Region:Middle East

Author(s):Dev

Product Code:KRAC3494

Pages:91

Published On:October 2025

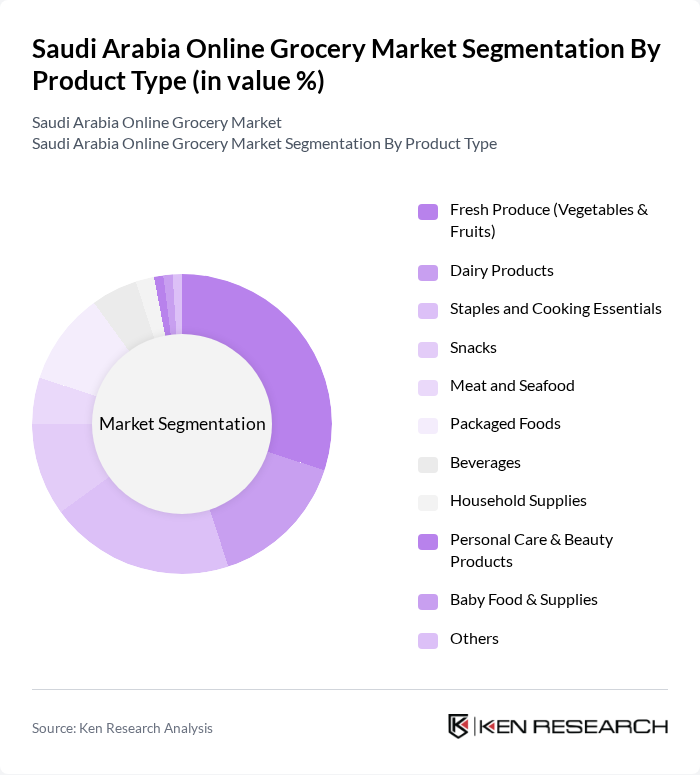

By Product Type:The product type segmentation includes various categories such as Fresh Produce (Vegetables & Fruits), Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Packaged Foods, Beverages, Household Supplies, Personal Care & Beauty Products, Baby Food & Supplies, and Others. Among these, Fresh Produce is the leading sub-segment, driven by the increasing demand for healthy and organic food options. Consumers are becoming more health-conscious, leading to a rise in the purchase of fresh fruits and vegetables online. The convenience of home delivery and the availability of a wider variety of products online further enhance the appeal of this segment. Retailers are focusing on delivering freshness through efficient cold-chain systems and emphasizing quality to replicate the in-store experience.

By Business Model:The business model segmentation includes Pure Marketplace, Hybrid Marketplace, and Direct-to-Consumer (D2C). The Pure Marketplace model is currently the most dominant, as it allows various sellers to list their products on a single platform, providing consumers with a wide range of options. This model is particularly appealing to consumers who prefer to compare prices and products from different vendors. The convenience of having multiple choices in one place, along with competitive pricing, drives the popularity of this model. Hybrid and D2C models are also gaining traction as retailers seek to differentiate through exclusive offerings and faster fulfillment.

The Saudi Arabia Online Grocery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour Saudi Arabia, Lulu Hypermarket Saudi Arabia, Tamimi Markets, Nana, Danube Online, Panda Retail Company, HungerStation, Mrsool, Sary, Qareeb, ZadFresh, Baqala, Noon Grocery (noon.com), Amazon.sa (Amazon Saudi Arabia), Grocery Basket contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online grocery market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer behaviors. The integration of artificial intelligence and automation in logistics is expected to enhance operational efficiency, while the growing emphasis on sustainability will likely influence product offerings. Additionally, as more consumers embrace digital shopping, the market is poised for further expansion, with innovative solutions catering to diverse consumer needs and preferences shaping the landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Produce (Vegetables & Fruits) Dairy Products Staples and Cooking Essentials Snacks Meat and Seafood Packaged Foods Beverages Household Supplies Personal Care & Beauty Products Baby Food & Supplies Others |

| By Business Model | Pure Marketplace Hybrid Marketplace Direct-to-Consumer (D2C) |

| By Platform | Web-Based App-Based |

| By Purchase Type | One-Time Purchase Subscription |

| By Delivery Method | Same-Day Delivery Scheduled Delivery Click and Collect |

| By Payment Method | Credit/Debit Cards Cash on Delivery Digital Wallets |

| By Consumer Demographics | Age Group Income Level Family Size |

| By Geographic Coverage | Central Region (Riyadh, etc.) Western Region (Jeddah, Makkah, Medina, etc.) Eastern Region (Dammam, Khobar, etc.) Southern Region (Asir, etc.) Northern Region (Ha'il, etc.) |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Online Grocery Shopping | 120 | Regular Online Shoppers, First-time Users |

| Logistics and Delivery Efficiency | 40 | Logistics Managers, Delivery Service Providers |

| Product Range and Pricing Strategies | 40 | Category Managers, Pricing Analysts |

| Customer Satisfaction and Retention | 80 | Customer Service Representatives, Marketing Managers |

| Technology Adoption in Online Grocery | 40 | IT Managers, E-commerce Platform Developers |

The Saudi Arabia Online Grocery Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased digital payment adoption, smartphone penetration, and changing consumer preferences towards convenience and time-saving solutions.