Region:Middle East

Author(s):Dev

Product Code:KRAC1278

Pages:90

Published On:October 2025

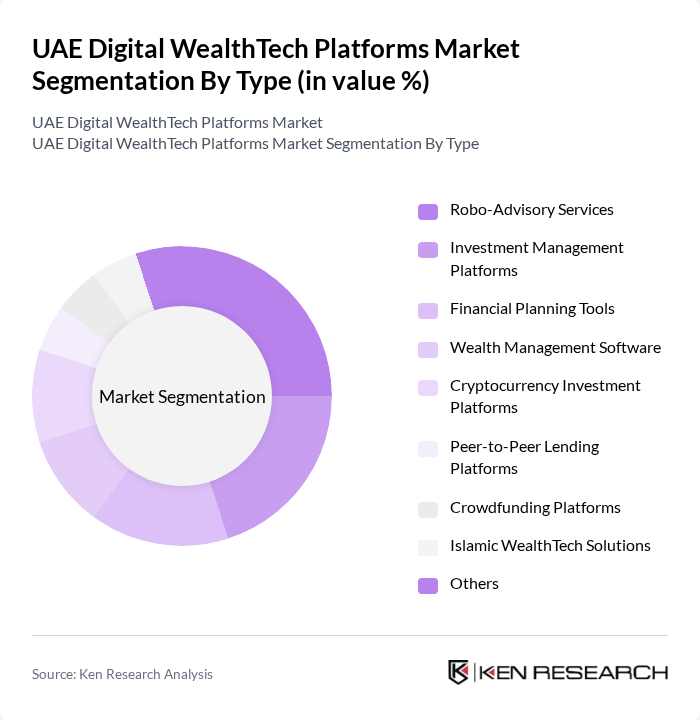

By Type:The market can be segmented into various types, including Robo-Advisory Services, Investment Management Platforms, Financial Planning Tools, Wealth Management Software, Cryptocurrency Investment Platforms, Peer-to-Peer Lending Platforms, Crowdfunding Platforms, Islamic WealthTech Solutions, and Others. Each of these segments caters to different consumer needs and preferences, contributing to the overall growth of the market. The diversity of offerings is fueled by high smartphone penetration, a young and digitally-inclined population, and the increasing integration of open banking APIs, which enable seamless connectivity between various financial services.

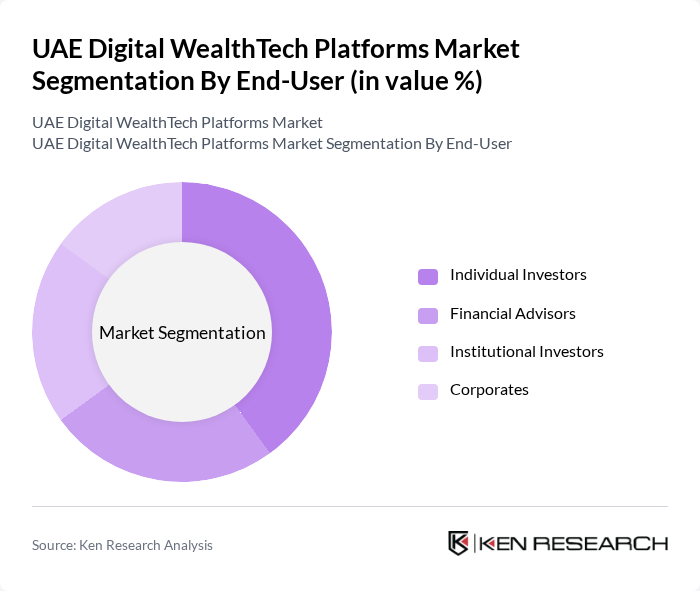

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, and Corporates. Each of these user groups has distinct requirements and preferences, influencing the types of digital wealth management solutions they seek. The rapid digitization of financial services and the availability of tailored solutions are driving adoption across all segments, with individual investors representing the largest user base due to the ease of access and affordability of digital platforms.

The UAE Digital WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, First Abu Dhabi Bank (FAB), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank, Noor Bank, Sarwa Digital Wealth (Capital) Limited, StashAway (Asia Wealth Platform Private Limited), Wahed Invest, Baraka Financial Limited, Neo Mena Technologies Limited, Quantum Wealth Tech Limited (Alpheya), BetterTradeOff Fintech Solutions Limited, Betasmartz HK Limited, Al Waha Capital PJSC, Thndr Technology Holding, Alif Investments Group, Zand, YAP, RAK Bank, Al Hilal Bank, Qardus, eToro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Digital WealthTech market appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt artificial intelligence and machine learning, they will enhance their service offerings, providing more personalized and efficient solutions. Additionally, the growing emphasis on sustainable investments will likely lead to the development of innovative financial products that cater to environmentally conscious investors, further expanding the market's potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Services Investment Management Platforms Financial Planning Tools Wealth Management Software Cryptocurrency Investment Platforms Peer-to-Peer Lending Platforms Crowdfunding Platforms Islamic WealthTech Solutions Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates |

| By Investment Type | Equity Investments Fixed Income Investments Alternative Investments Real Estate Investments Shariah-Compliant Investments |

| By Distribution Channel | Direct Online Platforms Mobile Applications Financial Institutions Third-Party Aggregators |

| By Customer Segment | High Net-Worth Individuals Mass Affluent Retail Investors SME Clients |

| By Geographic Presence | Abu Dhabi Dubai Sharjah Ajman Umm Al-Quwain Fujairah Ras Al Khaimah |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investors in WealthTech | 120 | Individual Investors, Financial Planners |

| Institutional Users of WealthTech Solutions | 80 | Portfolio Managers, Investment Analysts |

| Regulatory Stakeholders | 40 | Compliance Officers, Regulatory Analysts |

| Technology Providers in WealthTech | 60 | Product Managers, Tech Developers |

| End-Users of Wealth Management Apps | 100 | App Users, Financial Literacy Advocates |

The UAE Digital WealthTech Platforms Market is valued at approximately USD 25 million, reflecting a significant growth trend driven by the increasing adoption of digital financial services and a tech-savvy population.