Region:Asia

Author(s):Shubham

Product Code:KRAB6556

Pages:98

Published On:October 2025

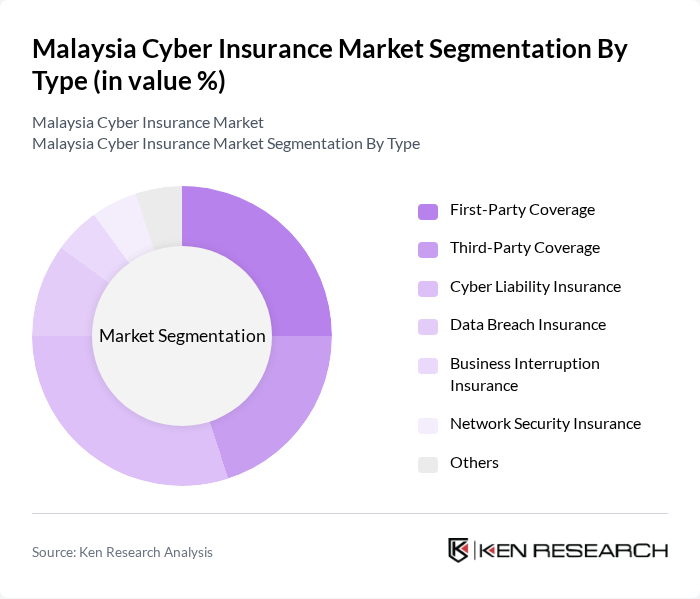

By Type:This segmentation includes various types of coverage that cater to different aspects of cyber risk management. The subsegments are First-Party Coverage, Third-Party Coverage, Cyber Liability Insurance, Data Breach Insurance, Business Interruption Insurance, Network Security Insurance, and Others. Each of these subsegments addresses specific needs and risks associated with cyber incidents.

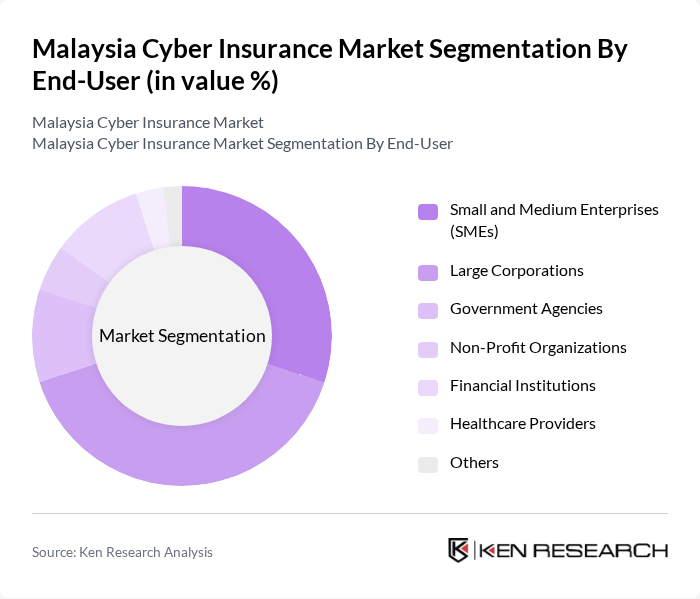

By End-User:This segmentation focuses on the various end-users of cyber insurance products, which include Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, Non-Profit Organizations, Financial Institutions, Healthcare Providers, and Others. Each end-user category has unique requirements and risk profiles that influence their insurance needs.

The Malaysia Cyber Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIG Malaysia Insurance Berhad, Allianz Malaysia Berhad, Chubb Insurance Malaysia Berhad, Tokio Marine Insurans (Malaysia) Berhad, Zurich Insurance Malaysia Berhad, MSIG Insurance (Malaysia) Berhad, Liberty Insurance Berhad, QBE Insurance (Malaysia) Berhad, Great Eastern General Insurance Berhad, Takaful Malaysia, AXA Affin General Insurance Berhad, Berjaya Sompo Insurance Berhad, AmGeneral Insurance Berhad, Hong Leong Assurance Berhad, Etiqa Insurance Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia cyber insurance market appears promising, driven by increasing digitalization and heightened awareness of cyber risks. As businesses continue to embrace digital transformation, the demand for comprehensive cyber insurance solutions is expected to rise. Additionally, regulatory pressures will likely compel more organizations to seek coverage, ensuring compliance and risk mitigation. The market is anticipated to evolve with innovative products tailored to specific industry needs, enhancing overall resilience against cyber threats and fostering a more secure digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Cyber Liability Insurance Data Breach Insurance Business Interruption Insurance Network Security Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Non-Profit Organizations Financial Institutions Healthcare Providers Others |

| By Industry Vertical | Financial Services Retail Manufacturing Technology Healthcare Education Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customized Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| By Policy Support | Subsidies Tax Exemptions Risk Management Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cyber Insurance | 100 | Risk Managers, Compliance Officers |

| Healthcare Sector Cyber Risk Management | 80 | IT Security Managers, Healthcare Administrators |

| E-commerce Cyber Insurance Adoption | 90 | eCommerce Directors, IT Managers |

| Manufacturing Cybersecurity Measures | 70 | Operations Managers, IT Directors |

| SME Cyber Insurance Awareness | 60 | Business Owners, Financial Officers |

The Malaysia Cyber Insurance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, heightened awareness of cybersecurity risks, and the digitalization of various sectors.