Global Remote Monitoring and Control Market Overview

- The Global Remote Monitoring and Control Market is valued at USD 27 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for automation, real-time data monitoring, and the integration of artificial intelligence across industries such as oil and gas, manufacturing, and healthcare. Enhanced operational efficiency, predictive maintenance, and reduced downtime are key factors propelling the adoption of remote monitoring solutions.

- Key players in this market are predominantly located in North America and Europe, with the United States and Germany leading due to their advanced technological infrastructure and significant investments in industrial automation. The presence of major companies and a strong focus on research and development in these regions contribute to their dominance in the remote monitoring and control market. North America accounts for over one-third of the global market share, driven by leading technology providers and rapid digital transformation initiatives.

- In 2023, the European Union implemented the Digital Operational Resilience Act (DORA), issued by the European Parliament and the Council, which mandates that financial institutions enhance their digital operational resilience. This regulation requires the adoption of robust remote monitoring and control systems to ensure continuous operations, risk management, and compliance with ICT-related requirements, thereby driving the demand for advanced monitoring solutions in the financial sector.

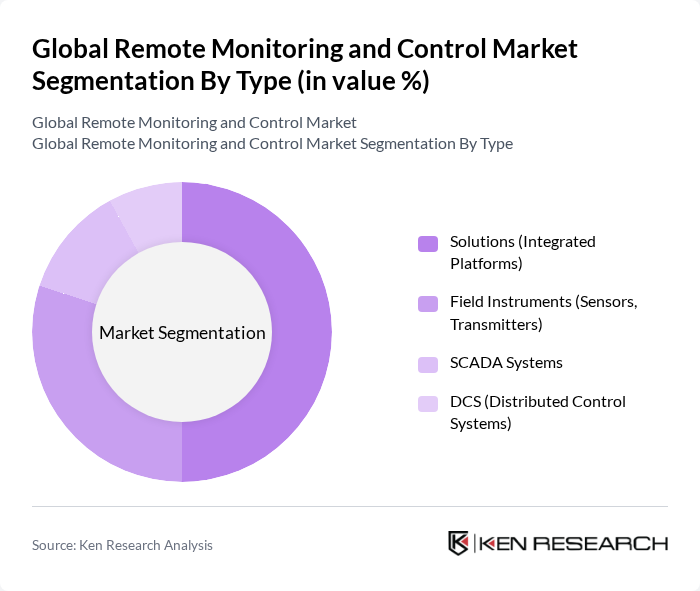

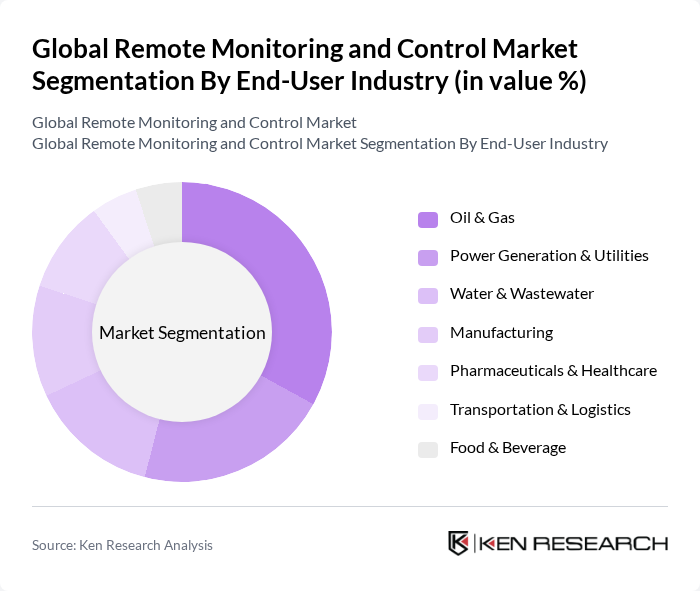

Global Remote Monitoring and Control Market Segmentation

By Type:The market is segmented into various types, including Solutions (Integrated Platforms), Field Instruments (Sensors, Transmitters), SCADA Systems, and DCS (Distributed Control Systems). Among these, Solutions (Integrated Platforms) are leading due to their ability to provide comprehensive monitoring and control capabilities across multiple systems, enhancing operational efficiency, data integration, and supporting Industry 4.0 and IoT initiatives.

