Region:Europe

Author(s):Shubham

Product Code:KRAA0731

Pages:85

Published On:August 2025

By Type:The market is segmented into Fulfillment Services, Last-Mile Delivery, Warehousing Solutions, Freight Forwarding, Reverse Logistics, Cold Chain Logistics, Cross-Border Logistics, Returns Management, and Others. Last-Mile Delivery is the most dominant segment, propelled by rising consumer demand for fast, flexible, and reliable delivery options. The surge in e-commerce has intensified expectations for rapid fulfillment, making last-mile solutions a critical differentiator for logistics providers. Additionally, investment in automation, real-time tracking, and micro-fulfillment centers is reshaping the competitive landscape in this segment .

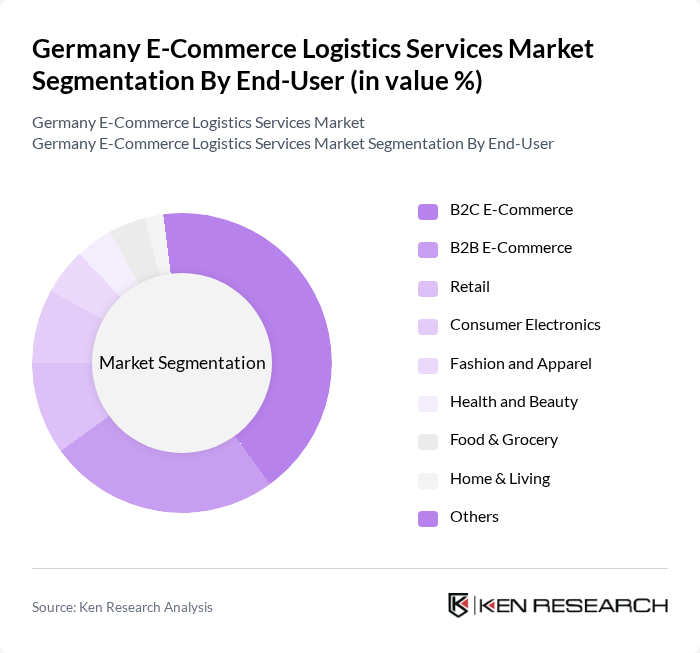

By End-User:The end-user segmentation includes B2C E-Commerce, B2B E-Commerce, Retail, Consumer Electronics, Fashion and Apparel, Health and Beauty, Food & Grocery, Home & Living, and Others. The B2C E-Commerce segment leads the market, driven by the growing prevalence of online shopping among consumers and the proliferation of digital marketplaces. This segment's dominance is reinforced by the expanding range of products available online, the convenience of home delivery, and the increasing sophistication of logistics solutions tailored to individual consumers .

The Germany E-Commerce Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (Deutsche Post DHL Group), DB Schenker, Hermes Germany GmbH, DPD Deutschland GmbH, GLS Germany (General Logistics Systems Germany GmbH & Co. OHG), UPS Germany, FedEx Express Germany, Kuehne + Nagel (AG & Co. KG), Rhenus Logistics, FIEGE Logistik Stiftung & Co. KG, Arvato Supply Chain Solutions (Bertelsmann), Amazon Logistics Germany, Geodis Germany, Hellmann Worldwide Logistics, Dachser SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German e-commerce logistics market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI technologies, operational efficiencies will improve, enabling faster delivery times. Additionally, the rise of sustainable logistics practices will likely reshape the industry, as consumers demand eco-friendly solutions. The focus on enhancing last-mile delivery capabilities will also be crucial, as urbanization continues to drive the need for efficient logistics solutions in densely populated areas.

| Segment | Sub-Segments |

|---|---|

| By Type | Fulfillment Services Last-Mile Delivery Warehousing Solutions Freight Forwarding Reverse Logistics Cold Chain Logistics Cross-Border Logistics Returns Management Others |

| By End-User | B2C E-Commerce B2B E-Commerce Retail Consumer Electronics Fashion and Apparel Health and Beauty Food & Grocery Home & Living Others |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Social Commerce Mobile Commerce Omnichannel Retail Others |

| By Distribution Mode | Standard Delivery Express Delivery Scheduled Delivery Click and Collect Locker Delivery Others |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging Bulk Packaging Temperature-Controlled Packaging Others |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Startups Individual Consumers Marketplace Sellers Others |

| By Service Level | Basic Service Premium Service Customized Service Value-Added Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Services | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 80 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Solutions | 60 | Warehouse Managers, IT Solutions Architects |

| Cross-Border E-commerce Logistics | 50 | International Trade Managers, Compliance Officers |

| Third-Party Logistics Providers | 70 | Business Development Managers, Supply Chain Analysts |

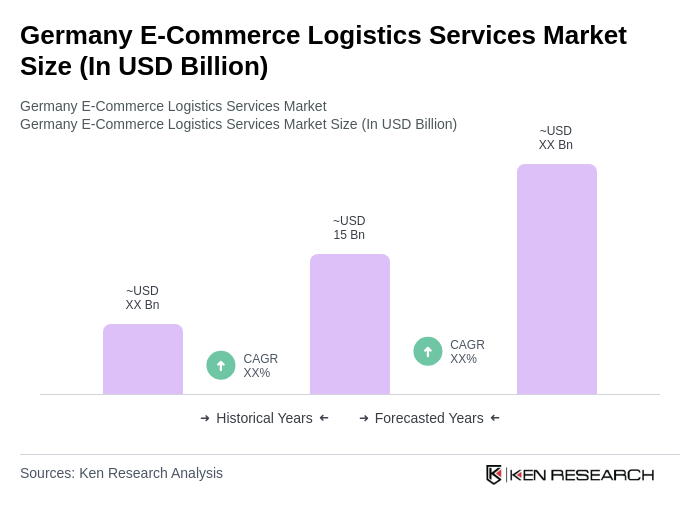

The Germany E-Commerce Logistics Services Market is valued at approximately USD 15 billion, reflecting the robust growth driven by increasing online retail sales and evolving consumer expectations for rapid delivery and digital payment solutions.