Region:Europe

Author(s):Rebecca

Product Code:KRAB2895

Pages:88

Published On:October 2025

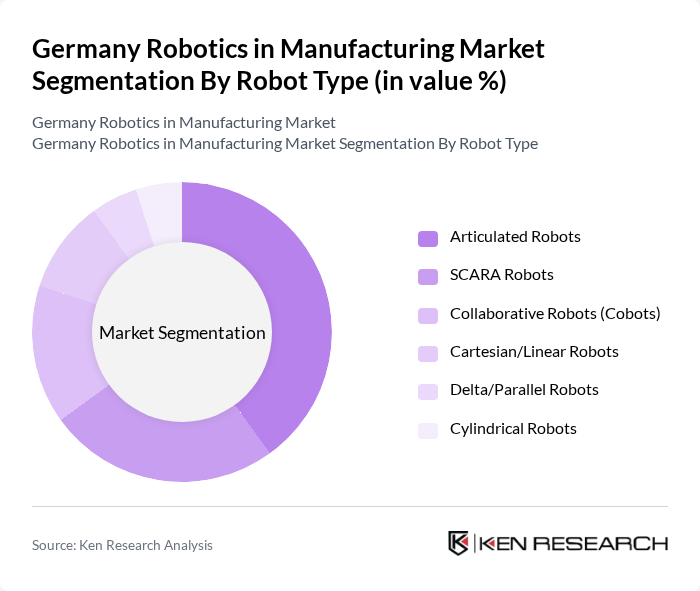

By Robot Type:The market is segmented into articulated robots, SCARA robots, collaborative robots (cobots), Cartesian/linear robots, delta/parallel robots, and cylindrical robots. Articulated robots lead the market due to their versatility and ability to perform complex tasks in automotive and electronics manufacturing. SCARA robots are increasingly adopted for high-speed assembly and pick-and-place applications, while collaborative robots are gaining traction for their safety, flexibility, and ease of integration alongside human workers, particularly in small and medium-sized enterprises.

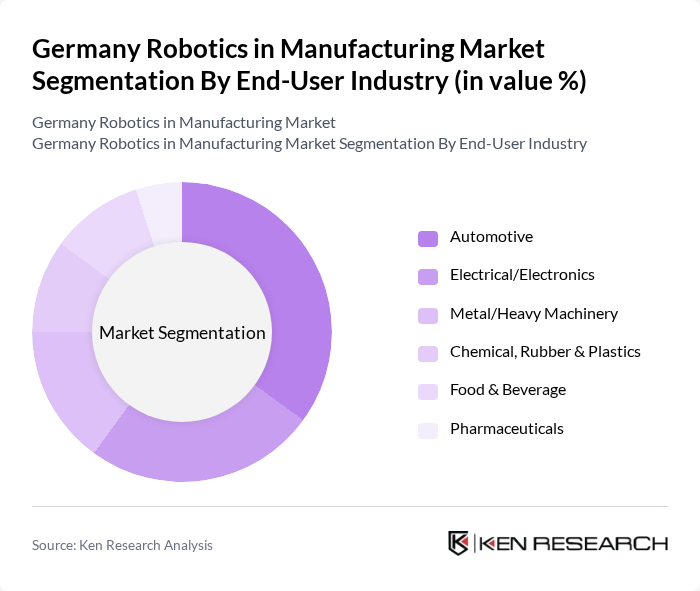

By End-User Industry:The robotics market in manufacturing is segmented by end-user industries, including automotive, electrical/electronics, metal/heavy machinery, chemical, rubber & plastics, food & beverage, and pharmaceuticals. The automotive industry remains the largest consumer, accounting for over 30% of new robot installations, driven by automation in assembly lines and body shops. The electrical and electronics sector follows, reflecting increased demand for precision and miniaturization. Food and beverage manufacturers are adopting robotics for packaging and processing, while chemical, rubber & plastics show the fastest growth due to rising automation needs in hazardous environments.

The Germany Robotics in Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as KUKA AG, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Kawasaki Heavy Industries Ltd., Denso Corporation, Universal Robots A/S, Omron Corporation, Stäubli International AG, Comau S.p.A., Nachi-Fujikoshi Corp., Epson Deutschland GmbH, Bosch Rexroth AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotics market in Germany appears promising, driven by ongoing technological advancements and increasing automation adoption. As manufacturers continue to seek efficiency and productivity, the integration of AI and IoT technologies will play a crucial role in shaping the industry. Additionally, the focus on sustainability will drive innovations in energy-efficient robotics, aligning with Germany's commitment to environmental goals. Overall, the market is poised for significant growth as companies adapt to evolving demands and challenges.

| Segment | Sub-Segments |

|---|---|

| By Robot Type | Articulated Robots SCARA Robots Collaborative Robots (Cobots) Cartesian/Linear Robots Delta/Parallel Robots Cylindrical Robots |

| By End-User Industry | Automotive Electrical/Electronics Metal/Heavy Machinery Chemical, Rubber & Plastics Food & Beverage Pharmaceuticals |

| By Application | Welding Assembly Material Handling Painting/Coating Packaging/Palletizing Machine Tending |

| By Payload Capacity | Low Payload (?16 kg) Medium Payload (16-60 kg) High Payload (60-300 kg) Very High Payload (>300 kg) |

| By Component | Hardware (Controllers, Manipulators, End-Effectors) Software (Programming, Simulation, Monitoring) Services (Installation, Maintenance, Training) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Robotics | 100 | Production Managers, Robotics Engineers |

| Electronics Assembly Automation | 80 | Operations Directors, Automation Specialists |

| Consumer Goods Robotics Integration | 60 | Supply Chain Managers, Process Improvement Managers |

| Pharmaceutical Manufacturing Automation | 50 | Quality Assurance Managers, Production Supervisors |

| Logistics and Warehouse Robotics | 70 | Warehouse Managers, Logistics Coordinators |

The Germany Robotics in Manufacturing Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by advancements in automation technology and the integration of artificial intelligence and machine learning in manufacturing processes.