Region:Europe

Author(s):Dev

Product Code:KRAB0916

Pages:93

Published On:October 2025

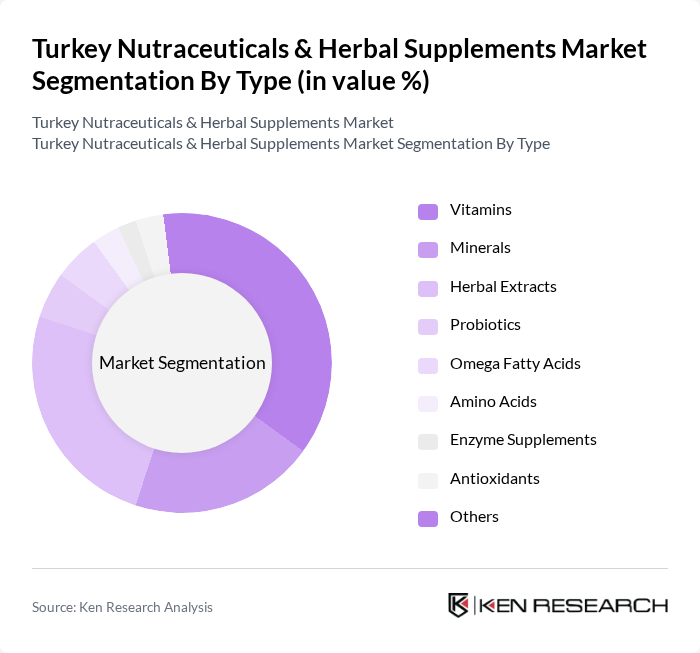

By Type:The market is segmented into various types, including Vitamins, Minerals, Herbal Extracts, Probiotics, Omega Fatty Acids, Amino Acids, Enzyme Supplements, Antioxidants, and Others. Among these, Vitamins and Herbal Extracts are the leading subsegments, driven by their widespread use in dietary supplements and functional foods. The increasing awareness of the health benefits associated with vitamins, particularly Vitamin D and C, has led to a surge in demand. Herbal Extracts are also gaining traction due to the growing preference for natural remedies and holistic health approaches.

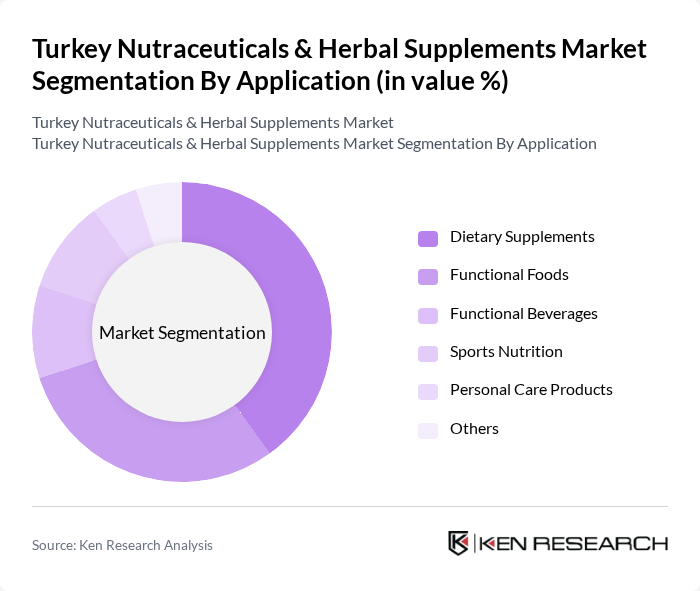

By Application:The applications of nutraceuticals and herbal supplements include Dietary Supplements, Functional Foods, Functional Beverages, Sports Nutrition, Personal Care Products, and Others. Dietary Supplements dominate the market, driven by the increasing consumer focus on health and wellness. Functional Foods are also gaining popularity as consumers seek to incorporate health benefits into their daily diets. The rise in fitness awareness has led to a growing demand for Sports Nutrition products, further diversifying the application landscape.

The Turkey Nutraceuticals & Herbal Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abdi ?brahim ?laç Sanayi ve Ticaret A.?., Orzaks ?laç ve Kimya Sanayi Tic. A.?., Zade Vital (Helvac?zade G?da ?laç Kimya Sanayi ve Ticaret A.?.), Pharmanatura (pharmanatura.com.tr), Solgar Turkey, Herbalife Nutrition Ltd., Amway Corp., GNC Türkiye (General Nutrition Centers), Nature’s Supreme (Aksu Vital), Oriflame Kozmetik Ürünleri Ticaret Ltd. ?ti., Zade Ya?lar?, Form Labs, Usana Health Sciences, Inc., Forever Living Products Turkey, Blackmores Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey nutraceuticals and herbal supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers prioritize wellness, the demand for personalized supplements is expected to rise, with companies leveraging technology for tailored solutions. Additionally, the expansion of e-commerce platforms will facilitate greater access to products, enhancing consumer engagement. These trends indicate a dynamic market landscape, ripe for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Extracts Probiotics Omega Fatty Acids Amino Acids Enzyme Supplements Antioxidants Others |

| By Application | Dietary Supplements Functional Foods Functional Beverages Sports Nutrition Personal Care Products Others |

| By Distribution Channel | Online Retail (e.g., Hepsiburada, Trendyol, N11) Supermarkets/Hypermarkets Pharmacies Health Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Herbal Supplements | 100 | Health-conscious Consumers, Dietary Supplement Users |

| Retail Insights on Nutraceutical Sales | 60 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 40 | Nutritionists, General Practitioners |

| Market Trends in E-commerce for Supplements | 80 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact on Nutraceuticals | 40 | Regulatory Affairs Specialists, Compliance Officers |

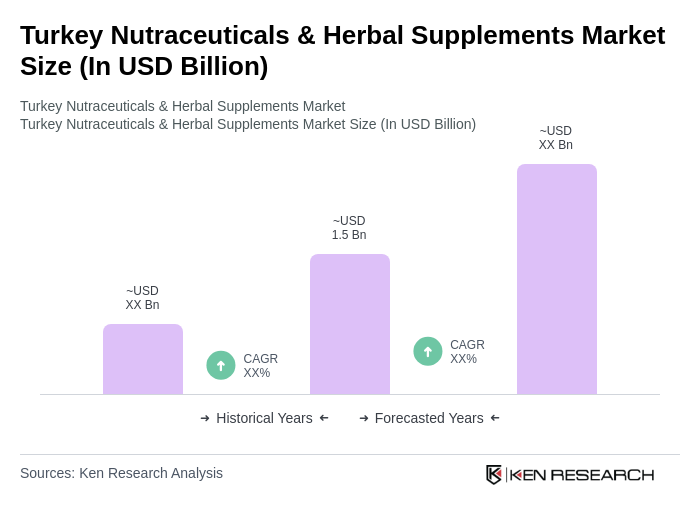

The Turkey Nutraceuticals & Herbal Supplements Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards preventive healthcare among consumers.