Region:Europe

Author(s):Geetanshi

Product Code:KRAA3312

Pages:98

Published On:September 2025

By Product Type:The market is segmented into three primary categories: Dietary Supplements, Functional Foods, and Functional Beverages. Among these, Dietary Supplements are the leading sub-segment, driven by increasing consumer awareness regarding health benefits and preventive care. The demand for vitamins, minerals, and herbal supplements has surged as consumers seek to enhance their overall well-being. Functional Foods and Beverages are also gaining traction, particularly among health-conscious individuals looking for convenient ways to incorporate nutrition into their diets. The rise in sports nutrition and weight management solutions further supports the growth of functional food and beverage segments .

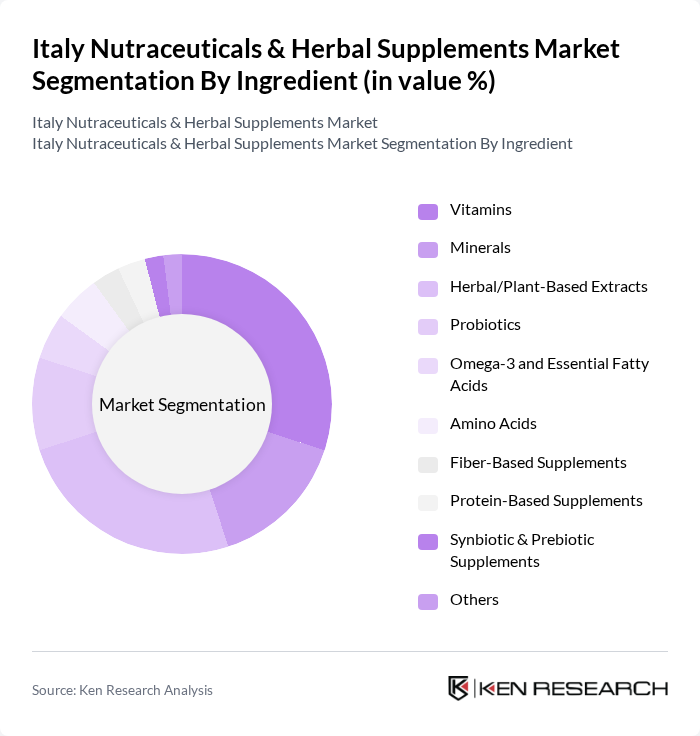

By Ingredient:This segmentation includes Vitamins, Minerals, Herbal/Plant-Based Extracts, Probiotics, Omega-3 and Essential Fatty Acids, Amino Acids, Fiber-Based Supplements, Protein-Based Supplements, Synbiotic & Prebiotic Supplements, and Others. Vitamins and Herbal/Plant-Based Extracts are the dominant sub-segments, as consumers increasingly prefer natural ingredients for their health benefits. The rising trend of plant-based diets and the growing awareness of the importance of gut health have further propelled the demand for these ingredients in nutraceutical products. Personalization and customization of supplements, along with increased interest in sustainable and eco-friendly options, are also shaping ingredient demand .

The Italy Nutraceuticals & Herbal Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Italia S.p.A., DSM Nutritional Products, Istituto Ganassini S.p.A., Aboca S.p.A., Enervit S.p.A., Herbalife Nutrition Ltd., Mylan N.V. (Viatris Inc.), Solgar S.p.A., Bayer HealthCare S.p.A., Named S.p.A., ESI S.p.A., Pool Pharma S.r.l., Pharmalife Research S.r.l., Bios Line S.p.A., Specchiasol S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian nutraceuticals and herbal supplements market appears promising, driven by ongoing trends in health consciousness and natural product demand. As the population ages, there will be an increasing focus on preventive healthcare solutions. Additionally, advancements in technology will facilitate personalized nutrition, allowing consumers to tailor their supplement choices to individual health needs. Companies that adapt to these trends and invest in innovation are likely to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dietary Supplements Functional Foods Functional Beverages |

| By Ingredient | Vitamins Minerals Herbal/Plant-Based Extracts Probiotics Omega-3 and Essential Fatty Acids Amino Acids Fiber-Based Supplements Protein-Based Supplements Synbiotic & Prebiotic Supplements Others |

| By Application/Function | Immune Health Metabolic Health (e.g., Diabetes Management) Bone and Joint Health Digestive Health Cognitive and Mental Health Weight Management Sports Nutrition Skin Health Aging Support Others |

| By Distribution Channel | Pharmacies Health Food Stores Supermarkets/Hypermarkets Online Retailers Non-Store Retailers Others |

| By Consumer Demographics | Age Group (Kids, Young Adults, Adults, Seniors) Gender (Male, Female, Unisex) Lifestyle (Active, Sedentary) |

| By Product Form | Tablets Capsules Powders Liquids Gummies & Jellies Soft Gels Premixes Others |

| By Nature | Organic Conventional |

| By Packaging Type | Bottles Blister Packs Jars and Containers Pouches and Sachets Cans and Tins Others |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Nutraceuticals | 150 | Store Managers, Retail Buyers |

| Consumer Preferences for Herbal Supplements | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Doctors, Nutritionists, Pharmacists |

| Market Trends in Online Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Italy Nutraceuticals & Herbal Supplements Market is valued at approximately USD 8.2 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards preventive healthcare among consumers.