Region:Middle East

Author(s):Rebecca

Product Code:KRAC1209

Pages:86

Published On:October 2025

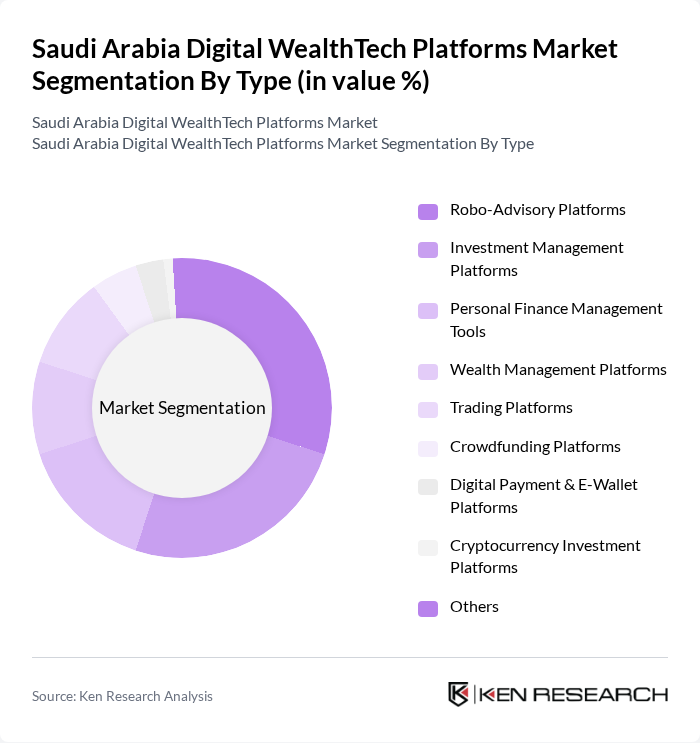

By Type:The market is segmented into various types of platforms that cater to different financial needs. The dominant sub-segment is the Robo-Advisory Platforms, which have gained popularity due to their user-friendly interfaces and low-cost investment options. Investment Management Platforms also hold a significant share, driven by the increasing demand for professional asset management services. Personal Finance Management Tools are becoming essential for consumers seeking to manage their finances effectively, while Wealth Management Platforms cater to high-net-worth individuals. Trading Platforms are witnessing growth due to the rise in retail trading activities, and Crowdfunding Platforms are gaining traction as alternative investment avenues. Digital Payment & E-Wallet Platforms are crucial for facilitating transactions, while Cryptocurrency Investment Platforms are emerging as a new trend in the investment landscape .

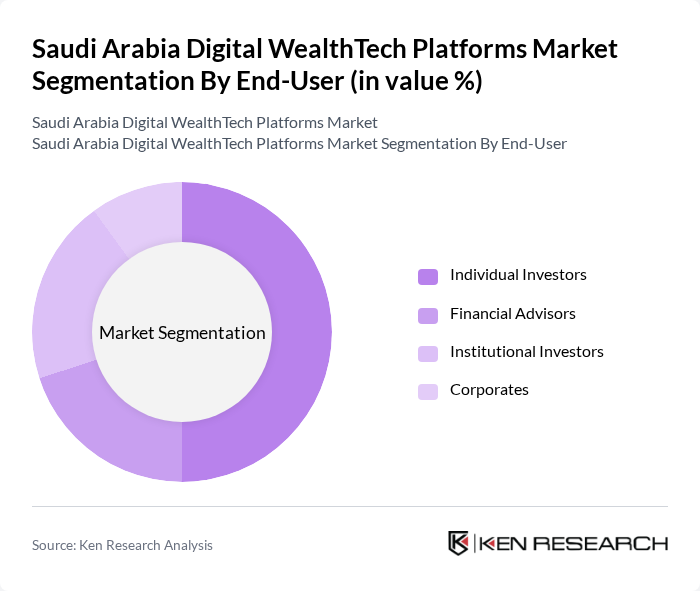

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, and Corporates. Individual Investors are the largest segment, driven by the increasing number of retail investors entering the market. Financial Advisors are leveraging digital platforms to enhance their service offerings, while Institutional Investors are increasingly adopting technology for asset management. Corporates are also utilizing WealthTech solutions for better financial management and investment strategies .

The Saudi Arabia Digital WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Capital, NCB Capital (SNB Capital), Riyad Capital, Alinma Investment, Aljazira Capital, Derayah Financial, Alkhabeer Capital, STC Pay, Tamara, Sarwa, Malaz Capital, Raqamyah, Malaa Technologies, Jeel-Synpulse, Abyan Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Digital WealthTech market appears promising, driven by technological advancements and a supportive regulatory environment. As the government continues to promote digital transformation, platforms are likely to leverage AI and machine learning to enhance user experiences. Additionally, the growing interest in sustainable investing will encourage WealthTech firms to develop innovative products that align with environmental, social, and governance (ESG) criteria, attracting a broader investor base and fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Platforms Investment Management Platforms Personal Finance Management Tools Wealth Management Platforms Trading Platforms Crowdfunding Platforms Digital Payment & E-Wallet Platforms Cryptocurrency Investment Platforms Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates |

| By Investment Type | Equity Investments Fixed Income Investments Real Estate Investments Alternative Investments Shariah-Compliant Investments |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) |

| By Distribution Channel | Direct Online Sales Partnerships with Financial Institutions Mobile Applications API Integrations/Open Banking |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors SMEs |

| By Regulatory Compliance Level | Fully Compliant Platforms Partially Compliant Platforms Non-Compliant Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robo-Advisory Services | 100 | Wealth Managers, Financial Advisors |

| Investment Platforms | 80 | Retail Investors, Financial Analysts |

| Digital Banking Integration | 70 | Banking Executives, Fintech Professionals |

| Regulatory Compliance in WealthTech | 60 | Compliance Officers, Legal Advisors |

| User Experience in WealthTech Apps | 90 | End-users, UX/UI Designers |

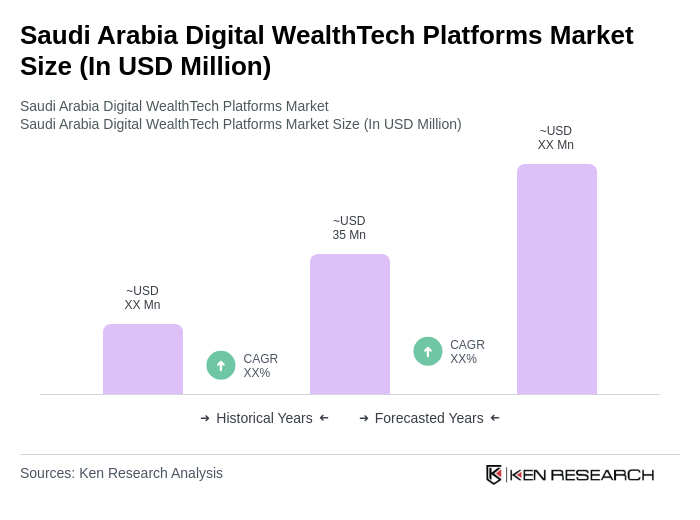

The Saudi Arabia Digital WealthTech Platforms Market is valued at approximately USD 35 million, reflecting a significant growth trend driven by increased adoption of digital financial services and government initiatives promoting fintech innovation.