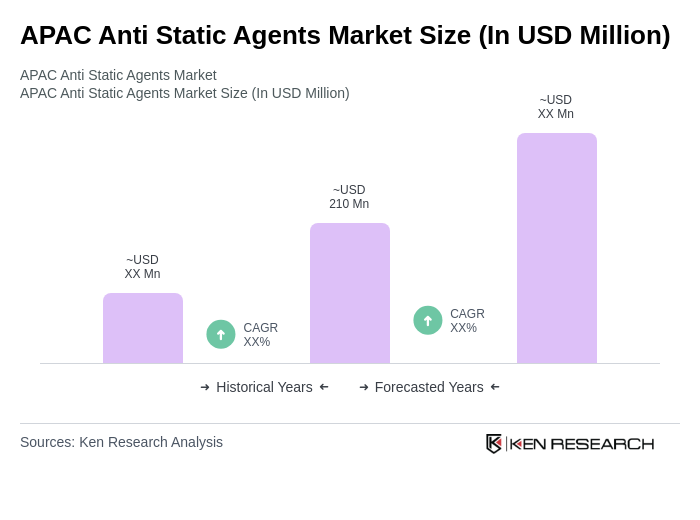

3.1.3 Growth in Packaging Industry

3.1.4 Technological Advancements in Anti Static Solutions3.2 Market Challenges3.2.1 High Cost of Advanced Anti Static Agents3.2.2 Stringent Regulatory Compliance3.2.3 Limited Awareness in Emerging Markets3.2.4 Competition from Alternative Solutions3.3 Market Opportunities3.3.1 Expansion in Emerging Economies3.3.2 Development of Eco-friendly Anti Static Agents3.3.3 Increasing Use in Automotive Applications3.3.4 Collaborations with Key Industry Players3.4 Market Trends3.4.1 Shift Towards Sustainable Products3.4.2 Integration of Smart Technologies3.4.3 Customization of Anti Static Solutions3.4.4 Growth of E-commerce and Online Retail3.5 Government Regulation3.5.1 Compliance with Environmental Standards3.5.2 Safety Regulations for Chemical Products3.5.3 Import and Export Regulations3.5.4 Incentives for Green Products4. SWOT Analysis5. Stakeholder Analysis6. Porter's Five Forces Analysis7. APAC Anti Static Agents Market Market Size, 2019-20247.1 By Value7.2 By Volume7.3 By Average Selling Price8. APAC Anti Static Agents Market Segmentation8.1 By Type8.1.1 Non-ionic Anti Static Agents8.1.2 Cationic Anti Static Agents8.1.3 Anionic Anti Static Agents8.1.4 Others8.2 By End-User8.2.1 Electronics8.2.2 Packaging8.2.3 Automotive8.2.4 Textiles8.3 By Application8.3.1 Coatings8.3.2 Plastics8.3.3 Films8.3.4 Others8.4 By Distribution Channel8.4.1 Direct Sales8.4.2 Distributors8.4.3 Online Retail8.4.4 Others8.5 By Region8.5.1 North Asia (China, Japan, South Korea)8.5.2 Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore)8.5.3 South Asia (India, Bangladesh, Sri Lanka)8.5.4 Others (Australia, New Zealand, Rest of APAC)8.6 By Price Range8.6.1 Low8.6.2 Medium8.6.3 High8.7 By Regulatory Compliance8.7.1 REACH Compliance8.7.2 OSHA Standards8.7.3 ISO Certifications8.7.4 Others9. APAC Anti Static Agents Market Competitive Analysis9.1 Market Share of Key Players9.2 Cross Comparison of Key Players9.2.1 Company Name9.2.2 Group Size (Large, Medium, or Small as per industry convention)9.2.3 Revenue Growth Rate (YoY, 3Y CAGR)9.2.4 Market Penetration Rate (APAC Market Share, Distribution Coverage)9.2.5 Customer Retention Rate (Repeat Business, Contract Renewals)9.2.6 Pricing Strategy (Premium, Competitive, Economy)9.2.7 Product Diversification Index (Breadth of Product Portfolio)9.2.8 Supply Chain Efficiency (Lead Time, Inventory Turnover)9.2.9 Brand Recognition Score (Brand Equity, Customer Awareness)9.2.10 Innovation Rate (R&D Spend as % of Revenue, New Product Launches)9.3 SWOT Analysis of Top Players9.4 Pricing Analysis9.5 Detailed Profile of Major Companies9.5.1 BASF SE9.5.2 Evonik Industries AG9.5.3 Dow Chemical Company9.5.4 3M Company9.5.5 Clariant AG9.5.6 Croda International Plc9.5.7 Huntsman Corporation9.5.8 Solvay S.A.9.5.9 AkzoNobel N.V.9.5.10 Momentive Performance Materials Inc.9.5.11 Afton Chemical Corporation9.5.12 Kraton Corporation9.5.13 Eastman Chemical Company9.5.14 PolyOne Corporation (now Avient Corporation)9.5.15 Air Products and Chemicals, Inc.9.5.16 Arkema S.A.9.5.17 Mitsubishi Chemical Corporation9.5.18 Shin-Etsu Chemical Co., Ltd.9.5.19 Sumitomo Chemical Co., Ltd.9.5.20 Toray