Region:Europe

Author(s):Rebecca

Product Code:KRAA0349

Pages:95

Published On:August 2025

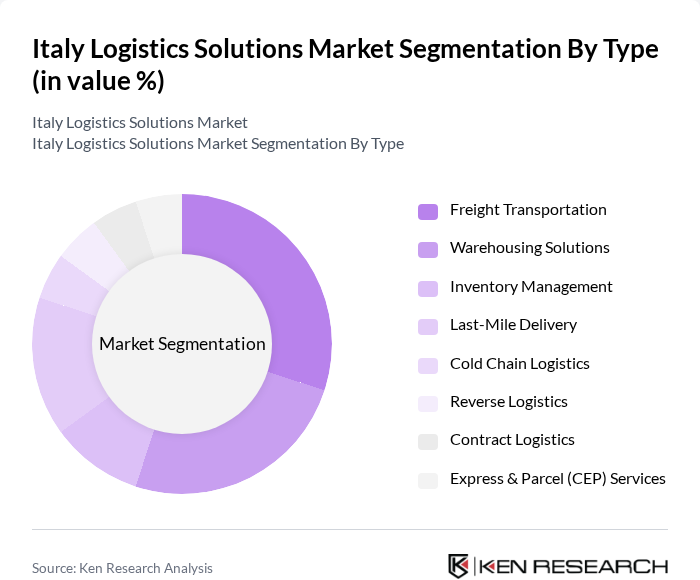

By Type:The logistics solutions market can be segmented into Freight Transportation, Warehousing Solutions, Inventory Management, Last-Mile Delivery, Cold Chain Logistics, Reverse Logistics, Contract Logistics, and Express & Parcel (CEP) Services. Freight Transportation remains the largest segment, driven by Italy’s role as a European trade gateway and the need for efficient movement of goods across borders. Warehousing Solutions and Last-Mile Delivery are also experiencing rapid growth, fueled by the surge in e-commerce and demand for faster, more flexible delivery options. Cold Chain Logistics and Reverse Logistics are expanding in response to rising pharmaceutical, food, and sustainability requirements .

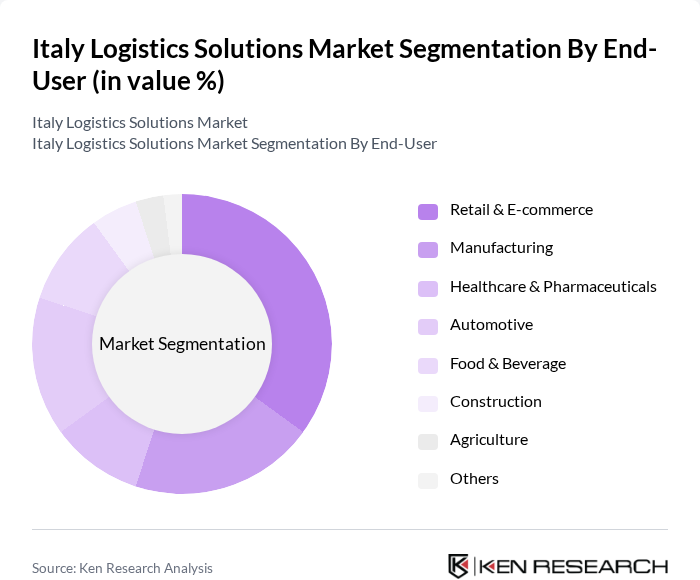

By End-User:The logistics solutions market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Construction, Agriculture, and Others. Retail & E-commerce is the dominant end-user segment, reflecting the rapid growth of online shopping and omnichannel retailing. Manufacturing and Automotive are significant contributors, supported by Italy’s industrial base and export orientation. Healthcare & Pharmaceuticals and Food & Beverage segments are expanding due to stricter requirements for temperature control, traceability, and regulatory compliance .

The Italy Logistics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, Geodis, DSV, CEVA Logistics, UPS Supply Chain Solutions, FedEx Express, Poste Italiane, Arcese Group, Sogemar (Contship Italia Group), GEFCO, Rhenus Logistics, Fercam, Savino Del Bene, Bartolini (BRT), SDA Express Courier, and Logista Italia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics solutions market in Italy appears promising, driven by ongoing technological advancements and increasing demand for efficient delivery services. As e-commerce continues to grow, logistics providers will need to invest in automation and smart logistics solutions to enhance operational efficiency. Additionally, the focus on sustainability will drive innovations in green logistics practices. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Solutions Inventory Management Last-Mile Delivery Cold Chain Logistics Reverse Logistics Contract Logistics Express & Parcel (CEP) Services |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Construction Agriculture Others |

| By Region | Northern Italy Central Italy Southern Italy |

| By Technology | Automated Warehousing Transportation Management Systems (TMS) Fleet Management Solutions IoT-Enabled Logistics Robotics & Automation Others |

| By Application | Supply Chain Management Freight Forwarding Customs Brokerage Renewable Energy Logistics Luxury Maritime Logistics Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Public-Private Partnerships Others |

| By Policy Support | Subsidies for Green Logistics Tax Incentives for Infrastructure Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Logistics Operations | 100 | Logistics Managers, Operations Directors |

| E-commerce Fulfillment Strategies | 60 | eCommerce Managers, Supply Chain Analysts |

| Transportation and Freight Services | 50 | Transport Managers, Freight Coordinators |

| Warehousing and Inventory Management | 40 | Warehouse Managers, Inventory Control Specialists |

| Last-Mile Delivery Solutions | 50 | Last-Mile Coordinators, Delivery Operations Managers |

The Italy Logistics Solutions Market is valued at approximately USD 125 billion, driven by the increasing demand for efficient supply chain management, e-commerce growth, and advancements in logistics technologies.