Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0179

Pages:100

Published On:August 2025

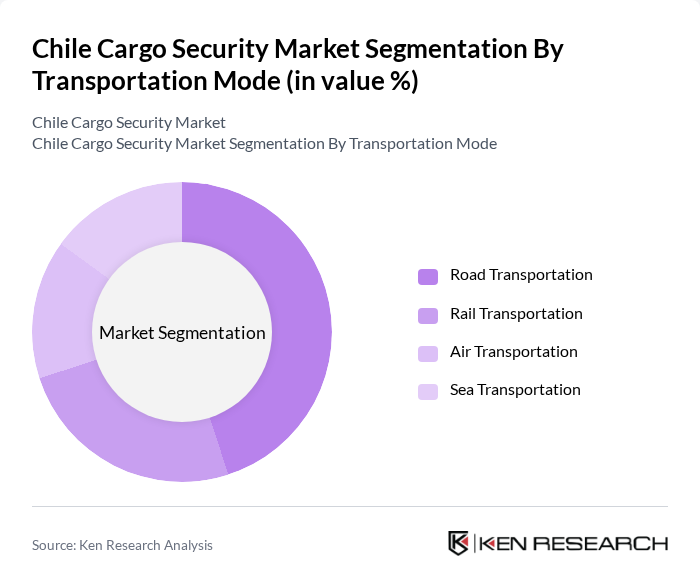

By Transportation Mode:

The transportation mode segment includes road, rail, air, and sea transportation. Road transportation is the most dominant due to Chile’s extensive and modernized road network, which facilitates efficient movement of goods nationwide. The increasing reliance on trucks for last-mile delivery, especially in urban areas, has led to a surge in demand for cargo security solutions tailored for road transport. Rail transportation remains significant for bulk commodities, while air and sea transportation are essential for international trade, each requiring specialized security measures. The adoption of advanced fleet management technologies and real-time tracking systems is further enhancing operational efficiency and security across all modes .

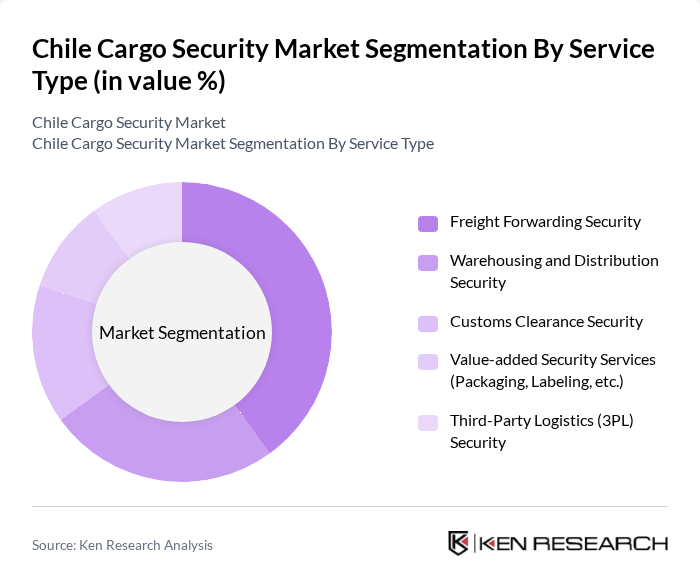

By Service Type:

This segment encompasses freight forwarding security, warehousing and distribution security, customs clearance security, value-added security services, and third-party logistics (3PL) security. Freight forwarding security leads the segment, driven by the growth of international trade and the need for secure logistics solutions. As businesses increasingly outsource logistics functions, the demand for comprehensive security services covering the entire supply chain has risen. The adoption of digital technologies for supply chain optimization, automated warehousing, and route optimization is also enhancing the security and efficiency of these services .

The Chile Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Securitas Chile, Prosegur, G4S Chile, Grupo Eulen Chile, ADT Security Services Chile, Chubb Fire & Security Chile, Tyco Integrated Security (Johnson Controls), Verisure Chile, Axis Communications, Hikvision, Dahua Technology, Honeywell Security, Bosch Security Systems, FLIR Systems, LATAM Cargo Chile, Maersk Chile, DHL Global Forwarding Chile, and UPS Chile contribute to innovation, geographic expansion, and service delivery in this space.

The Chile cargo security market is poised for significant evolution, driven by technological advancements and increasing security demands. As e-commerce continues to expand, the need for robust security solutions will intensify. Additionally, the integration of AI and IoT technologies will enhance threat detection and response capabilities. Companies are likely to prioritize partnerships with tech providers to innovate security measures, ensuring cargo safety and operational efficiency in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Service Type | Freight Forwarding Security Warehousing and Distribution Security Customs Clearance Security Value-added Security Services (Packaging, Labeling, etc.) Third-Party Logistics (3PL) Security |

| By Industry Vertical | Mining and Minerals Agriculture and Food Manufacturing Automotive Retail and Consumer Goods Pharmaceuticals and Healthcare |

| By Security Technology | RFID Technology GPS Tracking Biometric Systems Video Surveillance Access Control Systems Others |

| By Region | Santiago Valparaíso Concepción Antofagasta Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping and Freight Forwarding | 100 | Logistics Managers, Operations Directors |

| Customs and Regulatory Compliance | 60 | Customs Brokers, Compliance Officers |

| High-Value Cargo Security | 50 | Security Managers, Risk Assessment Specialists |

| Technology Solutions for Cargo Security | 40 | IT Managers, Technology Providers |

| Insurance and Liability in Cargo Transport | 40 | Insurance Underwriters, Risk Managers |

The Chile Cargo Security Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for secure transportation solutions and the expansion of e-commerce, which necessitates enhanced security measures for logistics and supply chains.