Region:Global

Author(s):Dev

Product Code:KRAA2604

Pages:80

Published On:August 2025

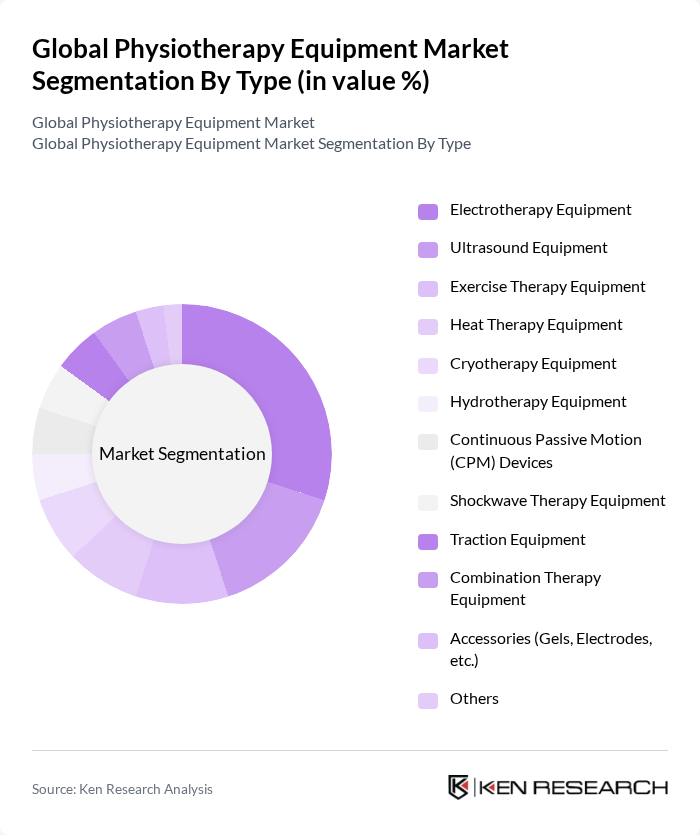

By Type:The physiotherapy equipment market is segmented into various types, including Electrotherapy Equipment, Ultrasound Equipment, Exercise Therapy Equipment, Heat Therapy Equipment, Cryotherapy Equipment, Hydrotherapy Equipment, Continuous Passive Motion (CPM) Devices, Shockwave Therapy Equipment, Traction Equipment, Combination Therapy Equipment, Accessories (Gels, Electrodes, etc.), and Others. Among these, Electrotherapy Equipment is the leading subsegment due to its widespread application in pain management and muscle rehabilitation. The increasing adoption of electrotherapy devices in clinics and hospitals, coupled with advancements in technology and the integration of digital health solutions, has significantly contributed to its dominance .

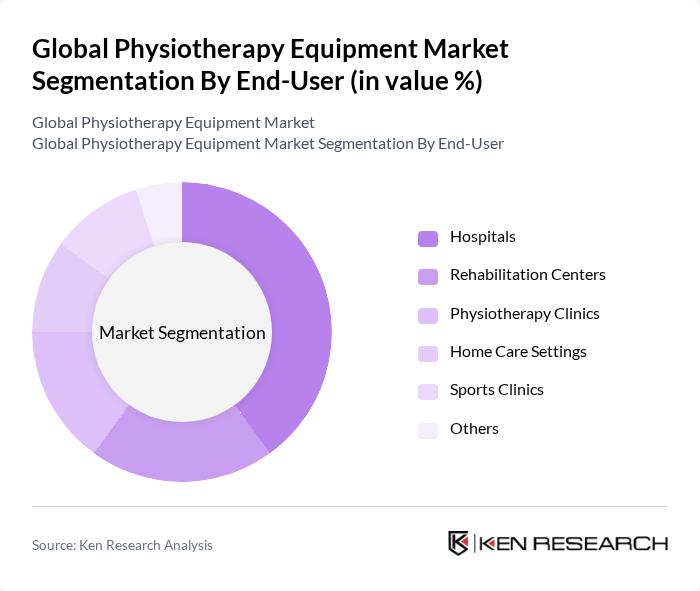

By End-User:The end-user segmentation includes Hospitals, Rehabilitation Centers, Physiotherapy Clinics, Home Care Settings, Sports Clinics, and Others. Hospitals are the dominant end-user segment, primarily due to their extensive patient base and the need for advanced physiotherapy services in post-operative care and rehabilitation. The increasing number of surgeries, the growing focus on recovery and rehabilitation in hospital settings, and the adoption of telehealth and home-based physiotherapy equipment have significantly boosted the demand for physiotherapy equipment .

The Global Physiotherapy Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Siemens Healthineers, GE Healthcare, Philips Healthcare, BTL Industries, Chattanooga Group (DJO Global), DJO Global (Enovis), Zynex Medical, Omron Healthcare, Zimmer MedizinSysteme, Enraf-Nonius, Mettler Electronics, Dynatronics Corporation, EMS Physio Ltd, STORZ Medical AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the physiotherapy equipment market in None appears promising, driven by increasing healthcare investments and a growing focus on preventive care. As the demand for personalized therapy solutions rises, healthcare providers are likely to adopt more advanced technologies. Additionally, the integration of telehealth services will enhance patient access to physiotherapy, allowing for remote consultations and treatment plans. This trend is expected to foster innovation and improve patient outcomes, ultimately shaping the market landscape positively.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrotherapy Equipment Ultrasound Equipment Exercise Therapy Equipment Heat Therapy Equipment Cryotherapy Equipment Hydrotherapy Equipment Continuous Passive Motion (CPM) Devices Shockwave Therapy Equipment Traction Equipment Combination Therapy Equipment Accessories (Gels, Electrodes, etc.) Others |

| By End-User | Hospitals Rehabilitation Centers Physiotherapy Clinics Home Care Settings Sports Clinics Others |

| By Application | Musculoskeletal Disorders Neurological Disorders Cardiovascular & Pulmonary Disorders Pediatric Disorders Sports Injuries Gynecological Disorders Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Medical Supply Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Brand | Premium Brands Mid-Range Brands Budget Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Physiotherapy Clinics | 120 | Clinic Owners, Lead Physiotherapists |

| Rehabilitation Centers | 90 | Rehabilitation Directors, Equipment Managers |

| Hospitals and Healthcare Facilities | 100 | Healthcare Administrators, Physiotherapy Department Heads |

| Home Healthcare Providers | 60 | Home Care Coordinators, Physiotherapy Practitioners |

| Sports Medicine Facilities | 50 | Sports Physiotherapists, Athletic Trainers |

The Global Physiotherapy Equipment Market is valued at approximately USD 23 billion, driven by the rising prevalence of musculoskeletal, neurological, and cardiopulmonary disorders, along with advancements in physiotherapy technologies and an increasing geriatric population.