Australia Used Vehicle and Auto Finance Market Overview

- The Australia Used Vehicle and Auto Finance Market is valued at USD 25 billion, based on a five?year historical analysis. This growth is primarily driven by increasing consumer demand for affordable transportation options, coupled with a rise in disposable income and favorable financing conditions. The market has seen a significant uptick in transactions as consumers opt for used vehicles over new ones, influenced by economic factors and changing consumer preferences.

- Key cities such as Sydney, Melbourne, and Brisbane dominate the market due to their large populations and robust economic activities. These urban centers have a high concentration of dealerships and financing institutions, making it easier for consumers to access used vehicles and financing options. Additionally, the presence of a diverse demographic contributes to a vibrant used vehicle market in these regions.

- In 2023, the Australian government implemented stricter emissions regulations aimed at reducing the carbon footprint of vehicles on the road. This regulation encourages consumers to consider more fuel-efficient and environmentally friendly used vehicles, thereby influencing purchasing decisions in the used vehicle market.

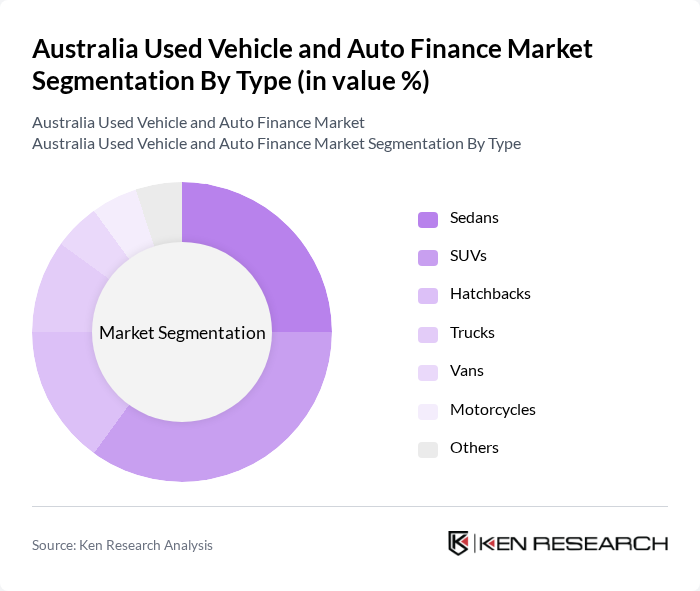

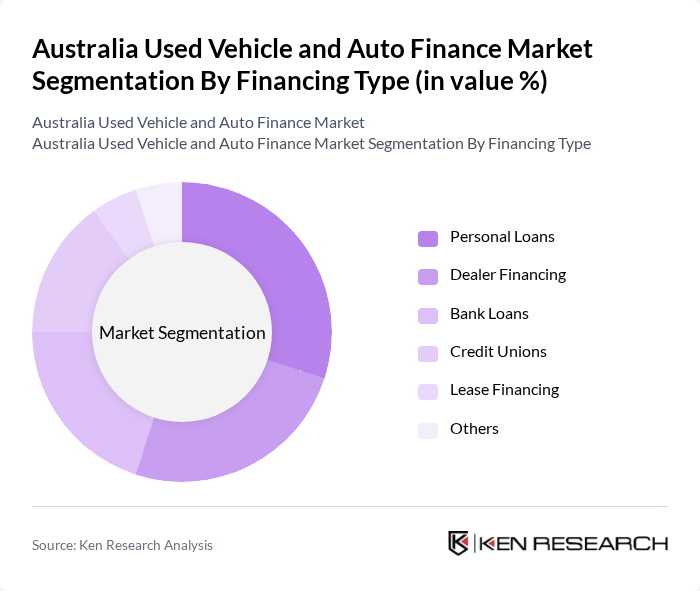

Australia Used Vehicle and Auto Finance Market Segmentation

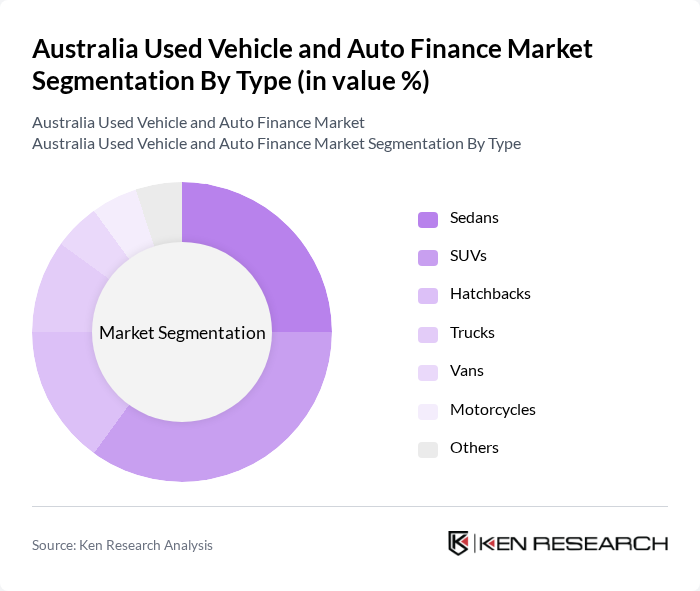

By Type:The used vehicle market is segmented into various types, including sedans, SUVs, hatchbacks, trucks, vans, motorcycles, and others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and adventure seekers alike. Sedans also maintain a strong presence due to their affordability and fuel efficiency. The demand for trucks and vans is driven by commercial needs, while motorcycles cater to a niche market focused on cost-effective and agile transportation.

