Qatar Digital WealthTech Platforms Market Overview

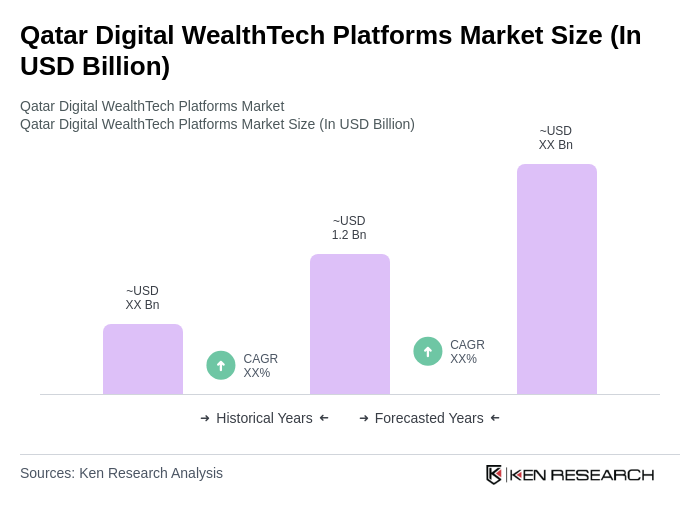

- The Qatar Digital WealthTech Platforms Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in the number of high-net-worth individuals, and the growing demand for personalized investment solutions. The market is also supported by advancements in technology, such as artificial intelligence, cloud computing, and mobile platforms, which enhance user experience and operational efficiency. The proliferation of digital payment solutions and the integration of robo-advisory services are further accelerating market expansion, as consumers and institutions seek more accessible and data-driven wealth management options .

- Key players in this market include Doha, Al Rayyan, and Lusail, which dominate due to their robust financial infrastructure, high levels of investment in technology, and a strong regulatory framework that encourages innovation. These cities are also home to a significant concentration of affluent individuals and businesses, creating a fertile ground for wealth management services. The implementation of smart city initiatives and the presence of financial free zones, such as the Qatar Financial Centre, further reinforce their leadership in digital wealth management .

- In 2023, the Qatar Financial Centre Regulatory Authority issued the QFC Digital Asset Framework, which established comprehensive rules for digital wealth management platforms. This regulation focuses on improving transparency and security in digital transactions, mandating that all digital wealth management platforms comply with strict data protection standards, including requirements for client data encryption, secure authentication protocols, and regular compliance audits, to safeguard client information and foster trust in digital financial services .

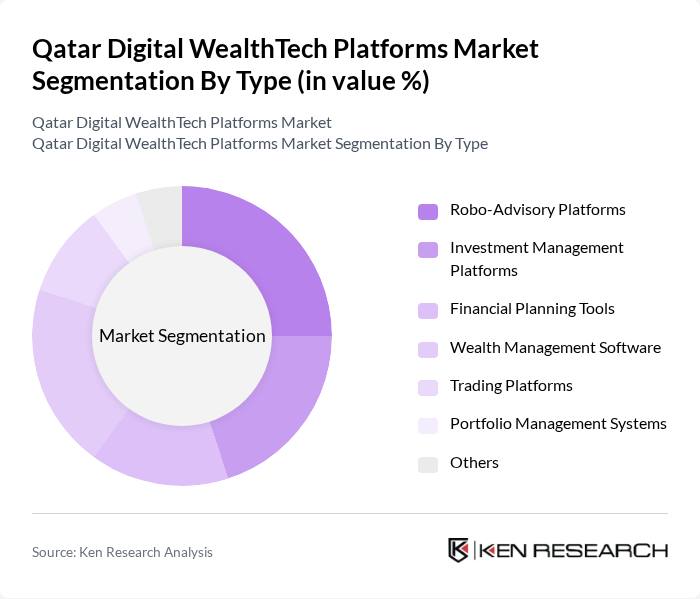

Qatar Digital WealthTech Platforms Market Segmentation

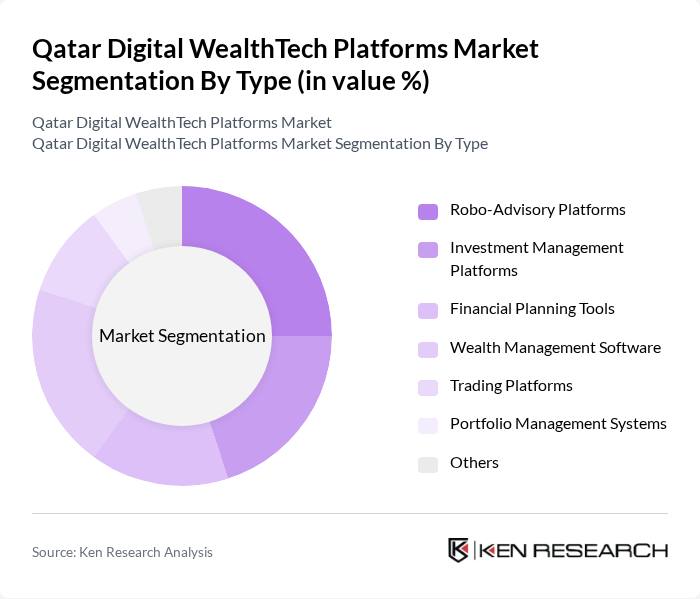

By Type:The market is segmented into various types, including Robo-Advisory Platforms, Investment Management Platforms, Financial Planning Tools, Wealth Management Software, Trading Platforms, Portfolio Management Systems, and Others. Each of these segments caters to different aspects of wealth management, with specific functionalities and target audiences. Robo-advisory and digital investment platforms are experiencing rapid adoption, particularly among younger investors and tech-savvy individuals, while traditional wealth management software and portfolio management systems remain essential for institutional and high-net-worth clients .

