Region:Middle East

Author(s):Geetanshi

Product Code:KRAB8313

Pages:100

Published On:October 2025

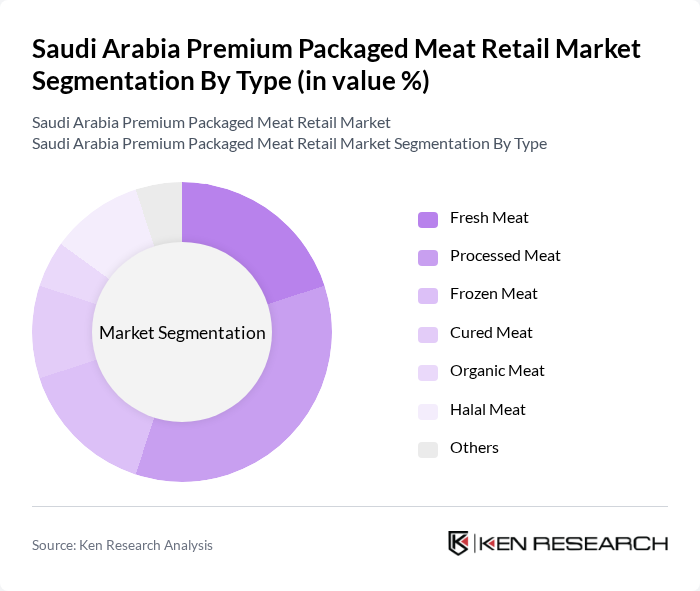

By Type:The market is segmented into various types of packaged meat products, including Fresh Meat, Processed Meat, Frozen Meat, Cured Meat, Organic Meat, Halal Meat, and Others. Among these, Processed Meat is currently the leading sub-segment, driven by consumer preferences for convenience and ready-to-eat options. The increasing trend of snacking and meal replacements has further propelled the demand for processed meat products, making them a staple in many households.

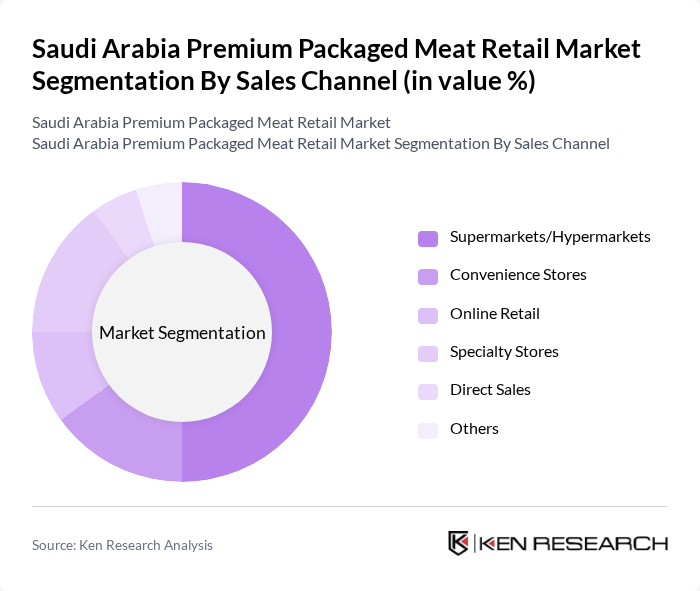

By Sales Channel:The sales channels for premium packaged meat include Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Direct Sales, and Others. Supermarkets/Hypermarkets dominate this segment due to their extensive reach and ability to offer a wide variety of products under one roof. The convenience of shopping in these large retail formats, combined with promotional offers, significantly drives consumer traffic and sales.

The Saudi Arabia Premium Packaged Meat Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Watania Poultry, Al-Faisal Meat Company, Al-Jazira Poultry, Al-Muhaidib Group, Al-Safi Danone, Al-Othaim Markets, Al-Baik, Al-Mansour Meat Company, Al-Hokair Group, Al-Muhaidib Foods, Al-Rajhi Group, Al-Salam Meat Company, Al-Mahmal Meat Company, Al-Muhaidib Poultry contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia premium packaged meat market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek organic and sustainably sourced products, the market is likely to witness a shift towards innovative packaging solutions that enhance product freshness. Additionally, the expansion of online sales channels will facilitate greater accessibility, allowing consumers to explore a wider range of premium meat options, thus fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Meat Processed Meat Frozen Meat Cured Meat Organic Meat Halal Meat Others |

| By Sales Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct Sales Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Skin Packaging Tray Sealing Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Distribution Others |

| By Price Range | Premium Mid-range Economy Others |

| By Consumer Demographics | Age Group Income Level Family Size Others |

| By End-User Segment | Households Restaurants Catering Services Institutional Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Packaged Meat Sales | 150 | Store Managers, Category Buyers |

| Consumer Preferences in Packaged Meat | 200 | Household Shoppers, Health-Conscious Consumers |

| Distribution Channels for Packaged Meat | 100 | Logistics Managers, Supply Chain Coordinators |

| Market Trends and Innovations | 80 | Food Industry Analysts, Product Development Managers |

| Regulatory Impact on Packaged Meat | 60 | Regulatory Affairs Specialists, Compliance Officers |

The Saudi Arabia Premium Packaged Meat Retail Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality meat products and convenience-oriented meal options.