Region:Middle East

Author(s):Rebecca

Product Code:KRAB2870

Pages:93

Published On:October 2025

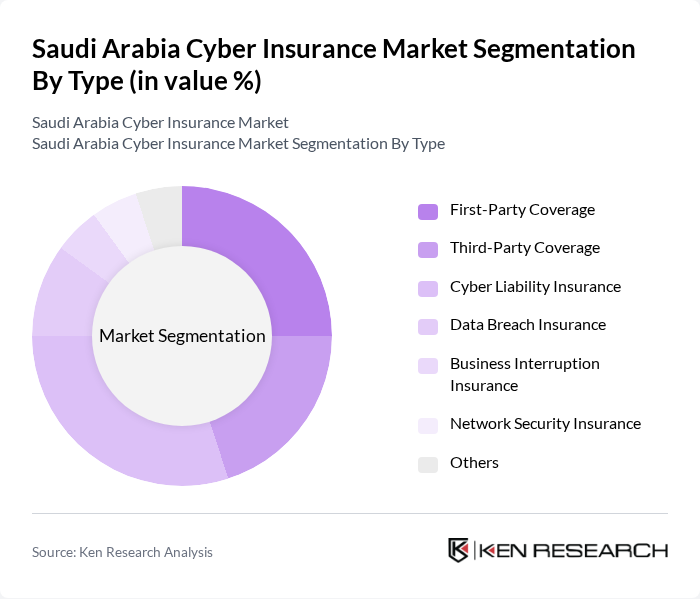

By Type:The market is segmented into various types of coverage, including First-Party Coverage, Third-Party Coverage, Cyber Liability Insurance, Data Breach Insurance, Business Interruption Insurance, Network Security Insurance, and Others. Each of these sub-segments addresses specific risks associated with cyber incidents, catering to the diverse needs of businesses and organizations .

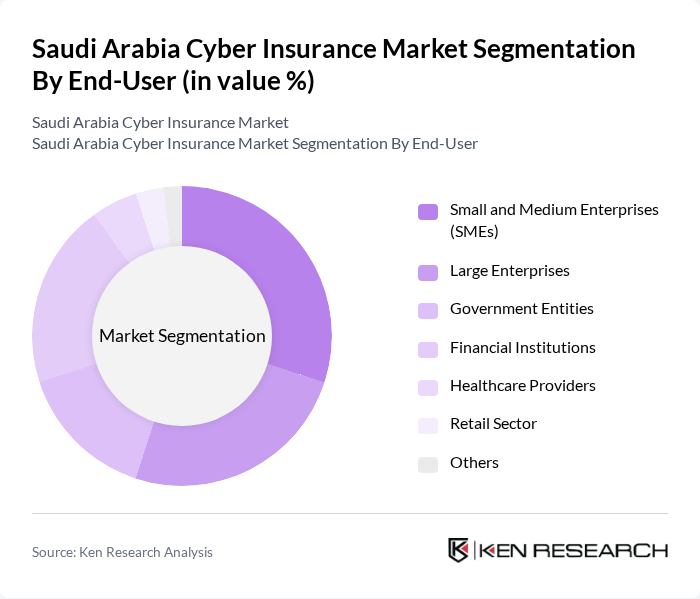

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Entities, Financial Institutions, Healthcare Providers, Retail Sector, and Others. Each segment has unique requirements and risk profiles, influencing their demand for specific types of cyber insurance coverage .

The Saudi Arabia Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Allianz Saudi Fransi, Gulf Insurance Group, Al Rajhi Takaful, Medgulf, Alinma Tokio Marine, United Cooperative Assurance, Al-Ahlia Insurance Company, Saudi Re, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Al-Jazira Takaful Taawuni, Al-Mawared Insurance, and Al-Bilad Insurance contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia cyber insurance market is poised for significant growth as businesses increasingly recognize the importance of safeguarding their digital assets. With the government's commitment to enhancing cybersecurity measures and the rising incidence of cyber threats, organizations are likely to invest more in comprehensive insurance solutions. Additionally, the integration of advanced technologies, such as AI and machine learning, will further enhance risk assessment and management capabilities, driving innovation in the cyber insurance sector.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Cyber Liability Insurance Data Breach Insurance Business Interruption Insurance Network Security Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Entities Financial Institutions Healthcare Providers Retail Sector Others |

| By Industry Vertical | Financial Services Healthcare Retail Manufacturing Telecommunications Energy and Utilities Others |

| By Coverage Type | Incident Response Coverage Legal Expenses Coverage Regulatory Fines Coverage Crisis Management Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Premium Range | Low Premium Medium Premium High Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 85 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 75 | IT Security Directors, Insurance Brokers |

| Retail Industry Cyber Insurance Adoption | 65 | Operations Managers, IT Managers |

| Telecommunications Cybersecurity Strategies | 55 | Network Security Analysts, Risk Assessment Specialists |

| SME Cyber Insurance Awareness | 80 | Business Owners, IT Consultants |

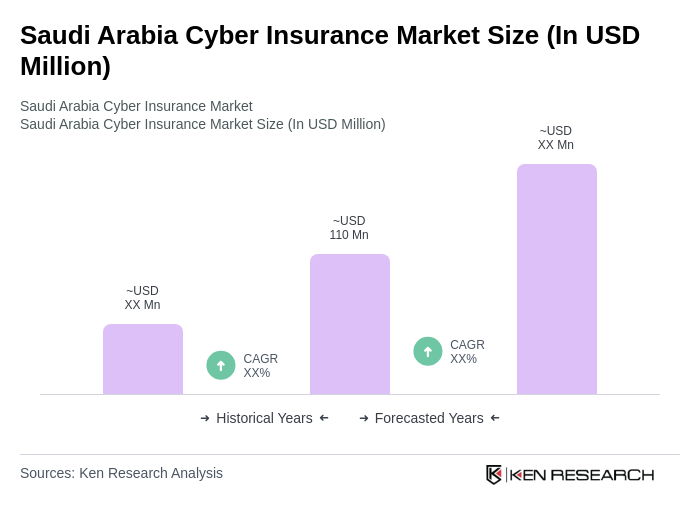

The Saudi Arabia Cyber Insurance Market is valued at approximately USD 110 million, reflecting a significant increase driven by the rise in cyberattacks and the government's Vision 2030 digital transformation agenda.