Region:Europe

Author(s):Dev

Product Code:KRAB6136

Pages:90

Published On:October 2025

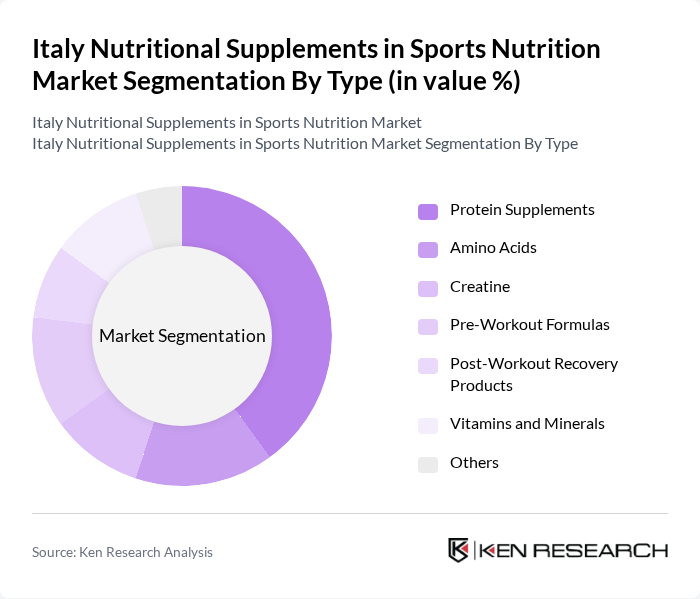

By Type:The market is segmented into various types of nutritional supplements, including protein supplements, amino acids, creatine, pre-workout formulas, post-workout recovery products, vitamins and minerals, and others. Among these, protein supplements are the most popular due to their effectiveness in muscle recovery and growth, appealing to both athletes and fitness enthusiasts. The increasing trend of fitness and bodybuilding has led to a significant rise in the consumption of protein-based products, making them a dominant force in the market.

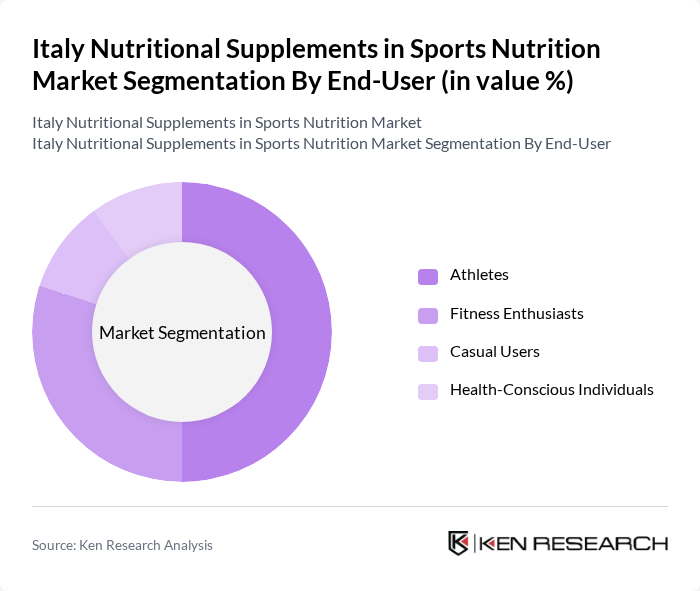

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual users, and health-conscious individuals. Athletes represent the largest segment, driven by their need for performance enhancement and recovery. This group is increasingly turning to specialized supplements to meet their rigorous training demands. Fitness enthusiasts also contribute significantly to the market, as they seek to optimize their workouts and achieve personal fitness goals, further propelling the growth of nutritional supplements.

The Italy Nutritional Supplements in Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, BSN (Bio-Engineered Supplements and Nutrition), MyProtein, MusclePharm, Scitec Nutrition, Dymatize Nutrition, Quest Nutrition, Isagenix International, GNC Holdings, Inc., NutraBio Labs, Inc., EAS (Energy Athletic Supplements), ProMix Nutrition, Klean Athlete, Vega contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nutritional supplements market in Italy appears promising, driven by ongoing trends in health and wellness. As consumers increasingly seek personalized nutrition solutions, companies are likely to invest in tailored products that meet specific dietary needs. Additionally, the integration of technology in product development, such as app-based tracking and AI-driven recommendations, will enhance consumer engagement and satisfaction, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Amino Acids Creatine Pre-Workout Formulas Post-Workout Recovery Products Vitamins and Minerals Others |

| By End-User | Athletes Fitness Enthusiasts Casual Users Health-Conscious Individuals |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales Others |

| By Formulation | Powder Capsules/Tablets Liquid Bars |

| By Price Range | Premium Mid-Range Budget |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers |

| By Packaging Type | Single-Serve Packs Bulk Packaging Retail Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Athletes | 100 | Elite athletes across various sports disciplines |

| Fitness Enthusiasts | 150 | Regular gym-goers and fitness program participants |

| Nutritionists and Dietitians | 80 | Certified nutrition professionals with sports specialization |

| Sports Coaches | 70 | Coaches from various sports organizations and clubs |

| Retailers of Nutritional Supplements | 60 | Store managers and owners of health food and supplement shops |

The Italy Nutritional Supplements in Sports Nutrition Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increased health awareness and sports participation among the population.