Industries, Inc.10. APAC Anti Static Agents Market End-User Analysis10.1 Procurement Behavior of Key Ministries10.1.1 Government Procurement Policies10.1.2 Budget Allocations for Anti Static Solutions10.1.3 Evaluation Criteria for Suppliers10.2 Corporate Spend on Infrastructure & Energy10.2.1 Investment Trends in Anti Static Solutions10.2.2 Budgeting for Compliance and Safety10.2.3 Long-term Contracts with Suppliers10.3 Pain Point Analysis by End-User Category10.3.1 Cost Management Challenges10.3.2 Quality Assurance Issues10.3.3 Supply Chain Disruptions10.4 User Readiness for Adoption10.4.1 Awareness of Anti Static Solutions10.4.2 Training and Support Needs10.4.3 Integration with Existing Systems10.5 Post-Deployment ROI and Use Case Expansion10.5.1 Measurement of Effectiveness10.5.2 Case Studies of Successful Implementations10.5.3 Future Expansion Plans11. APAC Anti Static Agents Market Future Size, 2025-203011.1 By Value11.2 By Volume11.3 By Average Selling PriceGo-To-Market Strategy Phase1. Whitespace Analysis + Business Model Canvas1.1 Market Gaps Identification1.2 Value Proposition Development1.3 Revenue Streams Analysis1.4 Customer Segmentation1.5 Key Partnerships1.6 Cost Structure Analysis1.7 Channels of Distribution2. Marketing and Positioning Recommendations2.1 Branding Strategies2.2 Product USPs2.3 Target Market Positioning2.4 Communication Strategies2.5 Digital Marketing Approaches3. Distribution Plan3.1 Urban Retail Strategies3.2 Rural NGO Tie-ups3.3 E-commerce Distribution3.4 Direct Sales Approaches3.5 Partnerships with Distributors4. Channel & Pricing Gaps4.1 Underserved Routes4.2 Pricing Bands Analysis4.3 Competitor Pricing Strategies4.4 Customer Willingness to Pay5. Unmet Demand & Latent Needs5.1 Category Gaps5.2 Consumer Segments Analysis5.3 Emerging Trends in Demand5.4 Future Needs Assessment6. Customer Relationship6.1 Loyalty Programs6.2 After-sales Service6.3 Customer Feedback Mechanisms6.4 Engagement Strategies7. Value Proposition7.1 Sustainability Initiatives7.2 Integrated Supply Chains7.3 Competitive Advantages7.4 Customer-Centric Innovations8. Key Activities8.1 Regulatory Compliance8.2 Branding Initiatives8.3 Distribution Setup8.4 Market Research Activities9. Entry Strategy Evaluation9.1 Domestic Market Entry Strategy9.1.1 Product Mix Considerations9.1.2 Pricing Band Strategy9.1.3 Packaging Innovations9.2 Export Entry Strategy9.2.1 Target Countries Identification9.2.2 Compliance Roadmap Development10. Entry Mode Assessment10.1 Joint Ventures10.2 Greenfield Investments10.3 Mergers & Acquisitions10.4 Distributor Model Evaluation11. Capital and Timeline Estimation11.1 Capital Requirements11.2 Timelines for Market Entry12. Control vs Risk Trade-Off12.1 Ownership vs Partnerships12.2 Risk Management Strategies13. Profitability Outlook13.1 Breakeven Analysis13.2 Long-term Sustainability Strategies14. Potential Partner List14.1 Distributors14.2 Joint Ventures14.3 Acquisition Targets15. Execution Roadmap15.1 Phased Plan for Market Entry15.1.1 Market Setup15.1.2 Market Entry15.1.3 Growth Acceleration15.1.4 Scale & Stabilize15.2 Key Activities and Milestones15.2.1 Milestone Planning15.2.2 Activity TrackingDisclaimerContact Us## Validation and Updates