By Financing Type:The financing options available for used vehicles include personal loans, dealer financing, bank loans, credit unions, lease financing, and others. Personal loans are increasingly popular due to their flexibility and competitive interest rates. Dealer financing is also a common choice, as it simplifies the purchasing process for consumers. Bank loans and credit unions provide additional options, while lease financing is gaining traction among consumers looking for short-term vehicle solutions.

Australia Used Vehicle and Auto Finance Market Competitive Landscape

The Australia Used Vehicle and Auto Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Financial Services, Westpac Banking Corporation, ANZ Banking Group, Commonwealth Bank of Australia, National Australia Bank, St. George Bank, Suncorp Group, Macquarie Group, Bendigo and Adelaide Bank, Latitude Financial Services, Bank of Queensland, ING Australia, Heritage Bank, RACQ Bank, CUA (Credit Union Australia) contribute to innovation, geographic expansion, and service delivery in this space.

Australia Used Vehicle and Auto Finance Market Industry Analysis

Growth Drivers

- Increasing Demand for Affordable Transportation:The Australian used vehicle market is driven by a significant demand for affordable transportation options. In the future, approximately 1.3 million used vehicles are expected to be sold, reflecting a 5% increase from the previous year. With the average price of a used vehicle around AUD 32,000, many consumers are opting for pre-owned cars to manage their budgets effectively. This trend is expected to continue as household disposable income remains stable, projected at AUD 1,050 per week in the future.

- Rise in Online Vehicle Sales Platforms:The shift towards digitalization has transformed the used vehicle market in Australia. In the future, online vehicle sales are expected to account for 40% of total used vehicle transactions, up from 25% in 2021. Platforms like Carsales and Drive have facilitated this growth, providing consumers with easy access to vehicle listings and financing options. As internet penetration reaches 95% in the future, the trend towards online purchasing is expected to further accelerate, enhancing market accessibility.

- Expansion of Financing Options:The availability of diverse financing options has significantly contributed to the growth of the used vehicle market. In the future, around 65% of used vehicle purchases are expected to be financed, with lenders offering competitive rates and flexible terms. The average loan amount for used vehicles is projected to be approximately AUD 27,000, with repayment terms extending up to 8 years. This expansion is supported by a low-interest rate environment, with the Reserve Bank of Australia maintaining rates at 2.9% in the future, encouraging consumer borrowing.

Market Challenges

- Economic Fluctuations Affecting Consumer Spending:Economic uncertainties pose a significant challenge to the used vehicle market. In the future, Australia's GDP growth is expected to slow to 2.3%, down from 3.5% in the previous year, impacting consumer confidence and spending. As inflation rates hover around 5.0%, many consumers are hesitant to make large purchases, including used vehicles. This cautious spending behavior is expected to persist into the future, potentially dampening market growth.

- Regulatory Compliance Complexities:The used vehicle market faces challenges related to regulatory compliance, particularly concerning emissions and safety standards. In the future, the Australian government is expected to introduce stricter emission regulations, requiring used vehicles to meet specific environmental criteria. Compliance costs can be burdensome for dealers, with estimates suggesting an increase of up to AUD 6,000 per vehicle for necessary modifications. This regulatory landscape complicates operations and may deter potential buyers concerned about compliance costs.

Australia Used Vehicle and Auto Finance Market Future Outlook

The future of the Australia used vehicle and auto finance market appears promising, driven by technological advancements and changing consumer preferences. The increasing adoption of electric and hybrid vehicles is expected to reshape the market landscape, with sales projected to rise significantly. Additionally, the expansion of digital financing solutions will enhance accessibility and convenience for consumers, fostering a more competitive environment. As sustainability becomes a priority, the market is likely to witness a shift towards eco-friendly vehicle options, aligning with global trends in transportation.

Market Opportunities

- Growth in Electric and Hybrid Used Vehicles:The demand for electric and hybrid used vehicles is on the rise, with sales increasing by 25% in the future. As consumers become more environmentally conscious, this segment presents a lucrative opportunity for dealers and financiers. The Australian government’s commitment to reducing carbon emissions further supports this trend, making it a key area for investment and growth in the coming years.

- Expansion of Digital Financing Solutions:The digital financing landscape is evolving rapidly, with fintech companies offering innovative solutions. In the future, digital financing options are expected to account for 45% of all auto loans, a figure expected to grow as technology advances. This shift allows for quicker approvals and personalized financing plans, catering to the needs of tech-savvy consumers and enhancing overall market efficiency.