Region:Africa

Author(s):Rebecca

Product Code:KRAB2861

Pages:92

Published On:October 2025

By Type:The segmentation encompasses a broad range of coverage types tailored to distinct cyber risk exposures. Subsegments include First-Party Coverage, Third-Party Coverage, Network Security Liability Insurance, Data Breach Liability Insurance, Business Interruption Insurance, Cyber Extortion/Ransomware Insurance, Media Liability Insurance, and Others. Each category addresses specific organizational needs, such as direct financial losses, liability to third parties, operational disruptions, and reputational risks associated with cyber incidents.

TheFirst-Party Coveragesegment leads the market, reflecting the growing recognition among Nigerian businesses of the need to protect internal assets and operations from cyberattacks. This coverage provides direct compensation for losses such as data breaches, ransomware events, and business interruption. The segment’s dominance is reinforced by the rising cost of cyber incidents and increased regulatory scrutiny, prompting organizations to prioritize comprehensive internal risk management.

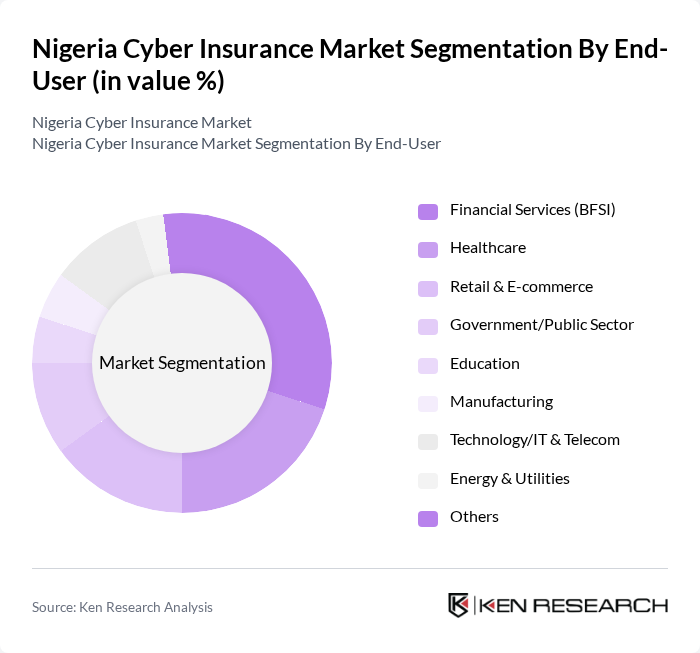

By End-User:This segmentation reflects the adoption of cyber insurance across diverse sectors. Subsegments include Financial Services (BFSI), Healthcare, Retail & E-commerce, Government/Public Sector, Education, Manufacturing, Technology/IT & Telecom, Energy & Utilities, and Others. Each sector faces unique cyber risks, with financial institutions and technology companies particularly exposed due to high-value data and digital operations. The segmentation highlights sector-specific demand drivers and risk profiles.

TheFinancial Services (BFSI)sector is the leading end-user of cyber insurance in Nigeria, driven by the high value of sensitive data, regulatory compliance requirements, and the increasing digitization of banking and payment systems. Financial institutions are proactively investing in cyber insurance to mitigate operational risks and maintain customer trust amid a rising threat landscape.

The Nigeria Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AXA Mansard Insurance Plc, Leadway Assurance Company Limited, Mutual Benefits Assurance Plc, Old Mutual Nigeria, NEM Insurance Plc, AIICO Insurance Plc, Cornerstone Insurance Plc, Sovereign Trust Insurance Plc, Wapic Insurance Plc, Veritas Kapital Assurance Plc, Prestige Assurance Plc, Universal Insurance Plc, Custodian & Allied Insurance Plc, FBNInsurance Limited, Great Nigeria Insurance Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria cyber insurance market appears promising, driven by increasing digitalization and a growing recognition of cyber risks. As businesses continue to embrace digital transformation, the demand for tailored cyber insurance products is expected to rise. Additionally, the collaboration between local insurers and international firms will enhance product offerings, making cyber insurance more accessible. With the government’s commitment to improving cybersecurity frameworks, the market is poised for significant growth, addressing both current and emerging threats effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Network Security Liability Insurance Data Breach Liability Insurance Business Interruption Insurance Cyber Extortion/Ransomware Insurance Media Liability Insurance Others |

| By End-User | Financial Services (BFSI) Healthcare Retail & E-commerce Government/Public Sector Education Manufacturing Technology/IT & Telecom Energy & Utilities Others |

| By Industry Vertical | Telecommunications Energy & Utilities Transportation & Logistics Media and Entertainment Technology/IT Industrial & Defense Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customized Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Policyholder Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Assessment | 60 | IT Security Managers, Hospital Administrators |

| Retail Industry Cyber Insurance Needs | 50 | Business Owners, IT Directors |

| Telecommunications Cybersecurity Strategies | 40 | Network Security Engineers, Operations Managers |

| SME Cyber Insurance Awareness | 70 | Small Business Owners, Financial Advisors |

The Nigeria Cyber Insurance Market is valued at approximately USD 30 million, reflecting a growing demand for cyber insurance products driven by increasing cyber threats and the expansion of the digital economy in Nigeria.