Region:Europe

Author(s):Geetanshi

Product Code:KRAA0102

Pages:97

Published On:August 2025

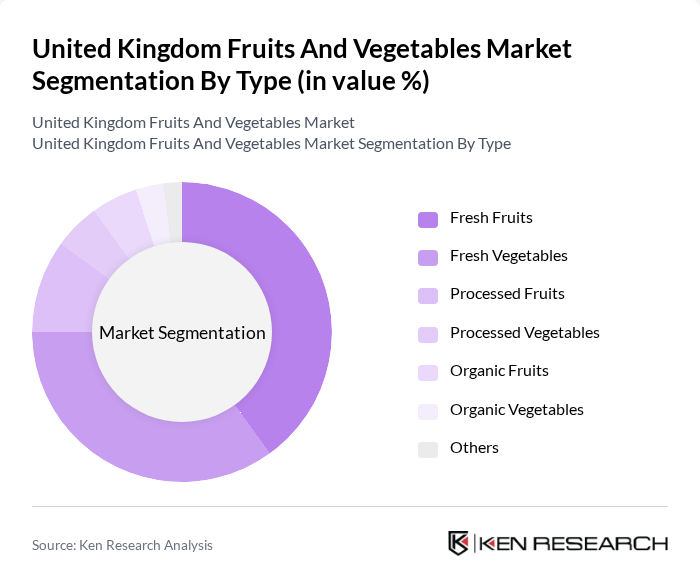

By Type:The fruits and vegetables market can be segmented into various types, including fresh fruits, fresh vegetables, processed fruits, processed vegetables, organic fruits, organic vegetables, and others. Among these, fresh fruits and vegetables dominate the market due to their high demand for health and wellness. Consumers are increasingly inclined towards fresh produce, driven by the growing awareness of nutrition and the benefits of a balanced diet. The processed segment is also gaining traction, particularly in urban areas where convenience is a priority. Organic fruits and vegetables are witnessing a surge in popularity as consumers seek healthier and environmentally friendly options .

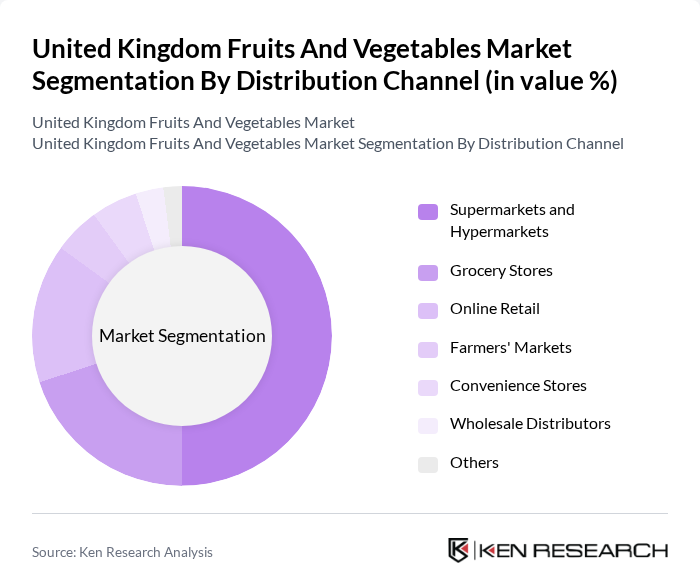

By Distribution Channel:The distribution channels for fruits and vegetables include supermarkets and hypermarkets, grocery stores, online retail, farmers' markets, convenience stores, wholesale distributors, and others. Supermarkets and hypermarkets are the leading distribution channels, accounting for a significant portion of the market share due to their extensive reach and variety of offerings. Online retail is rapidly growing, driven by the convenience of home delivery and the increasing trend of e-commerce. Farmers' markets are also gaining popularity as consumers seek fresh, locally sourced produce .

The United Kingdom Fruits and Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesco PLC, Sainsbury's Supermarkets Ltd, Wm Morrison Supermarkets Ltd (Morrisons), Waitrose & Partners, Aldi UK, Lidl GB, Marks & Spencer Group plc, Co-op Food (The Co-operative Group), Iceland Foods Ltd, Ocado Group plc, Total Produce plc, Fresca Group Ltd, Berry Gardens Ltd, Greenvale AP Ltd, Riverford Organic Farmers Ltd, Abel & Cole Ltd, Poupart Ltd, QV Foods Ltd, Fyffes Group Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK fruits and vegetables market appears promising, driven by increasing health awareness and a shift towards sustainable practices. As consumers continue to prioritize fresh and organic produce, the market is likely to see innovations in supply chain management and e-commerce. Additionally, the integration of smart agriculture technologies will enhance productivity and sustainability, positioning the market for robust growth. The focus on local sourcing will also strengthen community ties and support local economies, fostering a resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Fruits (e.g., Apples, Bananas, Strawberries, Grapes, Oranges, Pears, Plums, Cherries, Blueberries, Kiwi, Lemons & Limes, Peaches, Pineapple, Grapefruit, Others) Fresh Vegetables (e.g., Cauliflower & Broccoli, Onions, Tomatoes, Carrots, Cucumbers, Peas, Lettuce, Cabbage, Potatoes, Others) Processed Fruits (e.g., Dried, Canned, Frozen, Juices) Processed Vegetables (e.g., Dried, Canned, Frozen, Pickled) Organic Fruits Organic Vegetables Others (e.g., Exotic, Specialty, Mixed Packs) |

| By Distribution Channel | Supermarkets and Hypermarkets Grocery Stores Online Retail Farmers' Markets Convenience Stores Wholesale Distributors Others (e.g., Subscription Boxes, Direct-to-Consumer) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Modified Atmosphere Packaging Others |

| By Region | England Scotland Wales Northern Ireland |

| By Consumer Segment | Households Restaurants Food Service Providers Retailers Others |

| By Seasonality | Seasonal Fruits Seasonal Vegetables Year-Round Produce Others |

| By Price Range | Premium Mid-range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fruit and Vegetable Sales | 100 | Store Managers, Category Buyers |

| Wholesale Distribution Channels | 70 | Wholesale Managers, Supply Chain Coordinators |

| Farm Production Insights | 60 | Farm Owners, Agricultural Managers |

| Consumer Purchasing Behavior | 120 | General Consumers, Health-Conscious Shoppers |

| Export Market Dynamics | 40 | Export Managers, Trade Analysts |

The United Kingdom Fruits and Vegetables Market is valued at approximately USD 15.2 billion, reflecting a significant growth trend driven by health consciousness, plant-based diets, and improved retail channels.