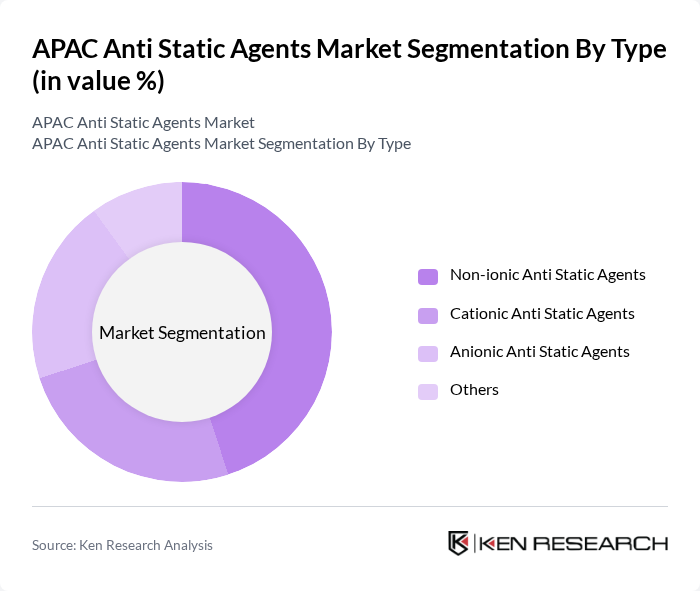

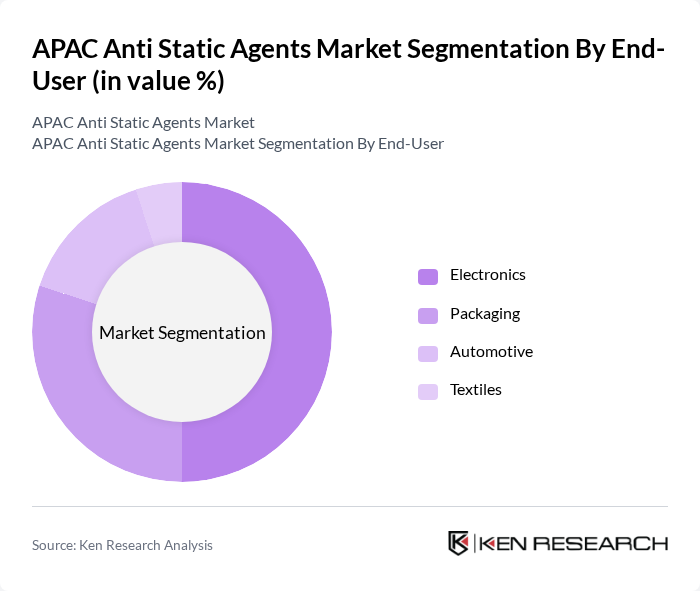

**Section 8: Market Segmentation**

The segmentation structure is robust and reflects the APAC market dynamics. However, the **By Region** sub-section (8.5) has been updated to explicitly list key countries in each sub-region (e.g., China, Japan, South Korea for North Asia; Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore for Southeast Asia; India, Bangladesh, Sri Lanka for South Asia), aligning with industry reports that highlight these as major consumers and growth drivers in the APAC anti-static agents market[1][2]. This granularity is critical for regional strategy and investment decisions.

**Section 9.2: KPIs for Cross Comparison of Key Players**

The original KPIs are generic. For the APAC anti-static agents market, the following investor-relevant, measurable metrics are recommended:

- **Revenue Growth Rate (YoY, 3Y CAGR):** Critical for assessing company momentum in a high-growth region[1].

- **Market Penetration Rate (APAC Market Share, Distribution Coverage):** Reflects regional dominance and channel strength[1].

- **Customer Retention Rate (Repeat Business, Contract Renewals):** Indicates customer satisfaction and sticky revenue.

- **Pricing Strategy (Premium, Competitive, Economy):** Key in price-sensitive APAC markets.

- **Product Diversification Index (Breadth of Product Portfolio):** Important for serving diverse end-use industries (electronics, packaging, automotive, textiles)[1][2].

- **Supply Chain Efficiency (Lead Time, Inventory Turnover):** Vital in a region with complex logistics and just-in-time manufacturing.

- **Brand Recognition Score (Brand Equity, Customer Awareness):** Influences procurement in brand-conscious APAC markets.

- **Innovation Rate (R&D Spend as % of Revenue, New Product Launches):** Drives differentiation in a competitive, innovation-led sector[1].

**Section 9.5: List of Major Companies**

The original list was global and omitted several APAC-focused players. The updated list includes both multinational leaders with strong APAC presence and major regional chemical companies, ensuring relevance to the APAC anti-static agents market. All company names are correctly encoded in UTF-8 and reflect current corporate identities (e.g., PolyOne Corporation is now Avient Corporation). Added companies such as Mitsubishi Chemical Corporation, Shin-Etsu Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., and Toray Industries, Inc. are critical regional players in advanced materials and additives, including anti-static agents[1]. These firms are deeply embedded in APAC supply chains for electronics, packaging, and automotive sectors.

**No other sections were modified.** All original numbering, tags, and structure are preserved. The updates ensure the TOC accurately reflects the APAC anti-static agents market’s segmentation, competitive dynamics, and key player landscape.