By End-User Industry:The market is segmented into several end-user industries, including Oil & Gas, Power Generation & Utilities, Water & Wastewater, Manufacturing, Pharmaceuticals & Healthcare, Transportation & Logistics, and Food & Beverage. The Oil & Gas sector remains the dominant segment, driven by the critical need for real-time monitoring, safety compliance, and asset optimization in hazardous and distributed environments.

Global Remote Monitoring and Control Market Competitive Landscape

The Global Remote Monitoring and Control Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Schneider Electric SE, ABB Ltd., Rockwell Automation, Inc., Emerson Electric Co., General Electric Company, Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Hitachi, Ltd., Advantech Co., Ltd., National Instruments Corporation, Teledyne Technologies Incorporated, PTC Inc., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., Atlas Copco AB, John Wood Group PLC, Ingersoll Rand Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Remote Monitoring and Control Market Industry Analysis

Growth Drivers

- Increasing Demand for Real-Time Data:The global demand for real-time data is surging, driven by industries seeking to enhance decision-making processes. In future, the global data generation is projected to reach 175 zettabytes, up from 79 zettabytes, according to the International Data Corporation. This exponential growth in data necessitates advanced remote monitoring solutions that can provide timely insights, thereby improving operational efficiency and responsiveness across sectors such as manufacturing, energy, and healthcare.

- Advancements in IoT Technology:The Internet of Things (IoT) is revolutionizing remote monitoring capabilities, with an estimated 30 billion connected devices expected in future, as reported by Statista. This proliferation of IoT devices facilitates seamless data collection and transmission, enabling organizations to monitor assets in real-time. The integration of IoT technology enhances predictive analytics, allowing businesses to anticipate issues before they escalate, thus driving the adoption of remote monitoring solutions across various industries.

- Rising Need for Operational Efficiency:Companies are increasingly focused on operational efficiency to remain competitive. According to a McKinsey report, organizations that implement advanced monitoring systems can achieve up to a 22% reduction in operational costs. This drive for efficiency is pushing businesses to adopt remote monitoring solutions that optimize resource utilization, streamline processes, and minimize downtime, particularly in sectors like manufacturing and logistics, where efficiency is paramount.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to adopting remote monitoring solutions is the high initial investment required. For instance, implementing a comprehensive monitoring system can cost upwards of $120,000 for mid-sized companies, according to industry estimates. This upfront cost can deter organizations, particularly small and medium enterprises, from investing in advanced technologies, limiting market growth and adoption rates in the sector.

- Data Security Concerns:As remote monitoring systems become more prevalent, data security concerns are escalating. A report by Cybersecurity Ventures predicts that cybercrime will cost the world $10.5 trillion annually by future. The increasing frequency of cyberattacks on IoT devices poses significant risks to sensitive data, leading organizations to hesitate in adopting remote monitoring solutions due to fears of breaches and compliance violations, which can hinder market expansion.

Global Remote Monitoring and Control Market Future Outlook

The future of the remote monitoring and control market appears promising, driven by technological advancements and increasing demand for efficiency. As organizations continue to embrace digital transformation, the integration of AI and machine learning into monitoring systems will enhance predictive capabilities and operational insights. Furthermore, the shift towards cloud-based solutions will facilitate scalability and accessibility, allowing businesses to leverage real-time data more effectively, ultimately fostering innovation and growth in the sector.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for remote monitoring solutions. With a projected GDP growth rate of 5.8% in future, according to the World Bank, these regions are increasingly investing in infrastructure and technology, creating a demand for efficient monitoring systems that can support rapid industrialization and urbanization efforts.

- Increasing Adoption in Healthcare:The healthcare sector is witnessing a surge in remote monitoring adoption, driven by the need for improved patient care. The global telehealth market is expected to reach $636.38 billion in future, as reported by Fortune Business Insights. This growth is fueled by the demand for remote patient monitoring solutions that enhance healthcare delivery, particularly in the wake of the COVID-19 pandemic, creating substantial opportunities for market players.