Region:Middle East

Author(s):Dev

Product Code:KRAA8231

Pages:97

Published On:November 2025

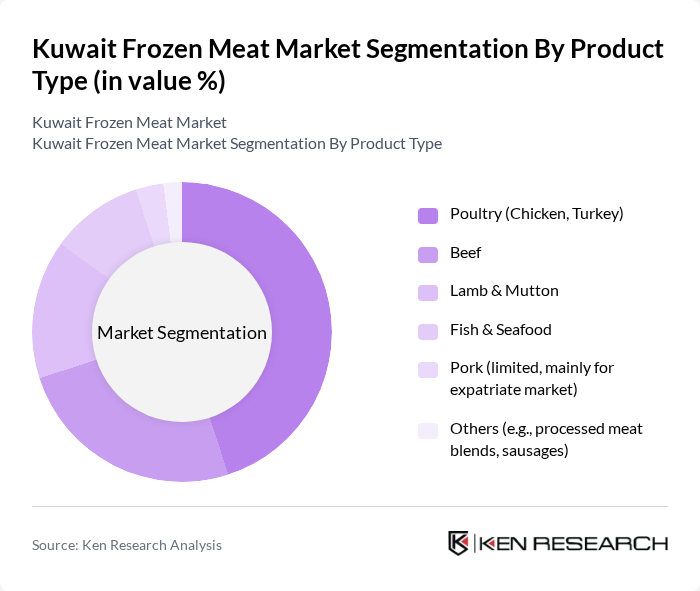

By Product Type:The frozen meat market is segmented into poultry, beef, lamb & mutton, fish & seafood, pork (limited), and others such as processed meat blends and sausages. Among these, poultry—especially chicken—remains the leading sub-segment, attributed to its affordability, versatility, and widespread consumer preference. Health-conscious trends have also increased demand for lean meats, further propelling the poultry segment. While fresh and chilled poultry dominate overall consumption, frozen poultry maintains significant market share due to its convenience and longer shelf life .

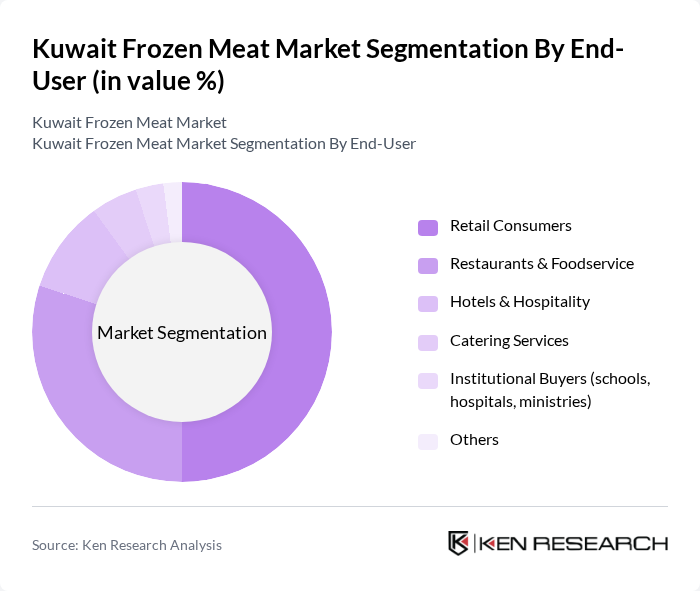

By End-User:The end-user segmentation includes retail consumers, restaurants & foodservice, hotels & hospitality, catering services, institutional buyers, and others. Retail consumers hold the largest share, driven by the increasing trend of home cooking and the convenience of frozen products. Restaurants and foodservice establishments are significant contributors, leveraging frozen meat for menu diversity and cost management. The expanding hospitality sector and institutional buyers also contribute to market growth, supported by robust supply chains and cold storage infrastructure .

The Kuwait Frozen Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americana Group (Kuwait Food Company), Al Kabeer Group, Al Safi Foods, Al Qatami Foods, Al-Mansour Meat Company, Al-Wazzan Foodstuff Company, Al-Babtain Group, Al-Mahfouz Group, Al-Muhanna Group, Al-Sultan Frozen Foods, Al-Jazeera Poultry, Al-Fahd Frozen Foods, Al Ain Farms, Al-Muhaidib Group, Al Watania Poultry contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait frozen meat market appears promising, driven by evolving consumer preferences and technological advancements. The increasing inclination towards organic and sustainably sourced frozen meat products is expected to shape market dynamics. Additionally, the rise of e-commerce platforms will facilitate greater accessibility for consumers, allowing for a more diverse range of frozen meat options. As health consciousness continues to grow, the market is likely to see innovations that cater to these changing demands, enhancing overall growth prospects.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Poultry (Chicken, Turkey) Beef Lamb & Mutton Fish & Seafood Pork (limited, mainly for expatriate market) Others (e.g., processed meat blends, sausages) |

| By End-User | Retail Consumers Restaurants & Foodservice Hotels & Hospitality Catering Services Institutional Buyers (schools, hospitals, ministries) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Wholesale Distributors Specialty Frozen Food Stores Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging (MAP) Rigid Packaging (plastic trays, boxes) Flexible Packaging (bags, pouches) Bulk Packaging (foodservice/institutional) Others |

| By Price Range | Economy Mid-Range Premium Organic/Health-focused Others |

| By Certification | Halal Certified Organic Certified Conventional Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Ahmadi Governorate Jahra Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Meat Sales | 150 | Store Managers, Category Buyers |

| Food Service Sector Insights | 100 | Restaurant Owners, Chefs |

| Consumer Preferences in Frozen Meat | 120 | Household Shoppers, Health-Conscious Consumers |

| Import and Distribution Channels | 80 | Import Managers, Logistics Coordinators |

| Market Trends and Innovations | 70 | Food Industry Analysts, Product Developers |

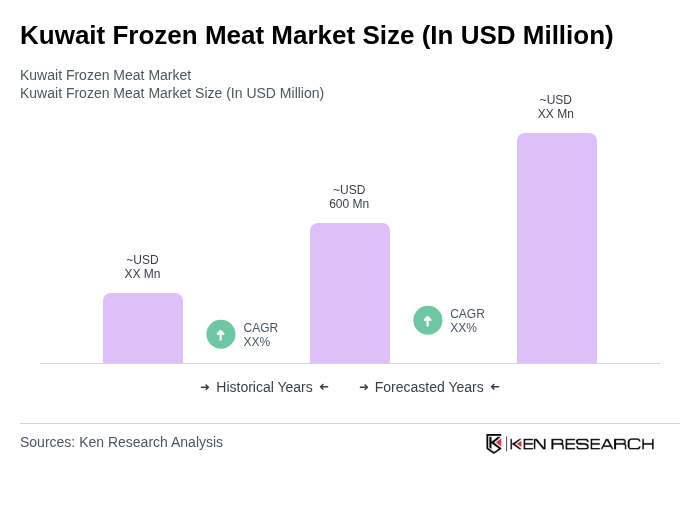

The Kuwait Frozen Meat Market is valued at approximately USD 600 million, reflecting the segment of frozen and processed meat within the broader national meat market, driven by consumer demand for convenience and advancements in cold chain logistics.