Region:Central and South America

Author(s):Shubham

Product Code:KRAB3256

Pages:80

Published On:October 2025

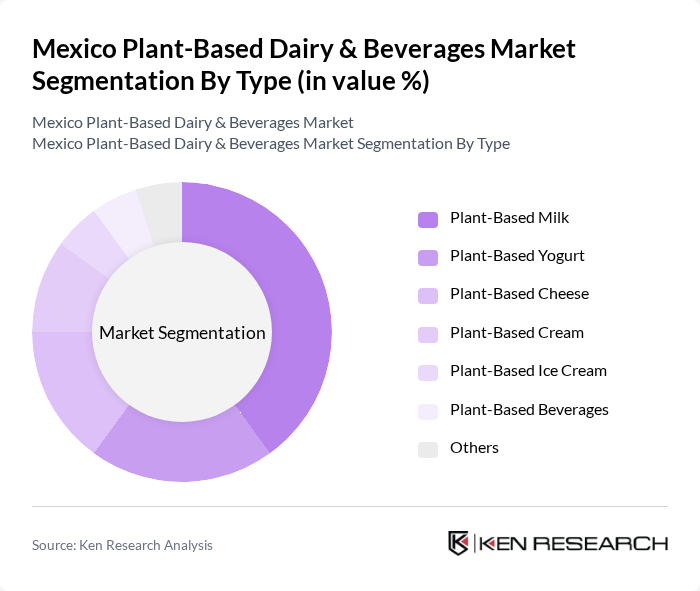

By Type:The market is segmented into various types, including Plant-Based Milk, Plant-Based Yogurt, Plant-Based Cheese, Plant-Based Cream, Plant-Based Ice Cream, Plant-Based Beverages, and Others. Among these, Plant-Based Milk is the leading sub-segment, driven by its versatility and widespread acceptance among consumers. The increasing availability of diverse flavors and formulations has further enhanced its popularity, making it a staple in many households.

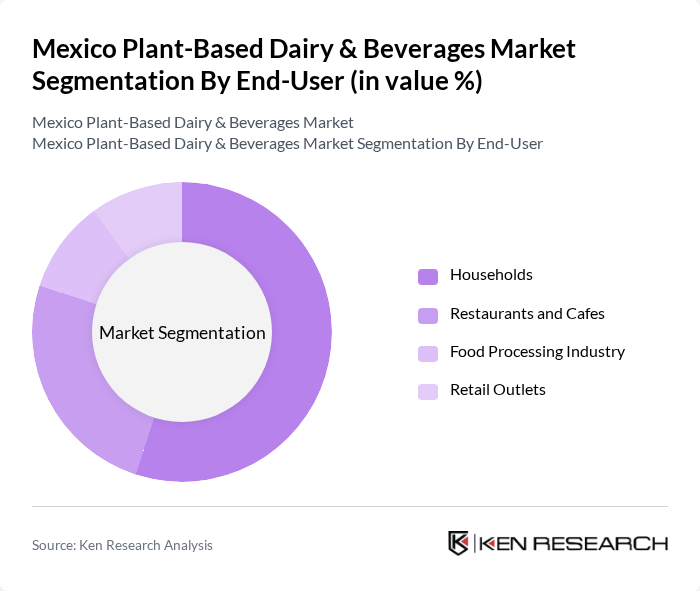

By End-User:The market is segmented by end-users, including Households, Restaurants and Cafes, Food Processing Industry, and Retail Outlets. Households represent the largest segment, driven by the increasing trend of health-conscious eating and the growing number of lactose-intolerant individuals. The convenience of plant-based products and their incorporation into daily diets have made them a preferred choice for many families.

The Mexico Plant-Based Dairy & Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro, Oatly, Silk, So Delicious, Califia Farms, Ripple Foods, Nutpods, Elmhurst 1925, Vitasoy, Tofutti, Daiya Foods, Follow Your Heart, Kite Hill, Good Karma Foods, Plant-Based Foods Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plant-based dairy and beverages market in Mexico appears promising, driven by increasing health consciousness and a growing vegan population. Innovations in product offerings and sustainable practices are likely to enhance consumer interest. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, allowing brands to reach a broader audience. As consumer preferences evolve, companies that adapt to these trends will be well-positioned for success in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Milk Plant-Based Yogurt Plant-Based Cheese Plant-Based Cream Plant-Based Ice Cream Plant-Based Beverages Others |

| By End-User | Households Restaurants and Cafes Food Processing Industry Retail Outlets |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Tetra Packs Bottles Pouches Others |

| By Flavor | Original Vanilla Chocolate Others |

| By Nutritional Content | High Protein Low Sugar Fortified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Milk | 150 | Health-conscious Consumers, Vegan Diet Adopters |

| Retail Distribution Insights | 100 | Store Managers, Category Buyers |

| Market Trends in Plant-Based Yogurt | 80 | Nutritionists, Food Bloggers |

| Consumer Attitudes Towards Plant-Based Cheese | 70 | Cheese Enthusiasts, Culinary Experts |

| Impact of Marketing on Plant-Based Beverage Choices | 90 | Marketing Professionals, Brand Managers |

The Mexico Plant-Based Dairy & Beverages Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by health awareness, lactose intolerance, and a shift towards sustainable dietary choices among consumers.