Region:Europe

Author(s):Dev

Product Code:KRAA3515

Pages:95

Published On:September 2025

By Solution Type:The solution type segmentation includes Network Security, Endpoint Security, Identity & Access Management (IAM), Data Security & Encryption, Cloud Security, Application Security, and Security Information and Event Management (SIEM). Network Security remains the leading subsegment, driven by the surge in ransomware, phishing, and advanced persistent threats targeting Swiss organizations. The rise in remote work and cloud adoption has amplified demand for comprehensive network security and zero-trust architectures. Endpoint Security and IAM are also experiencing strong growth, reflecting the need to secure remote devices and manage user access across hybrid environments.

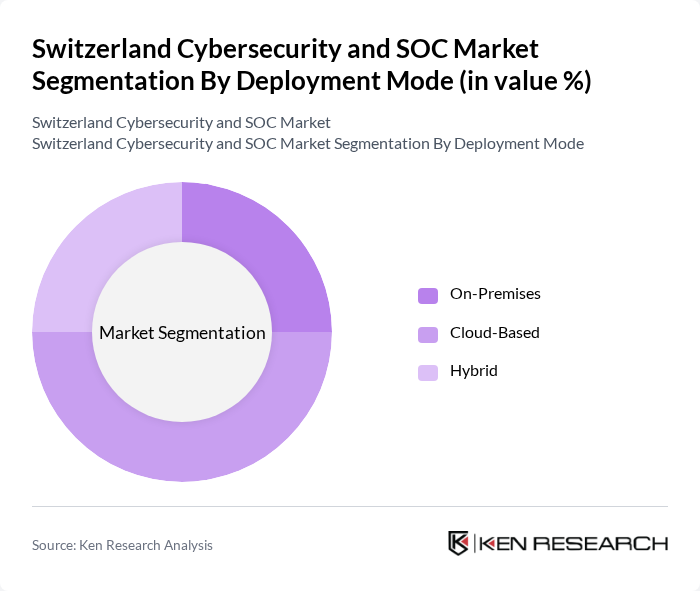

By Deployment Mode:The deployment mode segmentation includes On-Premises, Cloud-Based, and Hybrid solutions. Cloud-Based deployment is currently leading the market, as organizations increasingly migrate to cloud environments for scalability, flexibility, and compliance with Swiss data-sovereignty requirements. Hybrid models are also gaining traction, allowing sensitive data to remain on Swiss soil while leveraging cloud analytics. On-premises solutions remain relevant for sectors with strict regulatory and operational control needs.

The Switzerland Cybersecurity and SOC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swiss Cyber Security AG, Securosys SA, InfoGuard AG, Swisscom AG, Kudelski Security, IBM Switzerland, Cisco Systems Switzerland, PwC Switzerland, Deloitte Switzerland, KPMG Switzerland, Accenture Switzerland, Atos Switzerland, Orange CyberDefense Switzerland, F-Secure Corporation, Check Point Software Technologies Ltd., Fortinet Switzerland, McAfee Switzerland, Dell Technologies Switzerland, Juniper Networks Switzerland contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity market in Switzerland appears promising, driven by increasing awareness of cyber threats and the necessity for compliance with evolving regulations. Organizations are expected to prioritize investments in advanced security technologies, particularly in artificial intelligence and machine learning, to enhance threat detection and response capabilities. Furthermore, the shift towards managed security services will likely gain momentum, allowing businesses to leverage external expertise while focusing on core operations, thus fostering a more secure digital environment.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Security Endpoint Security Identity & Access Management (IAM) Data Security & Encryption Cloud Security Application Security Security Information and Event Management (SIEM) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) Healthcare Manufacturing Government & Defense IT & Telecommunications Other End Users |

| By Region | Zurich Geneva Basel Bern Others |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Service Type | Managed Security Services Professional Services Consulting Services |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | Chief Information Security Officers, IT Risk Managers |

| Healthcare Sector SOC Operations | 60 | Healthcare IT Directors, Compliance Officers |

| Manufacturing Cyber Defense Strategies | 50 | Operations Managers, Cybersecurity Analysts |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Program Managers |

| Telecommunications Security Measures | 70 | Network Security Engineers, Risk Assessment Specialists |

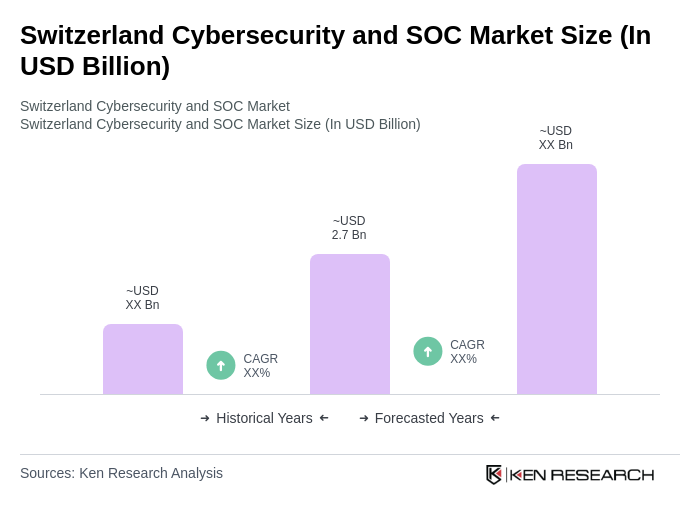

The Switzerland Cybersecurity and SOC Market is valued at approximately USD 2.7 billion, driven by increasing cyber threats, the need for data protection, and the adoption of cloud services across various sectors, including finance and healthcare.