Region:Europe

Author(s):Shubham

Product Code:KRAB6600

Pages:94

Published On:October 2025

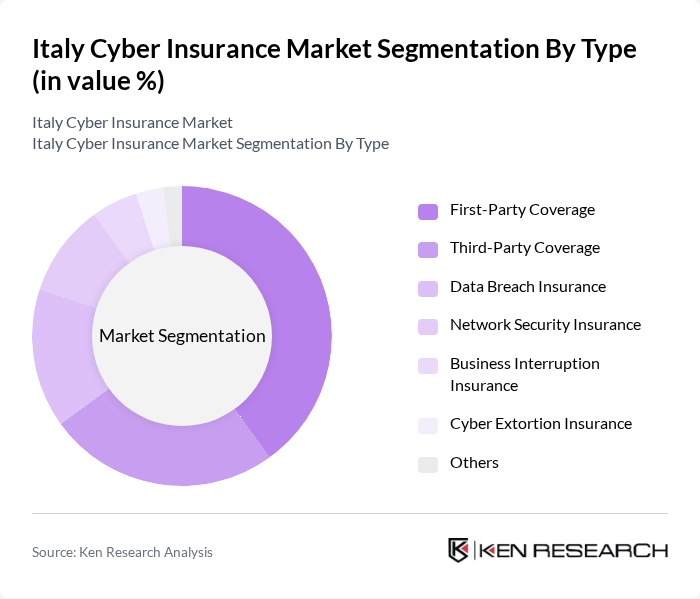

By Type:

The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Coverage, Data Breach Insurance, Network Security Insurance, Business Interruption Insurance, Cyber Extortion Insurance, and Others. Among these, First-Party Coverage is currently dominating the market due to the increasing need for businesses to protect their own assets and data from cyber threats. This type of coverage provides direct financial support to organizations in the event of a cyber incident, making it highly attractive to businesses that prioritize risk management. The growing trend of digital transformation across industries further fuels the demand for First-Party Coverage, as organizations seek to safeguard their operations and customer data.

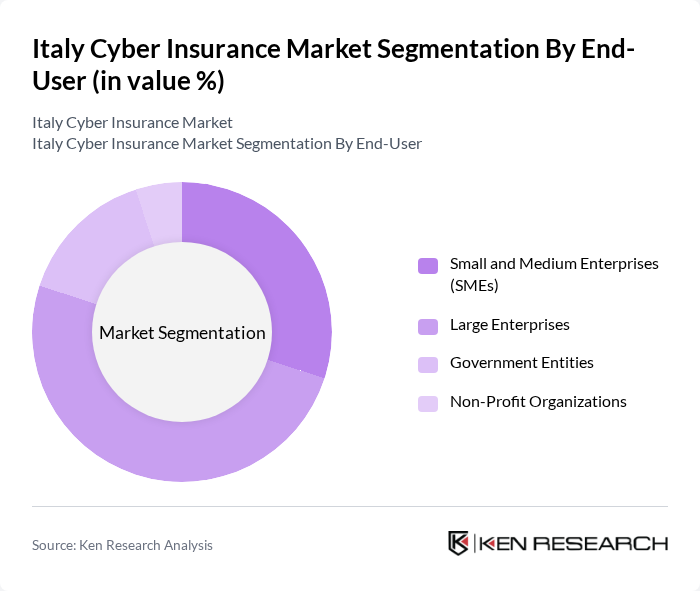

By End-User:

The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Entities, and Non-Profit Organizations. Among these, Large Enterprises are leading the market due to their extensive digital operations and higher exposure to cyber risks. These organizations often handle vast amounts of sensitive data and are more likely to invest in comprehensive cyber insurance policies to protect against potential financial losses. Additionally, the increasing regulatory requirements for data protection in larger organizations further drive the demand for cyber insurance, making it a critical component of their risk management strategies.

The Italy Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz S.p.A., Generali Group, AIG Europe S.A., Zurich Insurance Group, AXA Assicurazioni S.p.A., UnipolSai Assicurazioni S.p.A., Reale Mutua Assicurazioni, Cattolica Assicurazioni, Chubb European Group, Hiscox Ltd., Tokio Marine HCC, Marsh & McLennan Companies, Baloise Holding AG, RSA Insurance Group, Munich Re contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cyber insurance market in Italy appears promising, driven by increasing awareness of cyber risks and the necessity for businesses to protect themselves against evolving threats. As organizations continue to digitize their operations, the demand for comprehensive insurance solutions will likely grow. Additionally, the integration of advanced technologies, such as AI and machine learning, into insurance products will enhance risk assessment and management capabilities, further propelling market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Data Breach Insurance Network Security Insurance Business Interruption Insurance Cyber Extortion Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Entities Non-Profit Organizations |

| By Industry | Financial Services Healthcare Retail Manufacturing Technology Education Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customizable Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Policy Limit | Low Limit Policies Medium Limit Policies High Limit Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 80 | IT Security Directors, Healthcare Administrators |

| SME Cyber Insurance Adoption | 120 | Business Owners, IT Managers |

| Manufacturing Industry Cyber Threats | 70 | Operations Managers, Risk Assessment Specialists |

| Retail Sector Cyber Insurance Insights | 90 | IT Directors, E-commerce Managers |

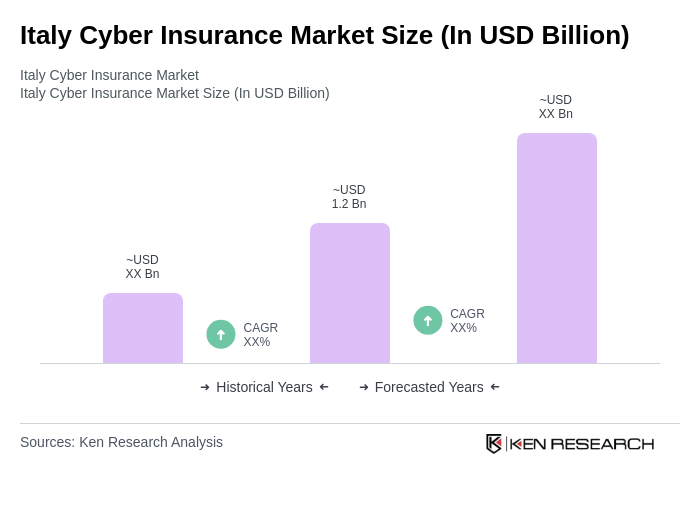

The Italy Cyber Insurance Market is valued at approximately USD 1.2 billion, reflecting a significant increase driven by the rising frequency of cyberattacks and growing awareness of data protection regulations among organizations.