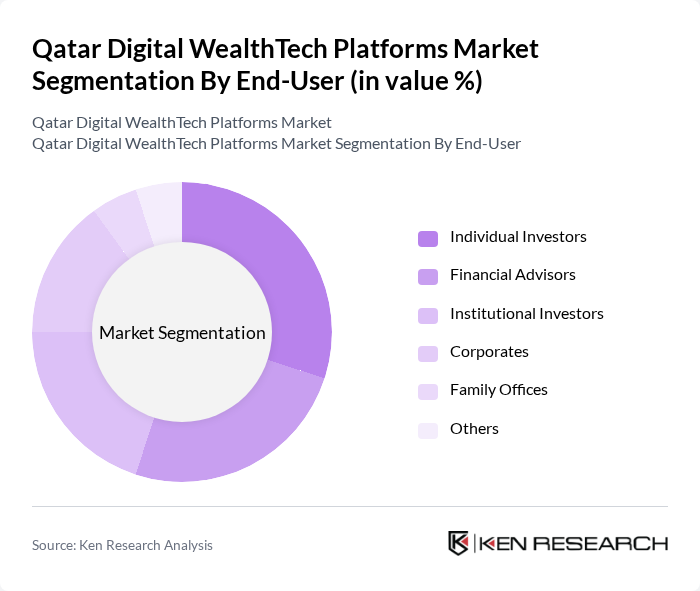

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, Corporates, Family Offices, and Others. Each segment represents a unique customer base with distinct needs and preferences in wealth management services. Individual investors are increasingly leveraging digital platforms for self-directed investing, while institutional investors and corporates utilize advanced portfolio management and analytics tools to optimize asset allocation and risk management .

Qatar Digital WealthTech Platforms Market Competitive Landscape

The Qatar Digital WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as QInvest, Qatar National Bank (QNB), Doha Bank, Qatar Islamic Bank (QIB), Al Rayan Investment, Dlala Brokerage, QNB Financial Services, Amwal, Barwa Bank, Qatar Financial Centre (QFC), Investment House, Qatar Development Bank, Al Khaliji Commercial Bank, Qatar Stock Exchange, Doha Bank Private Banking, Masraf Al Rayan, Commercial Bank of Qatar, and Qatar Insurance Company contribute to innovation, geographic expansion, and service delivery in this space .

Qatar Digital WealthTech Platforms Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Qatar boasts a smartphone penetration rate of approximately 90%, with over 2.5 million smartphone users. This high penetration facilitates access to digital wealth management platforms, enabling users to manage their finances conveniently. The World Bank reports that mobile internet subscriptions in Qatar have reached over 3 million, indicating a robust infrastructure that supports the growth of digital financial services, making them more accessible to a broader audience.

- Rising Demand for Personalized Financial Services:In future, the demand for personalized financial services in Qatar is projected to increase significantly, with 65% of consumers expressing a preference for tailored financial solutions. This trend is driven by a growing middle class and increased financial literacy, as evidenced by a 15% rise in financial education programs. The Qatar Central Bank's initiatives to promote financial inclusion further support this demand, encouraging platforms to offer customized services that cater to individual needs.

- Growth of the Fintech Ecosystem:Qatar's fintech ecosystem is rapidly expanding, with over 50 fintech startups established by future, reflecting a 20% increase from the previous year. The Qatar Financial Centre has reported that investments in fintech reached over $200 million, indicating strong investor confidence. This growth fosters innovation and competition, driving digital wealth management platforms to enhance their offerings and improve user experiences, ultimately benefiting consumers and the economy.

Market Challenges

- Regulatory Compliance Complexities:The regulatory landscape in Qatar presents significant challenges for digital wealth management platforms. As of future, compliance with the Qatar Central Bank's regulations requires substantial investment, with costs estimated at around $1 million per platform. Additionally, the evolving nature of regulations necessitates continuous adaptation, which can strain resources and hinder the agility of emerging fintech companies in the competitive market.

- Data Security and Privacy Concerns:Data security remains a critical challenge for digital wealth platforms in Qatar, with cybercrime incidents increasing by 30%. The implementation of stringent data protection laws requires platforms to invest heavily in cybersecurity measures, estimated at $500,000 annually. This financial burden can limit the ability of smaller firms to compete effectively, as they may lack the resources to ensure robust data protection and maintain consumer trust.

Qatar Digital WealthTech Platforms Market Future Outlook

The future of Qatar's Digital WealthTech platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the market matures, platforms will increasingly adopt AI and machine learning to enhance user experiences and streamline operations. Additionally, the growing emphasis on sustainable investments will likely shape product offerings, aligning with global trends. The collaboration between fintech firms and traditional banks will further enhance service delivery, creating a more integrated financial ecosystem that meets diverse consumer needs.

Market Opportunities

- Expansion of Digital Payment Solutions:The digital payment sector in Qatar is expected to grow, with transaction volumes projected to reach over $10 billion. This growth presents opportunities for wealth management platforms to integrate payment solutions, enhancing user convenience and driving engagement. By offering seamless payment options, platforms can attract a broader customer base and increase transaction frequency, ultimately boosting revenue.

- Integration of AI and Machine Learning:The integration of AI and machine learning technologies is set to revolutionize wealth management in Qatar. In future, it is anticipated that 40% of platforms will utilize these technologies to provide personalized investment advice and automate processes. This shift will not only improve operational efficiency but also enhance customer satisfaction, as users receive tailored recommendations based on their financial behaviors and preferences.