Region:Europe

Author(s):Dev

Product Code:KRAB5516

Pages:88

Published On:October 2025

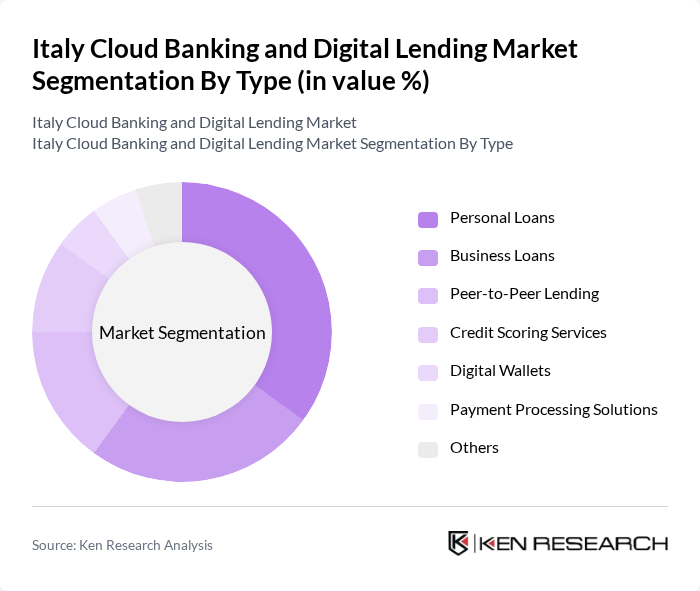

By Type:The market is segmented into various types, including Personal Loans, Business Loans, Peer-to-Peer Lending, Credit Scoring Services, Digital Wallets, Payment Processing Solutions, and Others. Among these, Personal Loans have emerged as the leading sub-segment, driven by consumer demand for quick and accessible financing options. The convenience of online applications and the ability to receive funds rapidly have made personal loans particularly appealing to individual consumers.

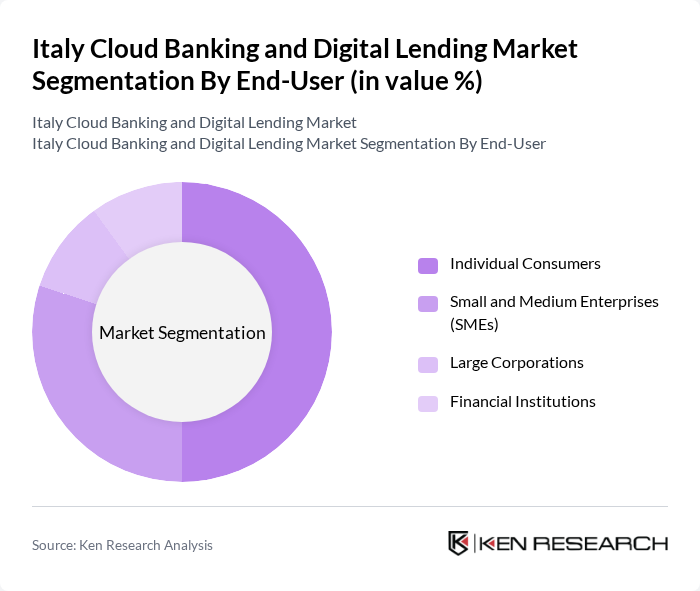

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Financial Institutions. Individual Consumers represent the largest segment, as they increasingly seek flexible financing options for personal needs. The rise of digital platforms has made it easier for consumers to access loans, contributing to the growth of this segment.

The Italy Cloud Banking and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intesa Sanpaolo S.p.A., UniCredit S.p.A., Banca Nazionale del Lavoro S.p.A., Credito Emiliano S.p.A., FinecoBank S.p.A., Nexi S.p.A., Sella Group, Banca Mediolanum S.p.A., Revolut Ltd., N26 GmbH, Younited Credit S.A., Soisy S.p.A., Credimi S.p.A., Lendix S.A., BorsadelCredito.it S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Italy's cloud banking and digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers are expected to embrace online financial services. Additionally, the integration of AI and machine learning will enhance risk assessment and customer service, making lending processes more efficient. The market is likely to see increased collaboration between fintechs and traditional banks, fostering innovation and expanding service offerings to meet diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Peer-to-Peer Lending Credit Scoring Services Digital Wallets Payment Processing Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Loan Purpose | Home Improvement Education Debt Consolidation Business Expansion |

| By Risk Assessment Methodology | Traditional Credit Scoring Alternative Data Analysis Machine Learning Models |

| By Policy Support | Subsidies for Digital Transformation Tax Incentives for Fintech Startups Grants for Innovation in Banking |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Digital Banking Users |

| SME Digital Lending Users | 100 | Business Owners, Financial Managers |

| Corporate Clients in Cloud Banking | 80 | CFOs, Treasury Managers |

| Fintech Startups in Italy | 70 | Founders, Product Development Leads |

| Regulatory Bodies and Financial Authorities | 50 | Policy Makers, Compliance Officers |

The Italy Cloud Banking and Digital Lending Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and the rise of fintech companies in the region.