Region:Europe

Author(s):Shubham

Product Code:KRAA1066

Pages:85

Published On:August 2025

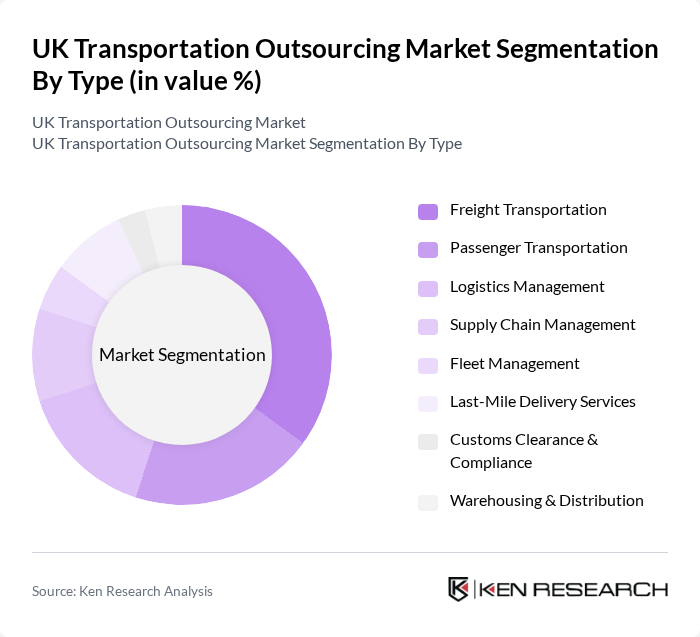

By Type:The transportation outsourcing market can be segmented into various types, including Freight Transportation, Passenger Transportation, Logistics Management, Supply Chain Management, Fleet Management, Last-Mile Delivery Services, Customs Clearance & Compliance, and Warehousing & Distribution. Among these, Freight Transportation is the leading segment, driven by the increasing demand for efficient goods movement and the growth of e-commerce. The rise in online shopping has significantly boosted the need for reliable freight services, making it a dominant force in the market .

By End-User:The end-user segmentation of the transportation outsourcing market includes Retail & E-commerce, Manufacturing & Industrial, Government & Public Sector, Healthcare & Pharmaceuticals, Construction & Infrastructure, Agriculture, Fishing & Forestry, Energy & Utilities, and Others. The Retail & E-commerce segment is the most significant contributor, fueled by the rapid growth of online shopping and the need for efficient logistics solutions to meet consumer demands. This segment's expansion is indicative of changing consumer behavior towards convenience and speed in delivery .

The UK Transportation Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DPD Group, FedEx, UPS, Geodis, DB Schenker, Wincanton, Palletways, Eddie Stobart Logistics, Yodel, DSV, GXO Logistics, Royal Mail Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK transportation outsourcing market appears promising, driven by ongoing technological advancements and the increasing need for efficient logistics solutions. As businesses continue to embrace automation and AI, the demand for integrated supply chain solutions will rise. Additionally, the focus on sustainability will push companies to adopt greener practices, further enhancing the appeal of outsourcing. With the anticipated growth in e-commerce and infrastructure investments, the market is poised for significant evolution, presenting new opportunities for service providers.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Passenger Transportation Logistics Management Supply Chain Management Fleet Management Last-Mile Delivery Services Customs Clearance & Compliance Warehousing & Distribution |

| By End-User | Retail & E-commerce Manufacturing & Industrial Government & Public Sector Healthcare & Pharmaceuticals Construction & Infrastructure Agriculture, Fishing & Forestry Energy & Utilities Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Transportation Management Systems (TMS) Managed Transportation Services Others |

| By Delivery Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation Multimodal Transportation Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage International/Cross-Border Coverage Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Public Sector Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Transportation Outsourcing | 100 | Logistics Managers, Supply Chain Executives |

| Manufacturing Logistics Services | 80 | Operations Managers, Procurement Specialists |

| Healthcare Supply Chain Management | 60 | Healthcare Logistics Coordinators, Compliance Officers |

| Third-Party Logistics Providers | 50 | Business Development Managers, Account Executives |

| Public Sector Transportation Contracts | 40 | Government Procurement Officers, Policy Analysts |

The UK Transportation Outsourcing Market is valued at approximately USD 90 billion, driven by the increasing demand for efficient logistics solutions, the rise of e-commerce, and the need for cost-effective transportation services.