Region:Africa

Author(s):Dev

Product Code:KRAB0579

Pages:82

Published On:August 2025

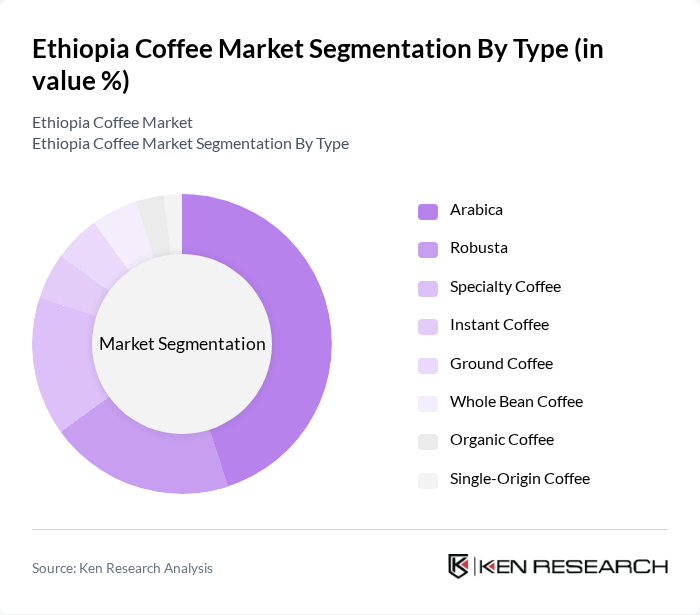

By Type:The coffee market in Ethiopia is segmented into various types, including Arabica, Robusta, Specialty Coffee, Instant Coffee, Ground Coffee, Whole Bean Coffee, Organic Coffee, and Single-Origin Coffee. Among these, Arabica coffee is the most dominant due to its superior flavor profile and higher market demand. Specialty Coffee has also gained traction, driven by consumer preferences for unique and high-quality brews. The growing trend towards organic and single-origin varieties reflects a shift in consumer behavior towards sustainability and quality. Ethiopia’s primary coffee production remains Arabica, with specialty and organic segments expanding due to global demand and premiumization trends .

By Application / End-User:The coffee market in Ethiopia serves various end-users, including households, cafés and restaurants, foodservice (hotels, catering), retail outlets (supermarkets, convenience stores), and export markets. Households represent a significant portion of the market, driven by the cultural importance of coffee in Ethiopian society. Cafés and restaurants are increasingly focusing on specialty and organic offerings to cater to the growing consumer demand for high-quality coffee experiences. The rise of café culture and urbanization is further expanding domestic consumption, while export markets remain a key revenue driver .

The Ethiopia Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ethiopian Coffee Exporters Association, Yirgacheffe Coffee Farmers Cooperative Union, Sidama Coffee Farmers Cooperative Union, Oromia Coffee Farmers Cooperative Union, Buna Qela Coffee Export PLC, Kaldi's Coffee, Tomoca Coffee, Addis Exporter Coffee, Ethiopian Coffee and Tea Authority, Coffee Quality Institute, Ethiopian Specialty Coffee Association, Harar Coffee Farmers Cooperative Union, Kafa Coffee Farmers Cooperative Union, Coffee Research Institute of Ethiopia, Ethiopian Coffee Federation contribute to innovation, geographic expansion, and service delivery in this space.

The Ethiopia coffee market is poised for growth, driven by increasing global demand for specialty coffee and government initiatives aimed at supporting farmers. As consumer preferences shift towards sustainable and high-quality products, Ethiopia's unique coffee varieties are likely to gain further traction. However, challenges such as climate change and infrastructure limitations must be addressed to ensure long-term sustainability. Continued investment in processing facilities and e-commerce platforms will enhance market access and profitability for Ethiopian coffee producers, fostering a resilient coffee industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Specialty Coffee Instant Coffee Ground Coffee Whole Bean Coffee Organic Coffee Single-Origin Coffee |

| By Application / End-User | Households Cafés and Restaurants Foodservice (Hotels, Catering) Retail Outlets (Supermarkets, Convenience Stores) Export Markets |

| By Sales Channel | Online Sales Supermarkets/Hypermarkets Specialty Coffee Shops Convenience Stores Wholesale Distributors |

| By Price Range | Premium Coffee Mid-Range Coffee Budget Coffee |

| By Packaging Type | Bags Cans Pods Bulk Packaging |

| By Roast Level | Light Roast Medium Roast Dark Roast |

| By Certification | Organic Certified Fair Trade Certified Rainforest Alliance Certified UTZ Certified |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Coffee Farmers | 120 | Farm Owners, Cooperative Leaders |

| Exporting Companies | 60 | Export Managers, Trade Analysts |

| Local Coffee Roasters | 50 | Roasting Facility Managers, Product Developers |

| Retail Coffee Outlets | 40 | Store Managers, Marketing Executives |

| Consumers of Specialty Coffee | 100 | Coffee Enthusiasts, Regular Consumers |

The Ethiopia Coffee Market is valued at approximately USD 4 billion, driven by increasing global demand for high-quality coffee, particularly specialty and organic varieties, alongside the country's rich coffee heritage and diverse growing regions.