Region:Europe

Author(s):Shubham

Product Code:KRAB4399

Pages:90

Published On:October 2025

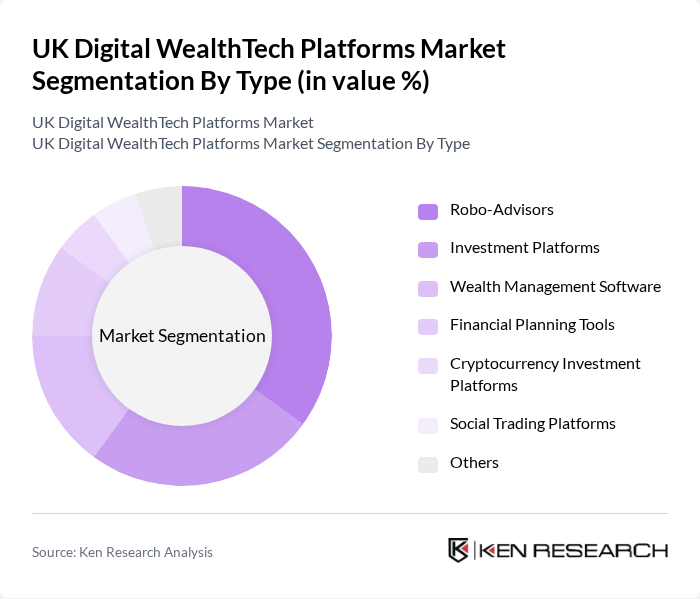

By Type:The market is segmented into various types, including Robo-Advisors, Investment Platforms, Wealth Management Software, Financial Planning Tools, Cryptocurrency Investment Platforms, Social Trading Platforms, and Others. Each of these segments caters to different consumer needs and preferences, with Robo-Advisors leading the charge due to their automated, low-cost investment solutions that appeal to a broad audience.

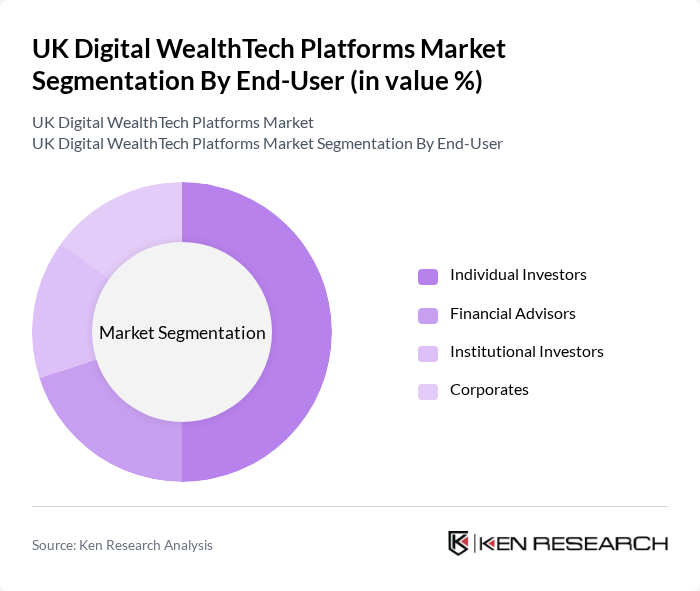

By End-User:The market is segmented by end-users, including Individual Investors, Financial Advisors, Institutional Investors, and Corporates. Individual Investors dominate the market, driven by the increasing number of retail investors seeking accessible and affordable investment options through digital platforms.

The UK Digital WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutmeg, Wealthsimple, Moneybox, Scalable Capital, Plum, eToro, Freetrade, Hargreaves Lansdown, AJ Bell, Interactive Investor, Revolut, Seedrs, Crowdcube, Sippdeal, ClearScore contribute to innovation, geographic expansion, and service delivery in this space.

The UK Digital WealthTech market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As more individuals seek personalized and sustainable investment options, platforms that leverage AI and machine learning will likely gain a competitive edge. Additionally, the integration of blockchain technology is expected to enhance transparency and security, further attracting users. The focus on mobile-first solutions will also cater to the increasing demand for accessible financial management tools, shaping the future landscape of WealthTech.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisors Investment Platforms Wealth Management Software Financial Planning Tools Cryptocurrency Investment Platforms Social Trading Platforms Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates |

| By Investment Type | Equities Bonds Mutual Funds ETFs Real Estate Commodities Others |

| By Distribution Channel | Direct Online Sales Financial Advisors Partnerships with Banks Affiliate Marketing |

| By Customer Segment | Millennials Gen X Baby Boomers High Net-Worth Individuals |

| By Service Model | Subscription-Based Commission-Based Hybrid Model |

| By Geographic Focus | Domestic UK Market International Markets Emerging Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robo-Advisory Services | 150 | Product Managers, Marketing Directors |

| Investment Management Platforms | 100 | Portfolio Managers, Compliance Officers |

| Financial Planning Tools | 80 | Financial Advisors, Wealth Managers |

| Consumer Adoption of WealthTech | 120 | End-users, Retail Investors |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Legal Advisors |

The UK Digital WealthTech Platforms Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by technological adoption in financial services and increasing consumer demand for personalized investment solutions.