Region:Global

Author(s):Rebecca

Product Code:KRAA2855

Pages:86

Published On:August 2025

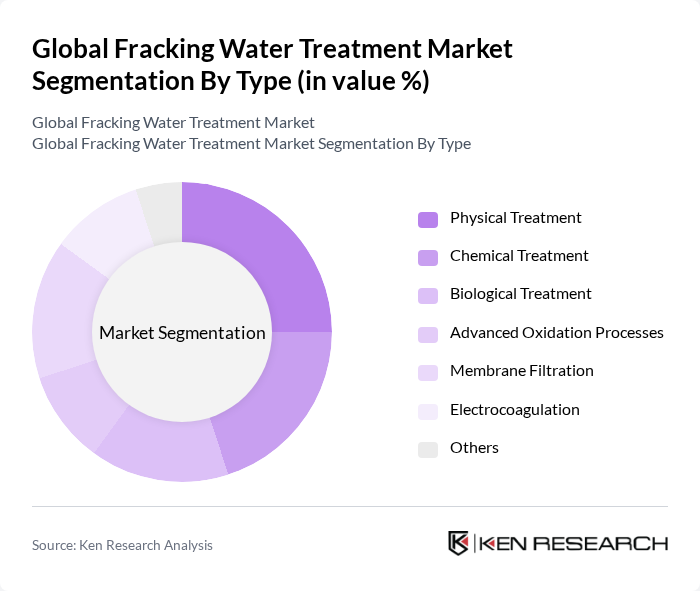

By Type:The market is segmented into various treatment types, including Physical Treatment, Chemical Treatment, Biological Treatment, Advanced Oxidation Processes, Membrane Filtration, Electrocoagulation, and Others. Each of these treatment methods plays a crucial role in ensuring the effective management of wastewater generated from fracking activities. Physical Treatment remains the most widely adopted due to its cost-effectiveness and ability to remove suspended solids, while advanced methods like membrane filtration and electrocoagulation are gaining traction for their efficiency in treating complex contaminants.

Among these, Physical Treatment is the leading sub-segment, primarily due to its cost-effectiveness and efficiency in removing suspended solids and other contaminants from produced water. The increasing focus on minimizing environmental impact and maximizing water reuse in fracking operations further drives the adoption of physical treatment methods.

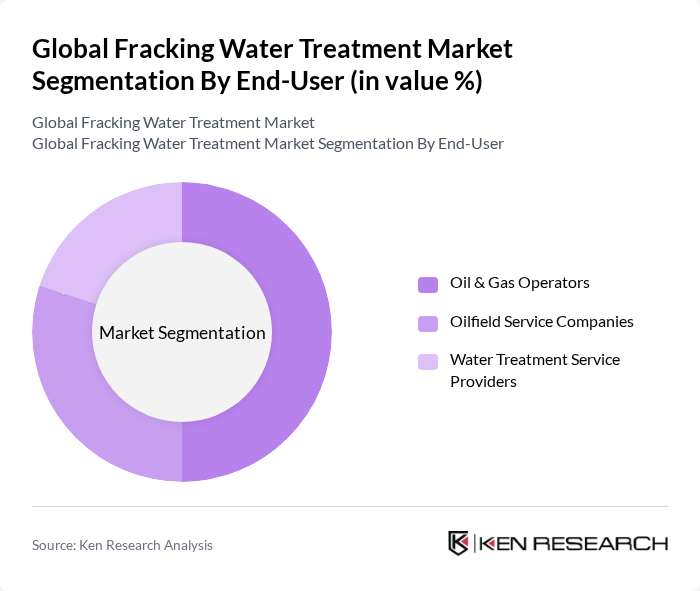

By End-User:The market is segmented into Oil & Gas Operators, Oilfield Service Companies, and Water Treatment Service Providers. Each of these end-users plays a significant role in the fracking water treatment ecosystem, contributing to the overall market dynamics. Oil & Gas Operators lead the market due to their direct involvement in hydraulic fracturing and the necessity to comply with regulatory standards for wastewater management.

Oil & Gas Operators dominate the market due to their significant investment in fracking activities and the need for effective water management solutions. The increasing regulatory pressure on environmental compliance and the push for sustainable practices further enhance the demand for water treatment services among these operators.

The Global Fracking Water Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environnement S.A., SUEZ S.A., Xylem Inc., Ecolab Inc., Aquatech International LLC, AECOM, Pentair plc, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Clean Harbors, Inc., Ovivo Inc., DuPont de Nemours, Inc., Calfrac Well Services Ltd., FTS International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fracking water treatment market is poised for significant transformation, driven by technological advancements and increasing environmental awareness. As companies adopt zero liquid discharge systems and integrate IoT solutions for real-time monitoring, operational efficiencies are expected to improve. Furthermore, the focus on circular economy principles will encourage sustainable practices, leading to enhanced resource recovery and reduced waste. These trends will shape the market landscape, fostering innovation and collaboration among stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Treatment Chemical Treatment Biological Treatment Advanced Oxidation Processes Membrane Filtration Electrocoagulation Others |

| By End-User | Oil & Gas Operators Oilfield Service Companies Water Treatment Service Providers |

| By Application | Produced Water Treatment Flowback Water Treatment Water Reuse & Recycling Desalination Water Quality Monitoring |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Subsidies for Water Treatment Technologies Tax Incentives for Sustainable Practices Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fracking Water Treatment Facilities | 100 | Facility Managers, Operations Directors |

| Environmental Compliance Experts | 60 | Regulatory Affairs Managers, Environmental Consultants |

| Water Treatment Technology Providers | 50 | Product Managers, Technical Sales Representatives |

| Fracking Operations Managers | 70 | Site Managers, Project Engineers |

| Research and Development in Water Treatment | 40 | R&D Managers, Innovation Leads |

The Global Fracking Water Treatment Market is valued at approximately USD 7 billion, driven by the increasing demand for effective water treatment solutions in the oil and gas sector and the rising volume of wastewater generated from hydraulic fracturing activities.