Region:Asia

Author(s):Dev

Product Code:KRAB5440

Pages:88

Published On:October 2025

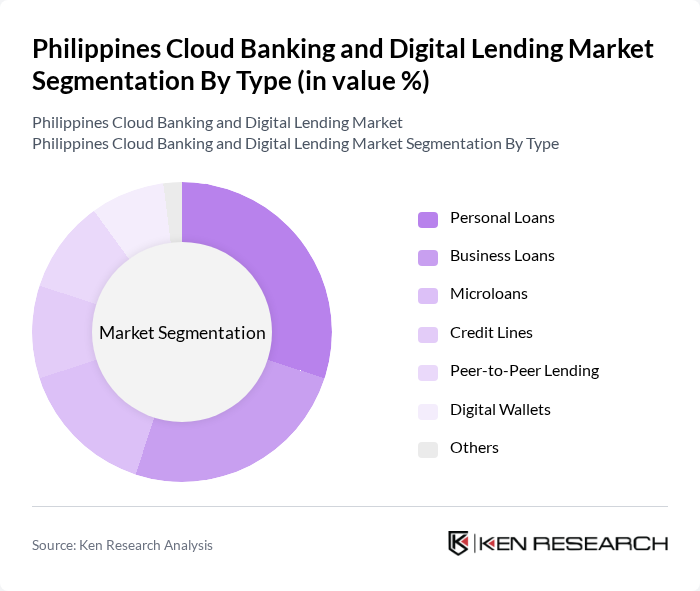

By Type:The market is segmented into various types, including Personal Loans, Business Loans, Microloans, Credit Lines, Peer-to-Peer Lending, Digital Wallets, and Others. Personal Loans are gaining traction due to the increasing need for quick and accessible financing options among consumers. Business Loans are also significant, driven by the growth of SMEs seeking capital for expansion. Microloans cater to the underserved population, while Digital Wallets are becoming popular for their convenience in transactions.

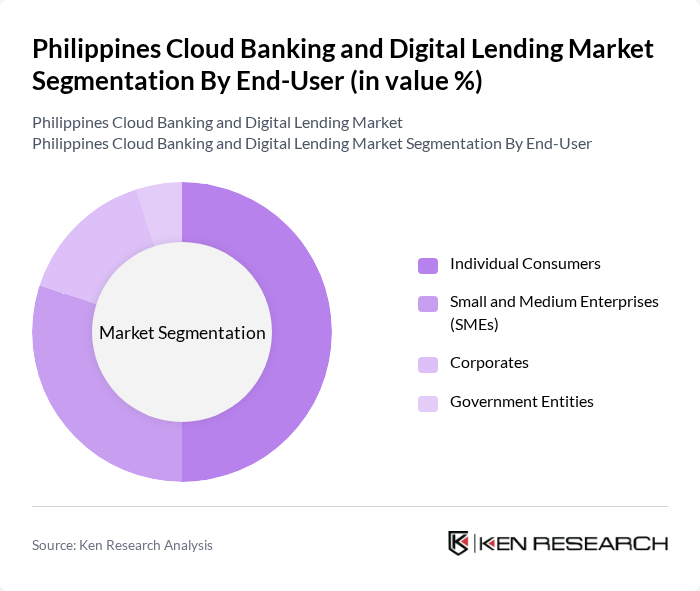

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers dominate the market as they increasingly seek personal loans and digital payment solutions. SMEs are also significant contributors, leveraging digital lending for growth and operational efficiency. Corporates and Government Entities are gradually adopting cloud banking solutions to streamline their financial operations.

The Philippines Cloud Banking and Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as UnionBank of the Philippines, RCBC, BPI, Grab Financial Group, Cashalo, Finastra, PayMaya, GCash, LendingClub, AUB (Asia United Bank), Home Credit Philippines, Tala, Kiva, LenddoEFL, SeedIn contribute to innovation, geographic expansion, and service delivery in this space.

The future of cloud banking and digital lending in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As fintech companies increasingly leverage artificial intelligence and machine learning, personalized financial services will become more prevalent. Additionally, the rise of neobanks and peer-to-peer lending platforms will reshape the competitive landscape, offering consumers more choices and fostering financial inclusion across diverse demographics, particularly in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Microloans Credit Lines Peer-to-Peer Lending Digital Wallets Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Application | Consumer Financing Business Financing Emergency Loans Educational Loans |

| By Distribution Channel | Online Platforms Mobile Applications Bank Branches Third-party Agents |

| By Customer Segment | Retail Customers Business Customers Institutional Customers |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets Cash Payments |

| By Loan Size | Small Loans Medium Loans Large Loans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 150 | Individual Borrowers, First-time Users |

| Small Business Cloud Banking Adoption | 100 | Small Business Owners, Financial Managers |

| Banking Executives Insights | 80 | Chief Financial Officers, Digital Transformation Leads |

| Fintech Startups in Digital Lending | 70 | Founders, Product Development Managers |

| Regulatory Perspectives on Cloud Banking | 50 | Regulatory Officials, Compliance Officers |

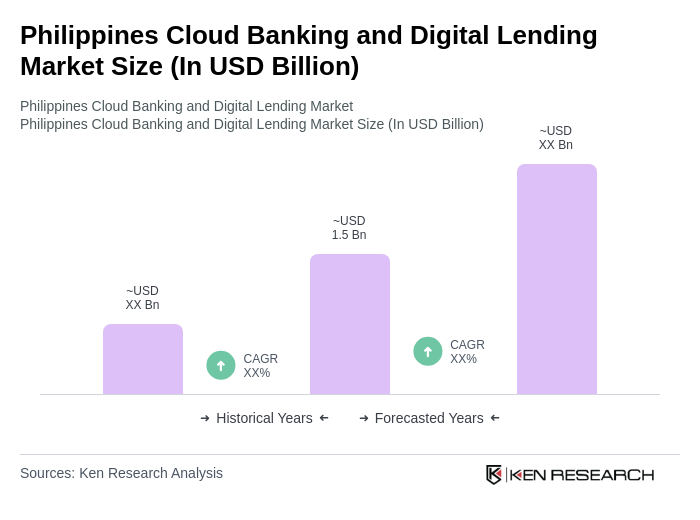

The Philippines Cloud Banking and Digital Lending Market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services, smartphone penetration, and a growing unbanked population seeking accessible financial solutions.