Region:Middle East

Author(s):Dev

Product Code:KRAA3507

Pages:94

Published On:September 2025

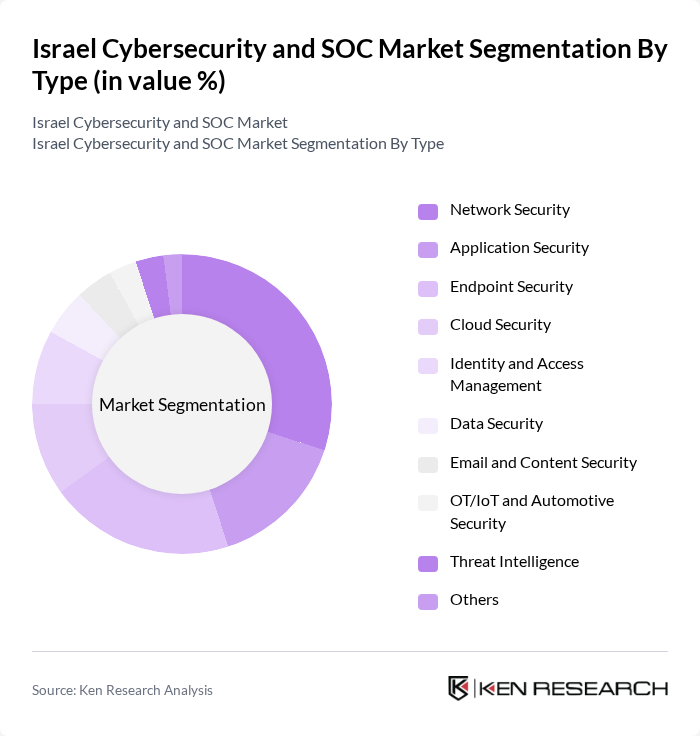

By Type:The market is segmented into Network Security, Application Security, Endpoint Security, Cloud Security, Identity and Access Management, Data Security, Email and Content Security, OT/IoT and Automotive Security, Threat Intelligence, and Others.Network Securityremains the leading sub-segment, driven by the persistent need to protect organizational networks from increasingly sophisticated cyberattacks and unauthorized access. The surge in remote work, cloud adoption, and the proliferation of connected devices have further fueled demand for robust network security and next-generation threat detection solutions .

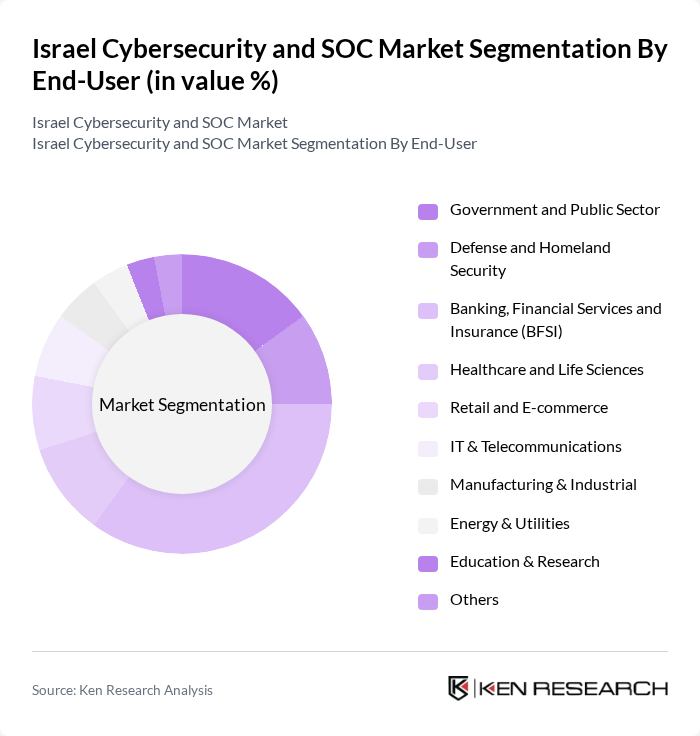

By End-User:This segmentation includes Government and Public Sector, Defense and Homeland Security, Banking, Financial Services and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT & Telecommunications, Manufacturing & Industrial, Energy & Utilities, Education & Research, and Others. TheBFSI sectoris the dominant end-user, driven by stringent regulatory requirements and the need for robust security measures to protect sensitive financial data. The increasing digitization of banking services, adoption of cloud platforms, and evolving threat landscape have further amplified the demand for advanced cybersecurity solutions in this sector .

The Israel Cybersecurity and SOC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Check Point Software Technologies Ltd., CyberArk Software Ltd., Radware Ltd., Palo Alto Networks, Inc., Fortinet, Inc., Imperva, Inc., SentinelOne, Inc., NSO Group Technologies Ltd., Snyk Ltd., Aqua Security Software Ltd., Cybereason, Inc., Votiro Technologies Ltd., Cato Networks, Inc., Argus Cyber Security Ltd., Morphisec Ltd., Perimeter 81 Ltd., Cyberint Technologies Ltd., Claroty Ltd., Illusive Networks Ltd., Sygnia Consulting Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Israel cybersecurity market appears promising, driven by ongoing technological advancements and increasing awareness of cyber threats. As organizations continue to adopt innovative security solutions, the integration of artificial intelligence and machine learning will play a pivotal role in enhancing threat detection and response capabilities. Additionally, the shift towards zero trust security models will redefine security frameworks, ensuring that organizations remain resilient against emerging cyber threats while complying with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Identity and Access Management Data Security Email and Content Security OT/IoT and Automotive Security Threat Intelligence Others |

| By End-User | Government and Public Sector Defense and Homeland Security Banking, Financial Services and Insurance (BFSI) Healthcare and Life Sciences Retail and E-commerce IT & Telecommunications Manufacturing & Industrial Energy & Utilities Education & Research Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Managed Security Services Consulting Services Integration Services Professional Services Others |

| By Industry Vertical | BFSI Government Energy and Utilities Education Healthcare IT & Telecom Manufacturing Retail Others |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management Data Loss Prevention Identity and Privileged Access Management |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Managed Security Services | 60 | Service Managers, Cybersecurity Analysts |

| Incident Response Services | 50 | Incident Response Team Leaders, SOC Managers |

| Threat Intelligence Solutions | 40 | Threat Analysts, Intelligence Officers |

| Compliance and Risk Management | 45 | Compliance Officers, Risk Management Directors |

| Cybersecurity Training Programs | 55 | Training Coordinators, HR Managers in Tech Firms |

The Israel Cybersecurity and SOC Market is valued at approximately USD 1 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and regulatory compliance requirements across various sectors.